Why do most investors buy high and sell low?

Author

Josh Pigford

There’s a famous quote by world-renowned investor Warren Buffett:

Be fearful when others are greedy and greedy when others are fearful.

The quote above is another way of phrasing the idea to “ buy low and sell high.” But most investors do just the opposite. They buy high and sell low—even when they know they should do the opposite. Let’s break down how and why this happens.

We all know the basic idea: when demand is high, prices rise, and when demand is low, prices fall. In the stock market, this tends to happen in cycles. When rising demand for a particular stock causes a bandwagon effect, more and more investors rush to purchase it, and the stock price goes up.

This behavior causes a chain reaction in which each investor buys the stock in question, hoping to sell it down the line for a profit after the price rises even further. Thus, as the price increases rapidly with more investors buying into the frenzy, the greed of investors escalates as well.

But eventually, the cycle reverses itself. When prices for a particular security are sky-high, any slight hint of negative news or macroeconomic changes can crash the stock price. Here, the chain reaction occurs in the opposite direction, wherein investors sell in a frenzy, which hammers the security price. As a result, most investors who got on later in the cycle book heavy losses, and any investors who haven’t bought the stock yet won’t touch it out of fear that the price will drop even lower.

This cyclical behavior is what Buffett’s quote warns investors against. He suggests that we should be doing the opposite, whether the investor bandwagon is buying (greed) or selling (fear). In Buffett’s mind, the best time to buy is when investors are at peak pessimism and the best time to sell is when they are at peak optimism.

So why don’t we do that? Why is it so hard to follow the wisdom of one of the richest and wisest investors that ever lived?

Comfort in crowds

We as humans are social animals, and it is easy to find solace in crowds. Our ancestors were social beings who lived in tribes and had a much larger chance of survival if they stuck together. This social structure made humans more formidable and less vulnerable to attacks from predators. Humans who strayed away from the tribe were weak and likely killed.

Our societies, cultures, markets, and interactions have become more complex in the last ten thousand years, but the structure of our brains has primarily remained the same. We still crave the safety of the tribe (crowd). So when we see our fellow investors all doing the same thing—all buying the same stock or selling it— we feel the pull to do it too, even if we know it’s not the best idea. It’s an emotional decision, not a logical one.

When the whole world is running towards a cliff, he who is running in the opposite direction appears to have lost his mind.

