Behavioral Biases: How you can improve your saving & investing decisions

Author

Josh Pigford

It is an acknowledged fact that we perceive errors in the work of others more readily than in our own.

Leonardo da Vinci

What are behavioral biases?

To understand behavioral biases, we must first understand what a bias is: a disproportionate weight in favor of or against an idea or thing , usually in a way that is closed-minded, prejudicial, or unfair.

Behavioral biases are a type of bias that consists of irrational beliefs or behaviors that can unconsciously influence our decision-making process. These biases arise from our brain taking shortcuts while making complex decisions. This works in our favor as we can make optimal decisions quickly. Still, it can lead to a lapse in rationality and a deviation from the most optimal decision in some situations.

They are generally of two types:

- Cognitive Biases

- Emotional Biases

Cognitive biases

Cognitive biases are errors that occur subconsciously in thinking that lead to a misinterpretation of information from the world around us. They are primarily caused by mental shortcuts (heuristics) that simplify complex information processing and decision making, societal pressures, and emotional (over)reactions to certain stimuli.

By understanding the cause and effects of the major cognitive biases and trying to think back to situations in the past where you might have acted on these biases, you can improve your decision-making abilities in complex situations.

Emotional biases

Emotional biases distort cognitive thinking and decision-making abilities due to emotional influence. Emotional biases result in us taking action based on feelings and intuition instead of relying on facts, research, and data. These are harder to identify and correct, but you can develop an intuition around choosing the best possible decision with time.

If you love podcasts, you can check out this episode of Ask Maybe where we discuss behavioral biases, our favorite biases, and how to combat them.

Major cognitive biases

Knowing the various cognitive biases (especially those around helping you save and invest better) can help you make the optimal decision in complex situations involving money.

Anchoring bias

The anchoring bias is a cognitive bias that causes us to focus and rely too heavily on the first piece of information we encounter on a particular topic. A general example of this bias would be in the real estate market, where a broker might show you houses that are priced extravagantly at first and then take you to one that fits your budget.

Here the prices of the expensive houses serve as an anchor , causing the houses that were shown to you later (which fit your budget) to seem like a great deal.

Anchoring bias in saving and investing

- Houses: When going house shopping or looking up rates for houses/trips online, it's easy to anchor our expectations of the correct price around the first price we see listed.

- Sales negotiations: Any salesperson (a used car salesperson, for example) will quote prices that are much higher than the fair value of the product. This initial high price is then set as an anchor, which tilts the negotiation in favor of the salesperson as the final sale price would generally be higher than if the salesperson had offered a fair or low price from the get-go.

- Stock prices: While comparing two stocks or ETFs, many investors may consider the stock/ETF with the lower price as potentially more valuable (undervalued) than the stock/ETF with the higher stock price because they can get larger quantities of the former.

- Shopping: Imagine you're out shopping, and you see a product worth $500. This price is then set as an anchor for that particular product. So if you see something cheaper (at $350, for example), you might consider that product a steal even though it may be grossly overpriced.

- Investment returns: Recent performance is not an indicator of future performance. Several investors who have entered the stock market during the bull run of the last decade may expect this performance to continue going forward. In this example, the market's performance during the most recent years serves as an anchor for the "normal" returns of the stock market. I nvestment decisions based on these assumptions could lead to disaster when the trend reverses.

Combating anchoring bias

Anchoring bias can lead to some sub-optimal decisions, especially regarding money. There's no way to eliminate this bias. However, there are specific steps we can take to overcome it.

- Acknowledge the bias: The first step in outsmarting a bias is to understand the various situations in which you might be susceptible to it. This bias occurs when you are under pressure to make complex decisions quickly or tend to act in haste.

- Delay your decision: The second step involves taking more time while making your decisions. Research prices, look at data and facts, check reviews and guides for necessary information, etc. This can help you eliminate impulsive decision-making.

- Create your anchor: If you do your research right and don't act impulsively, you can use the anchoring bias to your advantage. Informing your decisions with data and research can help you make the first informed offer and put you in an advantageous position during negotiations.

