Why you'll (mostly) fail to beat the index by trading

Author

Josh Pigford

Passive investing—in which you as an investor hold diversified index funds of several asset classes such as equities, bonds, or REITs has become increasingly popular among everyday investors over the past few years.

While index funds might not have the “glam factor” of trading and active investing, holding a diversified portfolio of assets often brings returns as good—if not better—than active investing, minus the headaches.

Let us try and understand why this seismic shift from trading and active investing to passive investing is underway. Also, we'll go through how you can structure your portfolio to yield maximum returns for the risk you're willing to take.

What is trading?

Trading is generally defined as the buying or exchange of goods and services. However, in the financial markets, trading refers to buying and selling securities such as stocks and bonds to profit from these transactions. Trading employs the help of technical analysis, which tries to forecast the direction of an asset’s price using past data, patterns, and trends.

Trading can be further classified into three types:

- Intraday trading: This type of trading involves the buying and selling of securities on the same trading day. Intraday traders aim to make a profit out of everyday fluctuations in various stocks in the market.

- Swing trading: This type involves holding positions in securities for a few days to a few weeks. Traders use swing trading to try and capture longer-term moves in the market and are analyzed using hourly or daily charts.

- Positional trading: This type of trading involves buying and holding positions in securities for more extended periods such as several weeks, months, or a few years at most. The aim here is to capture considerable movements in the price of a particular security.

Trading is generally considered more short-term than investing, which occurs over long periods such as years and decades.

What is active investing?

Active investing is similar to trading in that you try to choose specific securities that can help you make outsized profits. It involves taking a dynamic, hands-on approach (or hiring someone— usually a fund manager—to do it for you) to select the various assets in your portfolio.

Active investing differs from trading in that, in addition to technical analysis, which involves looking at charts and patterns (as in trading), fundamental analysis of the specific security is also generally conducted. Active investing often requires investors to hold on to securities for longer periods when compared to trading.

For example, when considering equity investments, active investors generally try and gather information about the company and its finances from documents like the balance sheet, income statement, and cash flow statement, as well as quarterly and annual reports to see if that specific stock could be a good fit for a portfolio.

The risks with trading and active investing

There are several risks involved, as a retail investor, in going down the route of trading securities or trying to actively invest in specific securities. When compounded through time, these risks can cause considerable variations in the final value of your portfolio.

Fees and other costs

Fees are a huge barrier when it comes to trading and active investing. Trading incurs high brokerage and transaction costs while investing in active mutual funds (which employ dedicated analysts and fund managers to try and outperform benchmark indices) usually have much higher fees (expense ratios) than index funds.