C.S. Lewis

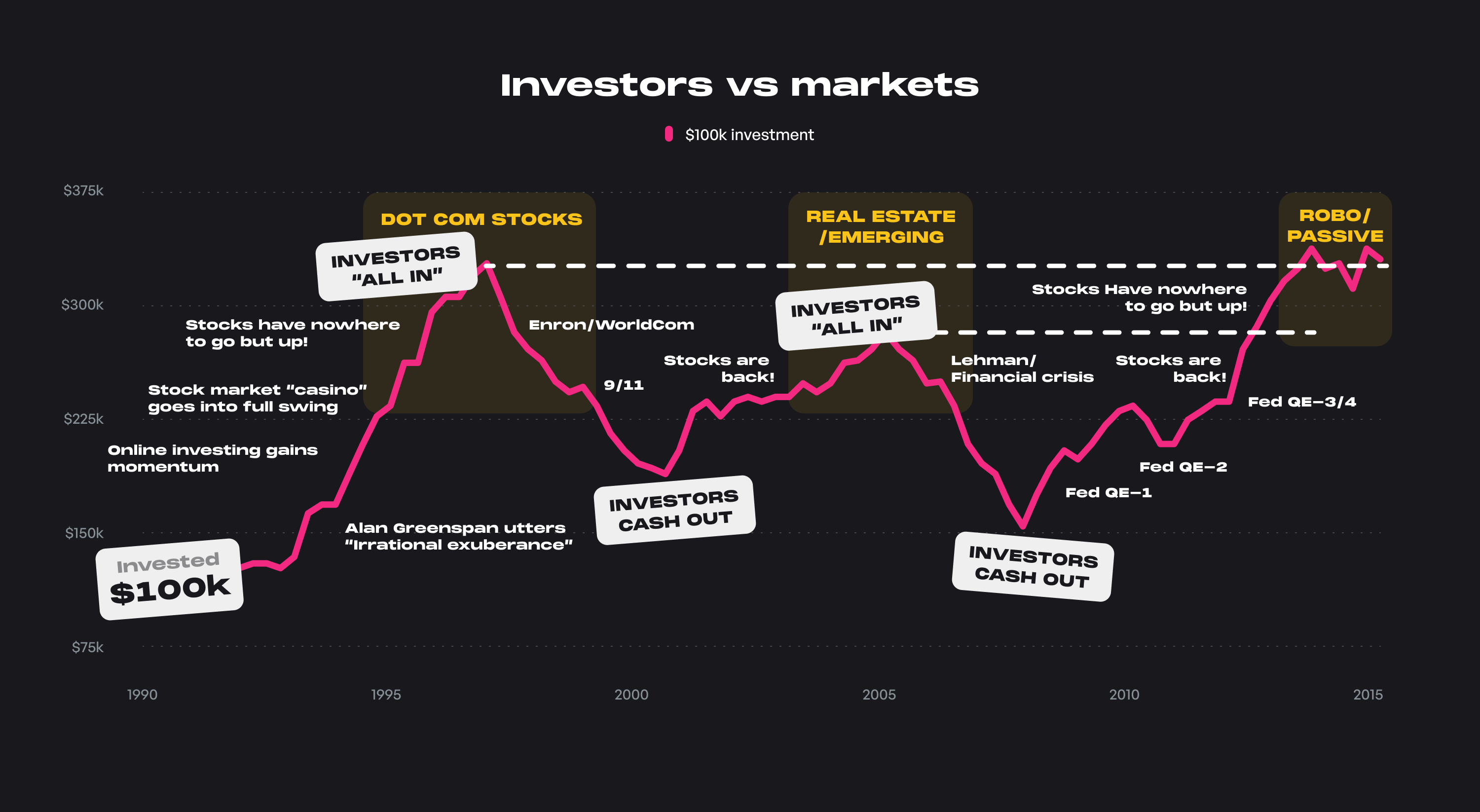

The above quote is a perfect representation of the behavior of investors in financial markets. There was maximum optimism at the bubble's peak during events like the Dot Com boom and the 2008 financial crisis. If anyone had a different opinion, they would have been laughed out of the room. The same sentiments reversed during the subsequent crash, and investors displayed maximum pessimism at market bottoms.

(Source: RIA)

In this podcast episode, Travis (our co-founder and certified financial planner) and Sophia (our community manager) discuss bear markets, risk tolerance, and how to keep calm when everyone else is freaking out.

A data-backed story on investor emotions

Let’s look at data from two significant events, the 2008 financial crisis and the COVID pandemic in 2020, to illustrate how investors behaved in those times of crisis.