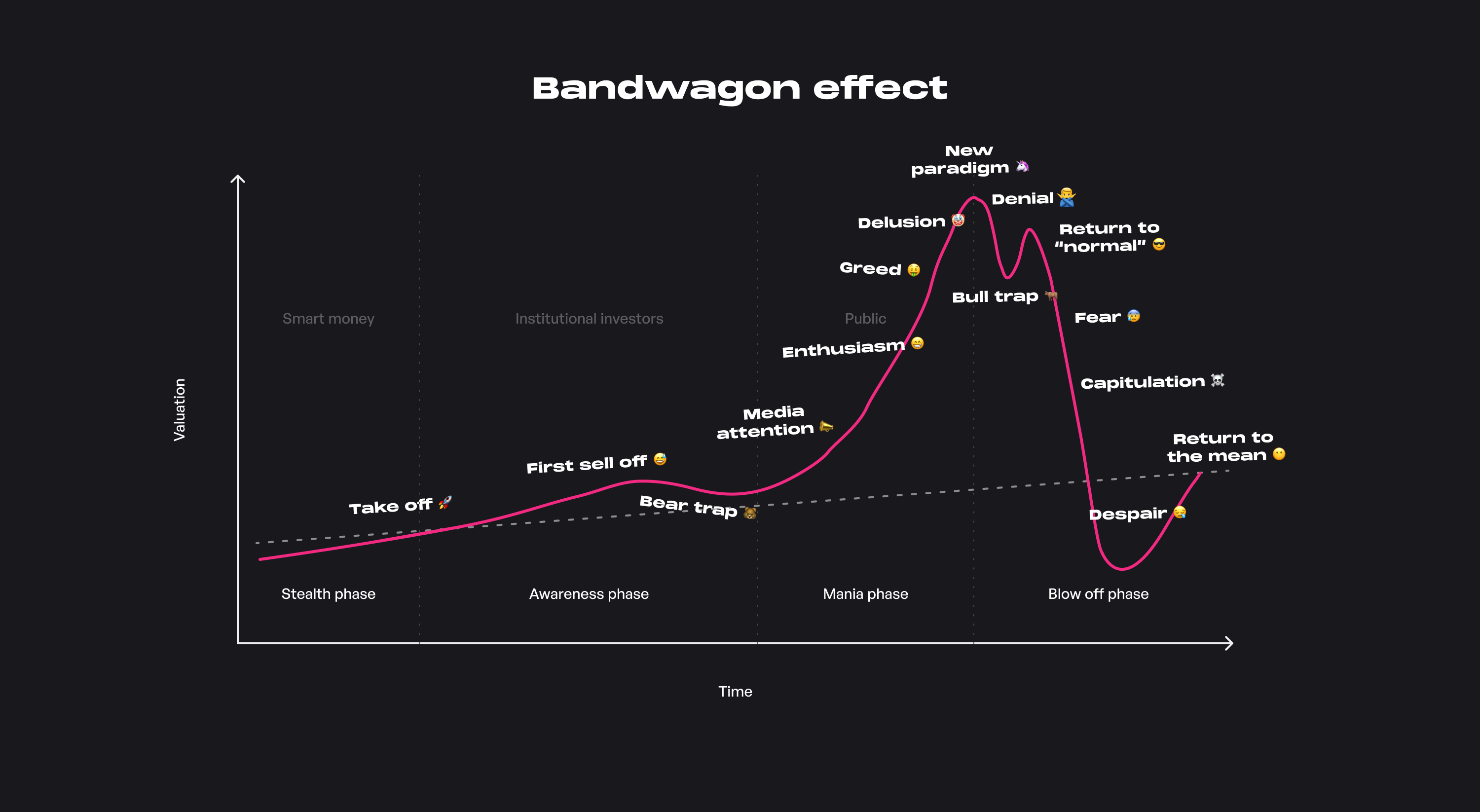

Bandwagon effect

The bandwagon effect (also known as herd mentality ) is a cognitive bias in which people do something primarily because others are doing it , sometimes even overriding and ignoring their long-held beliefs. Some great examples of the bandwagon effect are the financial bubbles (sub-prime mortgage crisis, dot-com bubble), where people follow others regardless of whether they understand the risks involved.

Bandwagon effect in saving and investing

- Chasing hot stocks: We are social creatures and feel comfortable knowing that others have made the same choices and decisions. In financial markets, this causes investors to buy certain stocks just because other investors are buying them because there is safety in the crowd.

- Financial bubbles: The bandwagon effect was prevalent during the dot-com bubble, where several companies that didn't have a viable business plan and no revenues raised millions of dollars in investment from the markets.

- Cryptocurrencies: Several cryptocurrencies (especially newer ones with small market caps) rely solely on the bandwagon effect to pump up prices. Pump and dump schemes and rug pulls employ the same tactics to defraud investors.