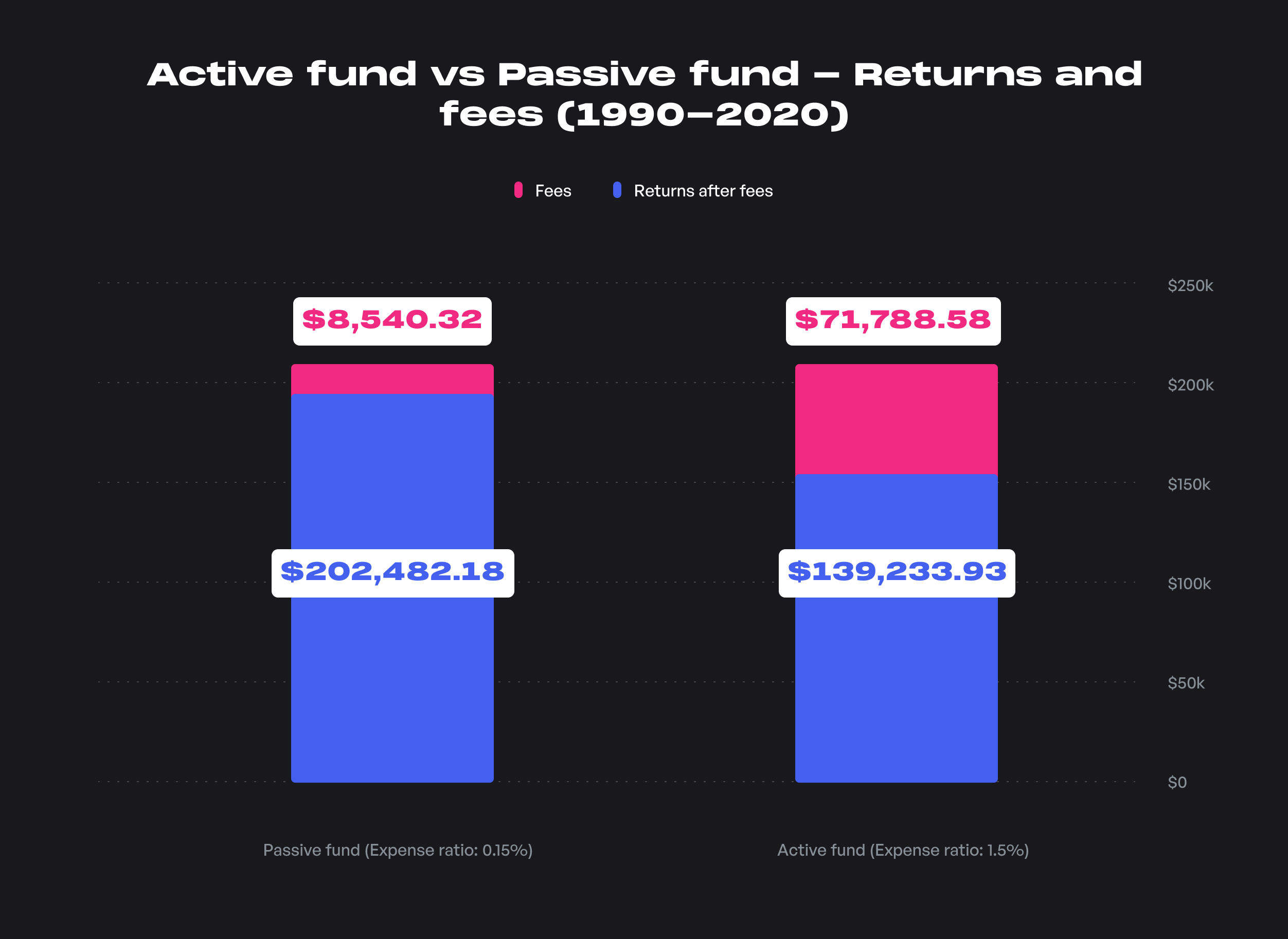

As seen below, a 1.5% expense ratio of an active fund compared to a 0.15% expense ratio of a passive (index) fund leads to a massive difference in the final value of the portfolio over a long period, in this case, 30 years. (Here, the inputs are an 8% annualized return before fees and with a starting investment of $10,000.)

In the case of trading, transaction costs could easily exceed the 1.5% given as fees to the actively managed fund. So on average, final annualized returns would be much lower if you trade a lot.

Markets are generally a zero-sum game with an equal number of winners and losers. However, when it comes to financial markets, it becomes a negative-sum game. This is because, despite having an equal number of winners and losers, expense ratios, brokerage fees, and other transaction costs are reduced from the overall returns, making the overall returns on both sides of a transaction a net negative.

Taxation

Trading and active investing require a high portfolio turnover (buying and selling securities frequently) compared to just buying and holding an index fund. Thus trading and investing in actively managed mutual funds could result in you paying higher taxes due to a high turnover in the securities you hold.

There are so many actively managed funds to choose from, and if a particular fund underperforms, it becomes tempting to switch or withdraw investments from a particular fund. Holding on to a diversified index fund reduces distractions and is tax-efficient.