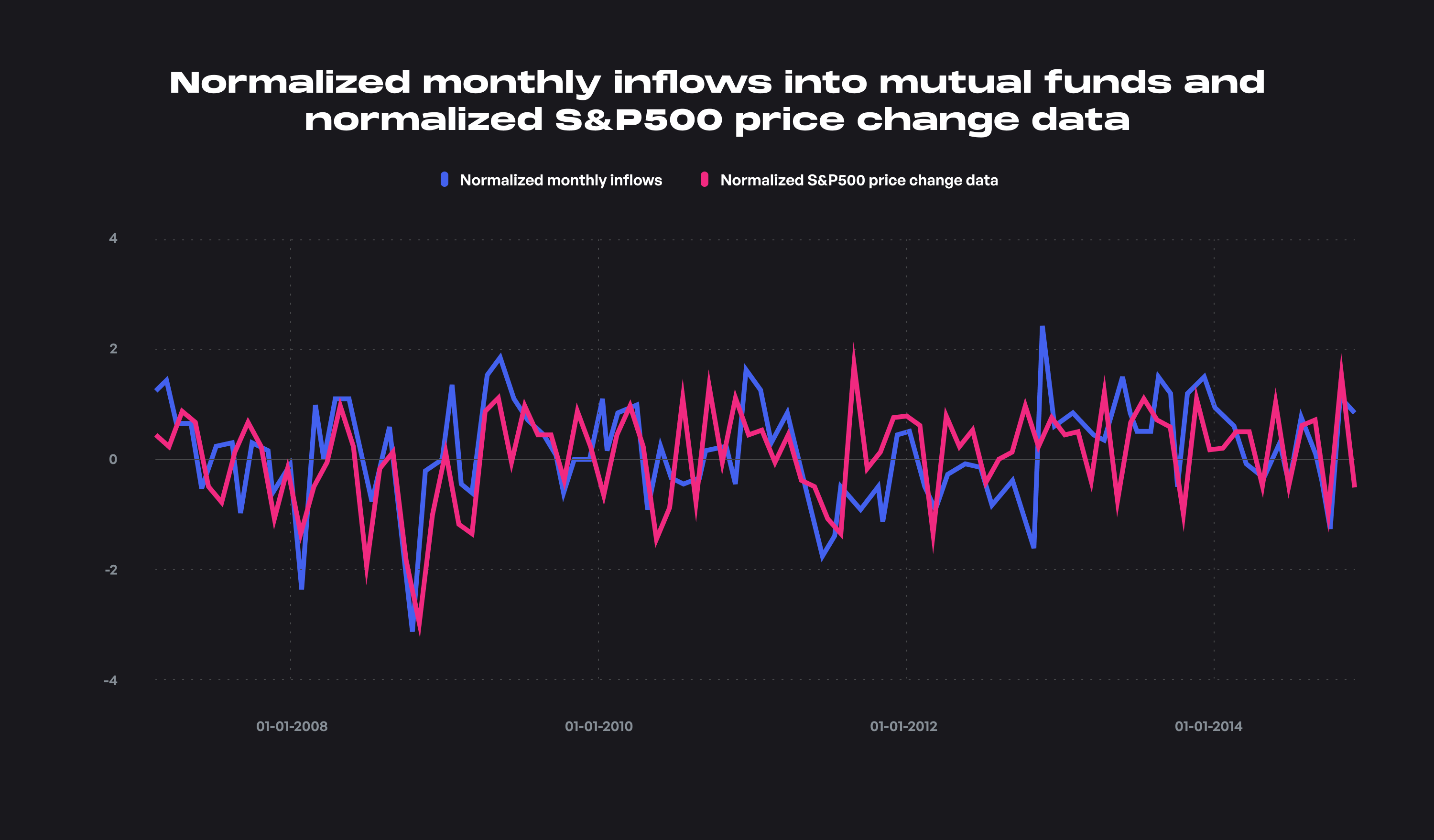

Part 1 - The 2008 Financial Crisis:

(All data involved in creating the graph is available here.)

The graph above shows the correlation between monthly inflows/outflows into equity mutual funds and their comparison with the price of the S&P 500 normalized so that the effects can be easily identifiable.

Just after January 2008, there were strong inflows of money into mutual funds (positive value for the blue line) at the peak of the housing bubble. This graph shows massive optimism in the stock market at the bubble’s peak.

However, after the market crashed in August 2008, investors withdrew money from mutual funds at huge losses. Even worse, they lagged the crash in stock prices by a small margin, which means that many investors liquidated their mutual fund portfolios precisely at the market bottom rather than getting out ahead of it.

