How to Successfully Complete the 100 Envelope Challenge

Author

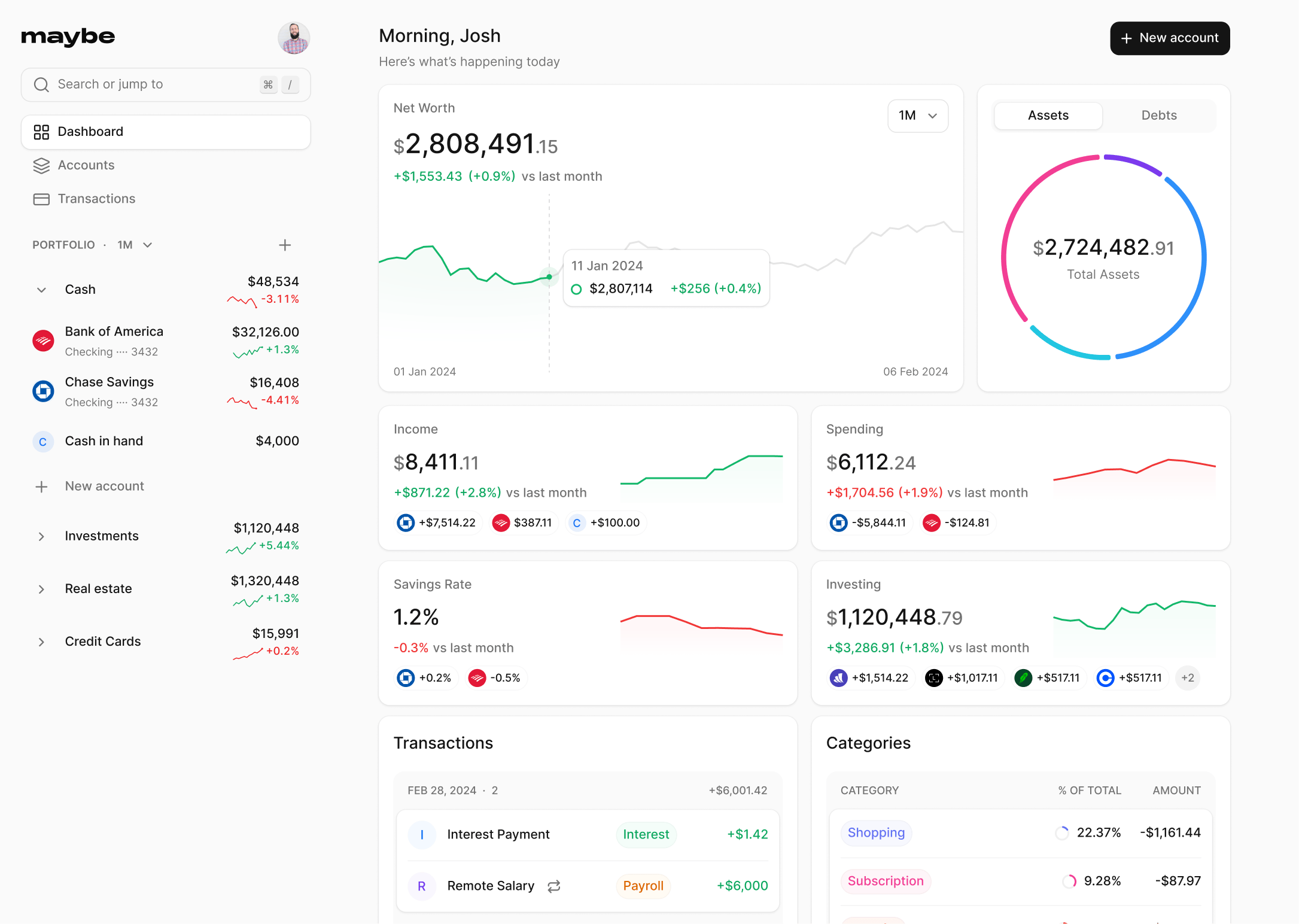

Josh Pigford

In an era where budgeting and money management have become pivotal for financial well-being, the 100 envelope challenge emerges as a captivating and effective strategy to build savings in a structured yet fun way. This challenge, deeply rooted in the principles of discipline and incremental progress, provides individuals an innovative framework to set aside a substantial amount of money within a definite period. By turning the often monotonous task of saving into an engaging activity, the 100 envelope challenge stands out as a noteworthy tool in personal finance management, appealing to a wide audience seeking practical solutions to enhance their financial landscape.

How the 100 Envelope Challenge Works

The 100 Envelope Challenge operates on a simple yet effective principle designed to make saving money both fun and achievable. Participants start with 100 envelopes, each numbered from 1 to 100. The challenge can be customized to fit personal preferences and financial situations, offering various methods to save a significant amount over time.

Step-by-step Guide to Set It Up

- Gather Supplies: You'll need 100 envelopes and a pen or marker for numbering.

- Number the Envelopes: Mark each envelope from 1 to 100.

- Choose a Storage Method: Find a secure place, like a box or drawer, to store your envelopes.

- Decide on a Frequency: Whether daily, weekly, or monthly, select an envelope and deposit the corresponding amount of cash.