Performance

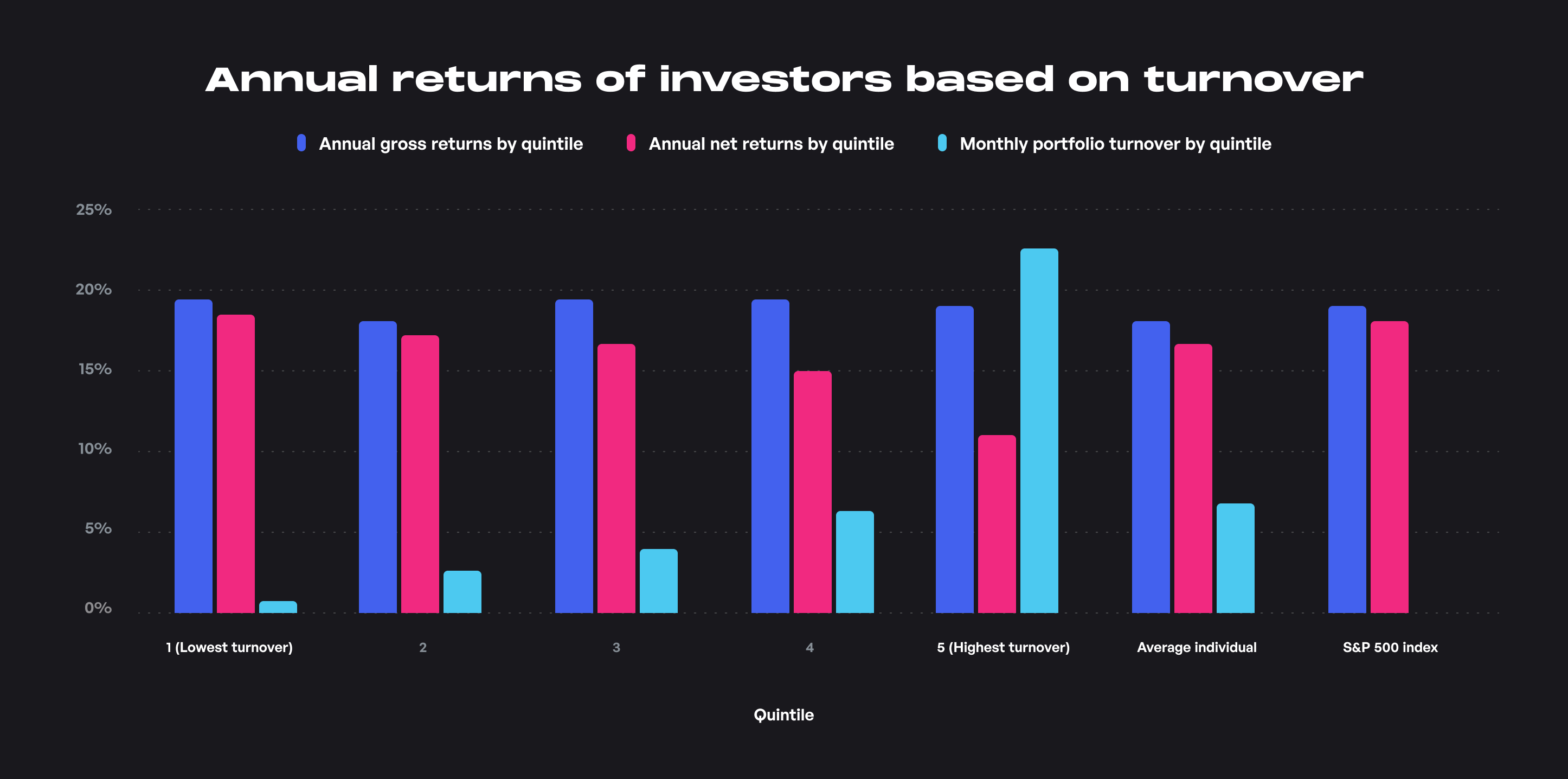

Several studies show that annual returns tend to drop off as turnover increases. When looking at trading performance, we can consider this study by the University of Berkley, which studied about 78,000 households in the US and concluded that the more a person traded, the more significant their underperformance compared to the benchmark indexes.

The cost and frequency of trading, not the specific assets in the portfolio, was the reason for the poor investment performance. Also, the households that traded the least achieved the highest returns among the households studied.

SPIVA data from Standard and Poor shows that over the long term, more than 83% of active funds fail to beat their respective benchmark, even before considering fees. This data indicates that it is challenging to beat the index regularly, even with the best data, top-class talent, and cutting-edge infrastructure.