Combating the bandwagon effect

- Keep your emotions in check: Especially when you're making large purchases and investing, it's important not to blindly follow the crowd as you don't know whether they're collectively going off a cliff.

Even the intelligent investor is likely to need considerable willpower to keep from following the crowd.

Benjamin Graham

- Play money: Yes, it's true! Good investing is rarely exciting. However, it's better to keep a small amount of money aside to speculate on high-risk/reward investments rather than risking your entire capital or retirement savings. This lets us quench our thirst for excitement without putting ourselves in the way of financial ruin. However, it would help if you are prepared to lose a considerable percentage of the money kept aside for more speculative investments.

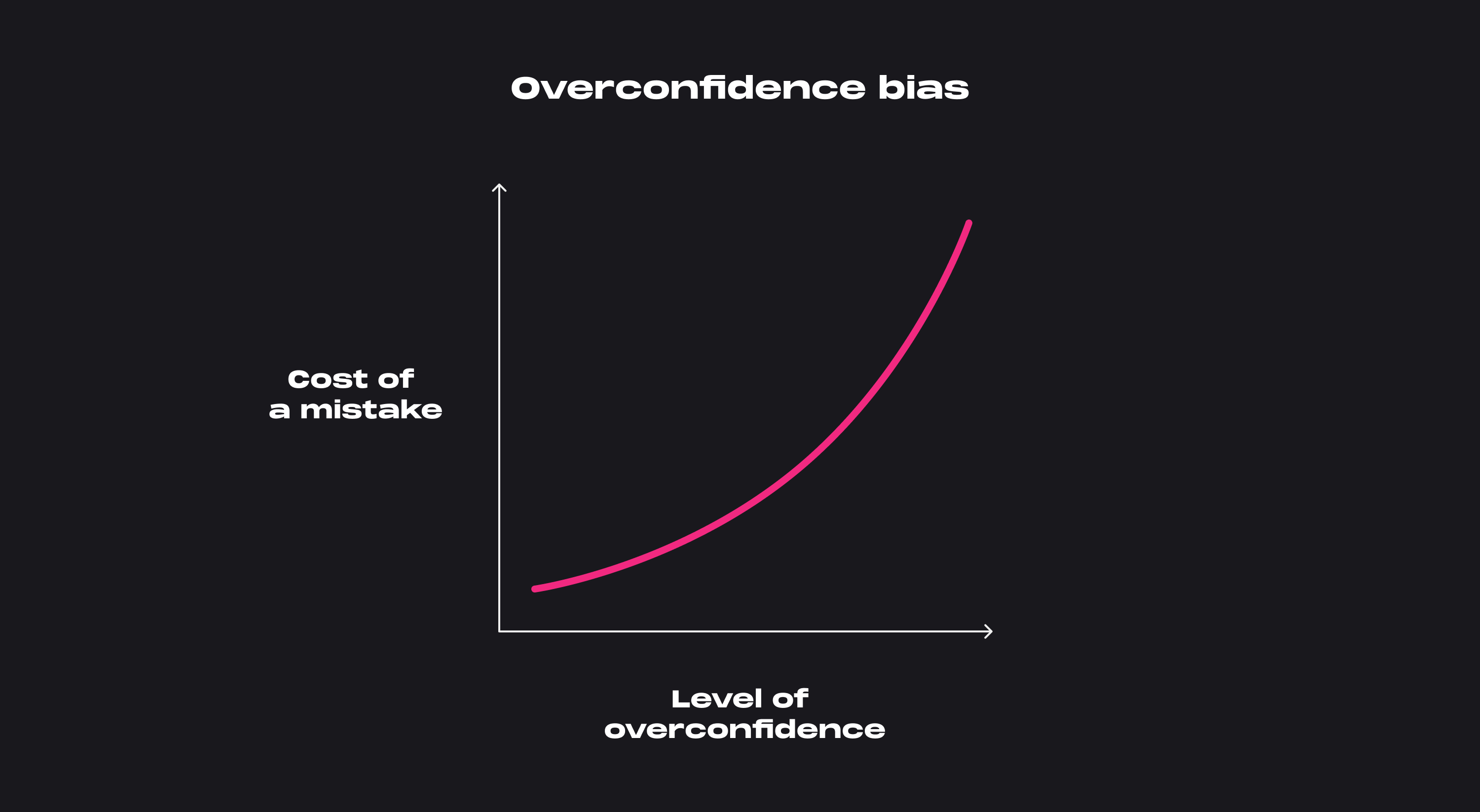

Overconfidence bias

Overconfidence bias is an emotional bias in which a person tends to have subjective confidence in their decisions that is much greater than the objective accuracy of those decisions. It's the tendency of a person to overestimate their abilities.