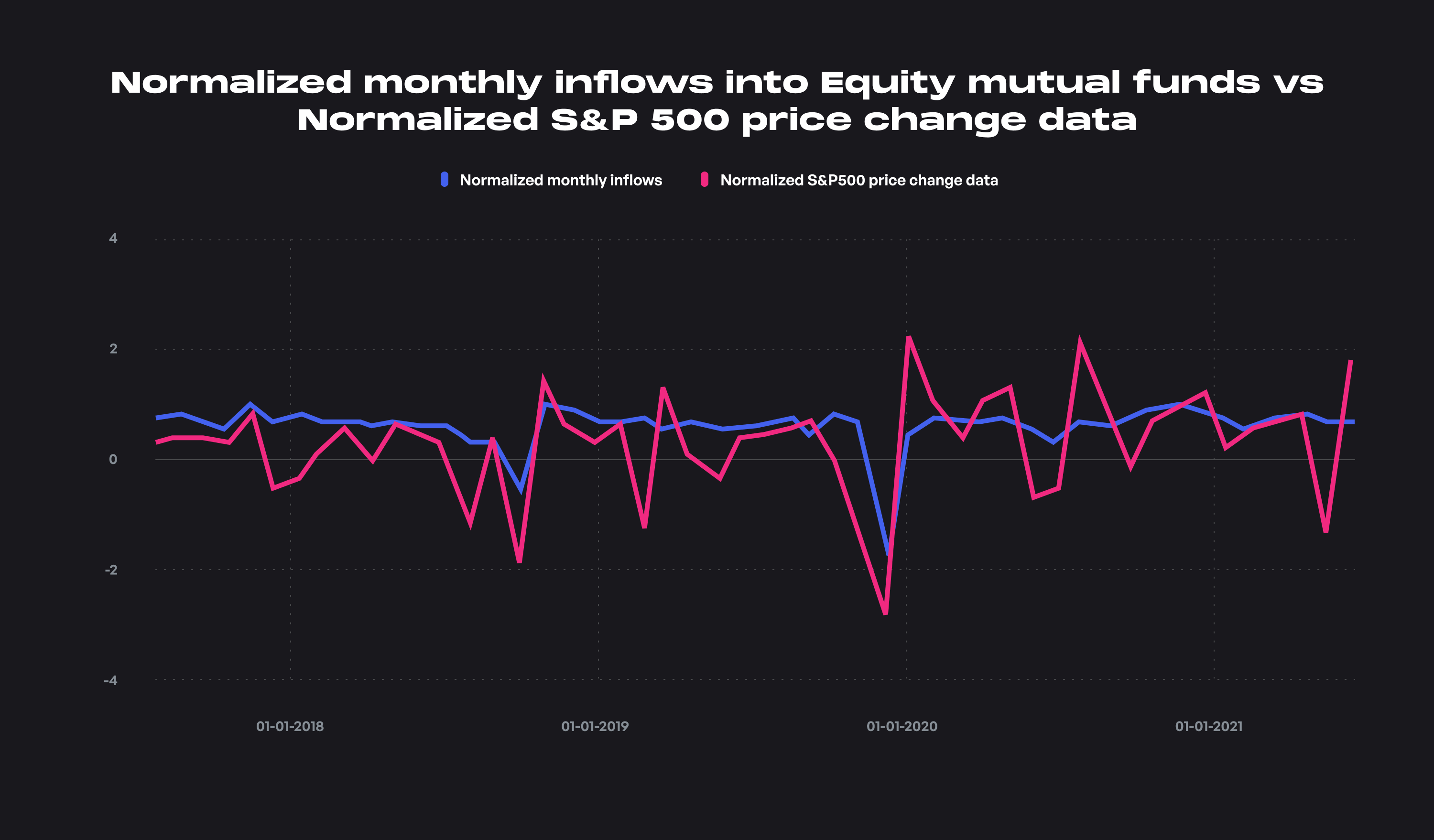

Part 2 - The 2020 COVID pandemic:

(All data involved in creating the graph is available here.)

The same phenomenon was observed during the COVID crash in March 2020. Investors pulled out a lot of money from the equity market via mutual funds just after the crash. The strange part about this crash was that the markets recovered relatively quickly. But even though the markets bounced back, still there were no large inflows of money into equity funds. (View complete data and analysis here.)

These findings show that many investors who liquidated their equity holdings in the COVID crisis did not reenter the market in the following months even after the market bounced back, which resulted in investors missing out on subsequent massive gains.

Why Investors Lost Out In 2008 and 2020

According to Buffett, even though it would have been difficult to do, the prudent investor in both situations should have been buying (greedy) while others panicked around them (fearful) and vice versa. However, most investors followed the crowd, being greedy (buying securities) while times were excellent but fearful (selling securities) as prices started falling (selling securities). It’s particularly telling to note that this fear extended past when the market began recovering, and these investors would have made significant gains if they’d been willing to buy again.

This scenario may be due to a couple of significant factors:

- Fear: It isn’t easy to do the opposite of what the crowd is doing. As discussed before, there is safety in the crowds. When everyone around you is screaming that it’s the end of the world, you might begin to think that it is. Also, it’s easy to be afraid of the past repeating itself. Investors who have lived through the Dotcom bust and the 2008 financial crisis would be more risk-averse due to these past experiences.