Human behavior

Trading or investing in securities means making dozens—even hundreds—of complex decisions. And the more decisions the human brain makes, the higher the probability of making an error.

When to enter and exit? Which security to choose? When should you take a profit or cut losses? Which industry will boom? How long should you hold a particular asset?

The human brain is afflicted by so many behavioral biases that cloud our rational judgment that it is nearly impossible to make an emotionless decision, especially regarding money and investing.

Humans, on average, overrate their abilities and underrate the abilities of others. According to a Swedish study in 1981, about 88% of American drivers said they possessed above-average driving skills, which is a mathematical impossibility.

This same phenomenon applies to investing as well. We don't want to be average and think we have superior trading or stock-picking skills. But, when we chart and understand our performance compared to the index, it generally results in us underperforming the benchmark. Investing is one of the only fields where you can be average and outperform most other market participants.

Luck

In investing, separating investing outperformance from random luck due to chance is almost impossible. To show statistical significance (a math term used to indicate if a particular outcome can be attributed to a specific cause), multiple decades of investment performance and data are required to attribute investment outperformance to skill and not luck.

In financial markets with millions of participants, there will be instances of investors or institutions outperforming the benchmark indexes just due to random probabilities. Investors who got lucky on their trades or stock picks generally attribute their successful investments and trades to their superior skills, whereas their losing trades, predictions, and stocks are chalked up to just plain old bad luck.

External factors

The prices of different assets in financial markets are the estimations of thousands or millions of market participants at a particular point in time. Investors in markets generally try to anticipate the future (forward-looking), and developing a strategy that can predict which securities are overpriced or underpriced consistently is difficult, if not impossible.

Markets can stay irrational longer than you can remain solvent , and you don't just have to get the specific security right; you have to be right at the right time. While investing in securities like stocks, there are an uncountable number of internal company-specific factors (industry tailwinds/headwinds, management decisions, talent, innovation, product lines, lawsuits, and IP) as well as external macroeconomic factors (interest rates, inflation, and forex rates) that determine the performance of a company in the future.

This vast number of input variables (many of which we don't even know about) is why it is so difficult to pick winners and losers, especially in the stock markets, as no one knows all the input variables that determine the price of a particular stock.

Looking at all the factors above, we can see that active investors and traders are affected by risks such as high fees and costs and higher taxation. Active mutual funds also underperform their benchmark indexes 80% of the time.

Also, behavioral biases make it very difficult to take the several decisions involved in active investing. Finally, there is the massive role of luck involved in trading and investing actively and the several external factors that affect the performance of a fund/stock. These factors make investing passively into diversified funds across asset classes attractive.

A well-rounded passive investing portfolio can help you hedge against these risks by having lower fees and associated costs, being tax-efficient, giving you the exact market return (no underperformance), reducing cognitive biases and the number of decisions you have to take, and removing the role of luck (picking the best performing stock/fund) from the equation. It also hedges you against the company and sector-specific risks and only exposes you to market risk.

Key takeaways

- In this article, we started by understanding the specific definition of trading, the different types of trading, such as intraday, swing, and positional trading, and the differences between the different types of trading.

- We then moved on to the concept of active investing, which means trying to actively build your portfolio by selecting various assets that make up your portfolio. Active investing involves choosing specific securities or outsourcing the process to investment professionals like fund managers.

- Finally, we moved on to the risks associated with trading and active investing and how we can mitigate these risks by investing passively. These include risks like higher fees and transaction costs which eat into your returns, higher capital gains taxes, lower returns than the benchmark indexes (83% of active funds underperform), the effect of human emotions on investment decisions, separating investment skill from luck and the influence of external factors (both micro and macroeconomic) on specific securities.

- So, while investing, instead of focusing on performance, which is primarily not in our control, we can focus on those factors (such as fees, taxes, and trading costs) that are in our control and try to minimize them.

Imputed Income: What It Is and How It Affects You

Josh Pigford

Maybe's Top Picks: Best Personal Money Management Software for Mac

Josh Pigford

Maybe's Top Balance Sheet Software for Small Businesses

Josh Pigford

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.