A simple example of this can be observed in a survey of 161 students in Sweden and the United States, asking them to compare their driving skills and safety to other people's.

a.) For driving skills, 93% of the U.S. sample and 69% of the Swedish sample put themselves in the top 50%;

b.) For safety, 88% of the U.S. and 77% of the Swedish put themselves in the top 50%.

This survey notes the general tendency of humans to overestimate their abilities and skill compared to the population set.

Overconfidence bias in saving and investing

- Trading stocks/ETFs: A study published by Brad M. Barber and Terrence Odean in the Journal of Finance analyzing the trades made by 10,000 clients of a large brokerage firm showed that frequent trading leads to lower returns. The more active the client was, the lower their returns were. This reduction in returns is attributed to several factors, including a lack of a properly diversified portfolio and significant transaction costs incurred due to frequent trading. In this case, traders with the most overconfidence in their ability to beat the market ended up performing the worst.

- Active fund managers: A survey conducted by James Montier of 300 professional fund managers asked the fund managers to rate themselves above or below average compared to the rest of the active managers. 74% of fund managers responded that they are above average, which is statistically impossible. Of the remaining 26% of managers, most thought they were average , with almost no one admitting that they were below average.

Combating the overconfidence bias

- Refer to statistics and data: When making any investment decision, compare it to the past performance of your active investments. Keep a spreadsheet and regularly assess how your active investments perform (after fees and transaction costs) against the benchmark. The data shows that individuals that trade less and invest for the long term generally do much better than those who trade frequently.