- Reentering the market: Imagine if you saw a product you liked priced at $100. Then the next day, you check the price, and it’s $110. You’re generally less inclined to buy the product now, feeling like you’ve missed your chance. You might wait for a future date (that may never come) when prices drop back to $100. We, as investors, face the same dilemma. If you sell your securities at $100, it isn’t easy to repurchase them at $110. This behavior results in investors waiting for corrections in the market that never come; hence they miss out on subsequent gains.

How you can buy low and sell high

Now that we know the mistakes most investors make and why they buy high and sell low, we can look for ways to combat this behavior. And since most decisions to buy high and sell low are driven by emotions like fear and crowd-following, the best ways to do the opposite involve logic and rational behavior.

- Understand your risk tolerance: The first step in overcoming emotions like fear and greed in investing is to understand the risk-to-reward ratio you are comfortable with. A young investor in their 20s with no debt can take on much more risk and stick to equities even in market drawdowns of >40-50%. However, an investor nearing retirement cannot afford to see his portfolio drop significantly in value as he needs his investments to cover his expenses shortly.

- Allocate your investment assets: Asset allocation is integral to building a portfolio that can help you achieve your financial goals. Diversifying your investments into asset classes such as stocks, bonds, cryptocurrencies, gold, REITs, and so on can help dampen exposure to market-specific risks. Asset allocation also helps you avoid panicking and liquidating your investments in periods of heavy drawdowns in a specific asset class, as the other asset classes in your portfolio can help keep it afloat with reduced volatility.

- Rebalance your portfolio regularly: Imagine that you had a simple portfolio allocation of 50% stocks and 50% bonds. During the succeeding year, stocks performed well, and now your portfolio contains 70% stocks and 30% bonds. In this scenario, you would sell off a part of the investment that has done well recently (sell high) and buy an asset class that has been beaten down recently (buy low). This process would rebalance your portfolio to 50% stocks and 50% bonds, enabling you to buy low and sell high with minimal risk.

- Practice dynamic asset allocation: The percentage allocation to different asset classes in your portfolio should not be a stationary number. Dynamically changing the percentage allocation to each asset class as you age and near your target asset allocation helps you avoid massive drops in portfolio value, especially in more risky asset classes like stocks and cryptocurrencies. As you near your financial goals, shifting a higher percentage allocation to safer asset classes can help reduce portfolio volatility and negate the effects of heavy drawdowns in riskier asset classes.

- Acknowledge your biases and past experiences: As human beings and investors, we are prone to several cognitive biases that cloud our rational decision-making abilities. Simply being aware that these biases may sway you helps you improve your ability to make a decision in complex environments. Getting informed about the primary behavioral biases that hurt investors the most can help you think twice before making any investment decision. Also, remember that your past experiences with investing play a vital role in how you react to crises where your portfolio drops in value.

Key takeaways

- Most investors buy high and sell low: Emotions such as greed and fear, as well as investor psychology, prompt investors to make bad financial decisions. Following the crowd can sometimes lead to disastrous investment outcomes.

- There’s no safety in crowds: During major events like the Financial crisis (2008) and the COVID pandemic stock market crash, many investors withdrew money at market bottoms and only reentered the market after subsequent months of missed returns as the stock market rallied. Some investors are still waiting on the sidelines to reenter the market at lower levels.

- Buy low, sell high: The actual structure that can help you as an investor buy low and sell high involves setting up systems of rational behavior and clear self-awareness. These systems and practices (mentioned above) will defend you against your fears and biases while creating simple strategies to buy low and sell high with high ease and low risk.

- Discounts during crises: When a crisis occurs, securities like stocks and bonds trade at a significant discount to their intrinsic value due to maximum pessimism in the markets. Buffet advises that this is a good time for individual investors to add additional positions in a broadly diversified basket of stocks using vehicles like low-cost, broad market, market-cap weighted index funds.

Why you'll (mostly) fail to beat the index by trading

Josh Pigford

Understanding money and its history

Josh Pigford

Bad Investments: How to Avoid Losing Money

Josh Pigford

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.