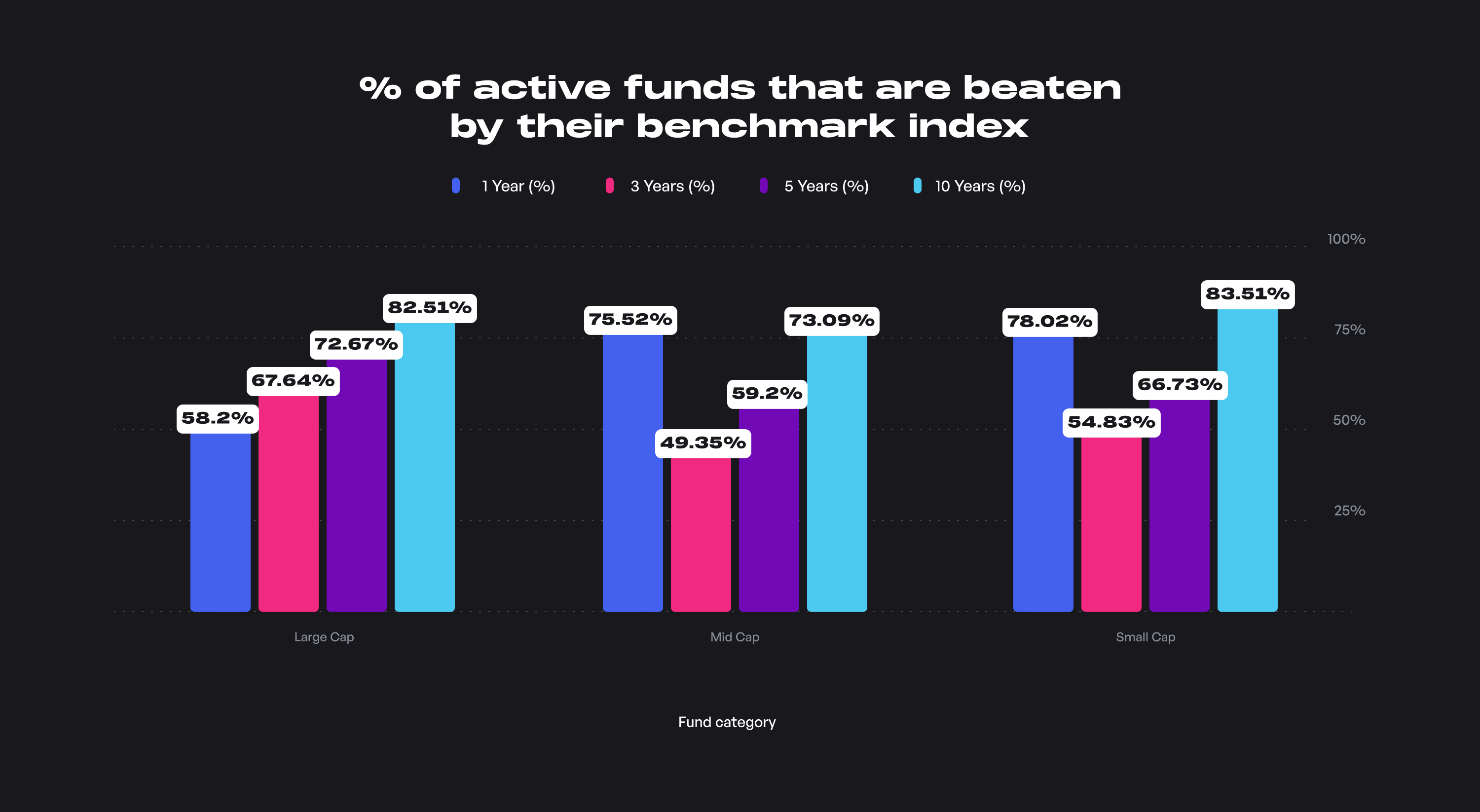

- Remove the human in the loop: As long as a human makes decisions on purchases and investments, biases may be part of the decision-making process. Removing human emotions and biases in investment decision-making (such as switching from active to passive funds ) can help minimize transaction costs and expense ratios and eliminate the biases inherent in fund managers while keeping a large share of the market returns to yourself.

Seersucker illusion

The seersucker illusion is a cognitive bias in which people become overly reliant on expert advice. This bias is seen primarily in media, business, and finance.

The s eersucker illusion in saving and investing:

- Investment advisors: Several investors make investment decisions solely on the recommendations of their investment advisors without understanding the rationale or thought process behind why a specific investment decision is suggested. Also, consider fee-only financial advisors who have a fiduciary duty to put their clients' interests over theirs (no conflict of interest). They are paid based on the service they provide to the client and not by the commissions paid by fund houses or taking a percentage of assets under management. Understanding the incentives in each interaction involving financial decisions is paramount.

- Investment recommendations in the media: Many investors look towards media channels for investment advice and stock recommendations without doing further research on the person's track record or analyzing whether the specific asset class/strategy recommended is in line with their financial goals and risk appetite.

Combating the s eersucker illusion

- Do your own research (DYOR): Several studies on the analyst estimates of stock prices show that estimates are generally way off from the predicted price. Also, these estimates vary significantly from firm to firm, so there's no way of knowing which firm will get the forecast right in a given year.

- Look at the data: The SPIVA report published by Standard and Poor contains research into the debate on active vs. passive funds. According to the study, 82.5% of large-cap active managers have underperformed the S&P 500 benchmark in the last decade. There was a greater than 4/5 chance of investors picking an active fund that underperformed the index over the previous ten years.

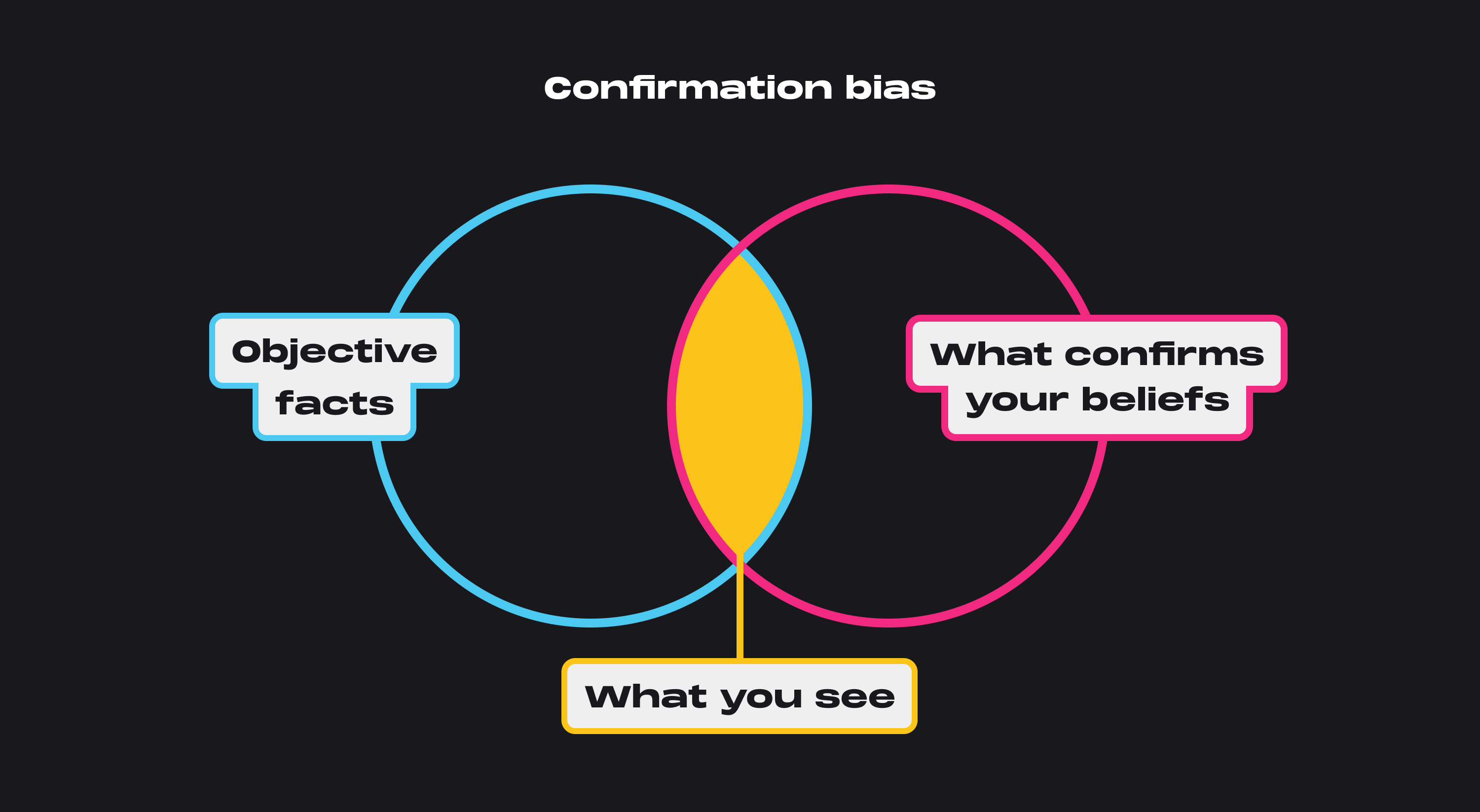

Confirmation bias

Confirmation bias is the tendency to process information by looking for or interpreting information consistent with one's existing beliefs. It involves favoring information that confirms previously held beliefs and biases and ignoring all information contrary to such beliefs.

Confirmation bias in saving and investing

- High-value purchases: When considering the purchase of high-value assets such as a specific car or house, confirmation bias can influence us significantly. It can prompt us to seek information that aligns with our pre-existing beliefs/biases without looking at it objectively and deciding if it would be the right choice in terms of utility and cost. For example, we might read articles that say " reasons to buy X" instead of "what are the pros and cons of buying X."

- Investment decisions: If an investor has made up their mind about the rise of a particular sector/stock, they might actively seek out articles, videos, TV channels, and other outlets of information that corroborate with and reinforce their beliefs. Even worse, when there are actual negative changes that might affect the industry/stock, some investors double down and refuse to accept the new information, convincing themselves that the negative news is temporary.

Combating confirmation bias

- Seek information that contradicts your beliefs: You can overcome confirmation bias by actively looking for new information that challenges your long-held notions and beliefs. Seek out strong arguments against any significant money decisions you take and understand if the opposite side makes valid points.

- Frame research questions appropriately: Frame questions so that you can understand both sides of an argument (for and against) instead of actively seeking out data points that support your preferred conclusions.

Key takeaways

Cognitive biases play a significant role in the decision-making process, especially when we have to make complex decisions with high stakes quickly. You cannot eliminate them entirely, but you can take steps to mitigate them, especially in monetary decisions.

The most crucial step is the awareness that cognitive biases exist and that they inhibit your decision-making abilities. Then you can follow the recommendations above for specific ways to combat these biases.

What Is a Stipend? Understanding Its Purpose and Benefits

Josh Pigford

11 bold ways to boost your financial health

Josh Pigford

How is Maybe different than Personal Capital?

Josh Pigford

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.