- Track Your Progress: Use a tracker or simply mark off each envelope as you fill it to keep track of your savings.

Variations of the Challenge

- Electronic Version: For those uncomfortable with holding cash, transfer the equivalent amount into a savings account instead of using physical cash.

- Customization: Adjust the challenge by using fewer envelopes or altering the frequency to suit your financial capacity.

- Creative Envelopes: Make the process enjoyable by crafting or decorating the envelopes, adding a personal touch to the challenge.

- Partner Participation: Engage in the challenge with a partner or friend to add a competitive edge and share the savings journey.

This structured approach not only simplifies the process of saving but also introduces flexibility and creativity, making the 100 Envelope Challenge a versatile tool for enhancing personal finance management.

Benefits of the 100 Envelope Challenge

Financial Discipline

The 100 Envelope Challenge instills financial discipline by encouraging participants to save a significant amount, potentially more than they would in a similar timeframe. This structured approach to saving can transform it into a rewarding activity, making it easier to continue saving beyond the challenge. Adapting the challenge to fit individual financial situations ensures everyone can participate, fostering a habit of saving and making it feel less like a chore and more like an engaging game.

Achieving Savings Goals

Saving $5,050 is a substantial achievement that the 100 Envelope Challenge offers. It not only provides a clear savings target but also strengthens individuals by setting and reaching financial goals. This challenge makes saving money more enjoyable and promotes contentment through reduced spending. Additionally, budgeting becomes an integral part of the process, empowering participants to take control of their finances. The challenge also encourages communal participation, creating a sense of closeness among family and friends working towards a common goal.

Challenges and How to Overcome Them

While the challenge is beneficial, it may not be realistic for everyone, especially those with tight budgets. However, the flexibility of the challenge allows for modifications to suit different financial capacities. For those concerned about the safety of storing large amounts of cash, alternatives such as transferring funds to a savings account can offer a solution, combining the challenge with the benefits of earning interest. Starting with smaller, manageable goals can help overcome the challenge's daunting aspect, gradually building up to larger savings targets and fostering a long-term habit of financial prudence.

Tips to Succeed in the 100 Envelope Challenge

Reducing Spending

- Assess Your Expenses: Begin by evaluating your current spending habits. Identify non-essential expenses such as dining out, fancy lattes, or subscriptions that can be paused. Consider meal prepping instead of eating out and opting for free activities like hiking or visiting parks.

- Budgeting: Create a detailed budget to track where each dollar is going. This visibility allows you to manage your finances more effectively and make informed decisions about where to cut costs.

Finding Extra Income

- Boost Your Earnings: Look for opportunities to increase your income through side hustles, selling unused items, or working overtime. These extra efforts, concentrated over the 100 days of the challenge, can significantly boost your envelope savings.

- Utilize Resources: Utilize budgeting tools like EveryDollar to allocate your increased income efficiently, ensuring that extra earnings go directly into your savings rather than being spent.

Staying Motivated

- Set Clear Goals: Define what you are saving for, whether it's paying off debt, building an emergency fund, or planning a vacation. Keeping these goals in sight can help you stay focused and avoid unnecessary spending.

- Accountability Partners: Engage family or friends in the challenge to create a support system. This can add a layer of accountability and even healthy competition, which can be very motivating.

- Celebrate Milestones: Recognize and celebrate small successes to maintain motivation. Whether it's treating yourself to a small reward after reaching a certain amount or sharing your progress with your accountability partner, acknowledging these achievements can provide continued encouragement.

Alternative Savings Challenges

30-day Savings Challenge

For individuals seeking a short-term financial boost, the 30-day Savings Challenge offers a structured yet flexible approach. This challenge encourages saving spare change with every purchase, promoting the habit of saving as frequently as one spends. Another variant, the No Dining Out Challenge, highlights the potential savings from eliminating restaurant expenses for a month. By preparing meals at home and avoiding daily coffee purchases, participants can significantly reduce their monthly food expenditure. Additionally, setting a goal to save $500 within 30 days provides a clear target and motivates individuals to scrutinize their budgets for savings opportunities or to explore additional income sources.

365-day Penny Challenge

The 365-day Penny Challenge is a gradual savings strategy starting with saving $0.01 on day one and increasing the savings by a penny daily. This challenge accumulates to over $600 in a year, making it a practical option for long-term savings without feeling the financial strain. Its simplicity and incremental nature make it suitable for individuals at different financial stages, including children, to cultivate a savings habit early on.

52-week Money Challenge

The 52-week Money Challenge simplifies saving by aligning the savings amount with the week number of the year, starting with $1 in the first week and increasing by $1 each subsequent week. This challenge culminates in significant savings of $1,378 by the year's end. It's adaptable to various financial situations, allowing for modifications such as reversing the savings order or adjusting the weekly savings amount. This challenge not only aids in building a substantial savings fund but also in establishing a consistent saving habit.

Each of these alternative savings challenges provides unique benefits and can be tailored to individual financial situations, goals, and preferences. Whether it's building an emergency fund, saving for a vacation, or simply improving money management skills, these challenges offer a structured path to financial improvement.

Understanding Grantor vs Grantee in Real Estate Transactions

Josh Pigford

Maybe's Top Balance Sheet Software for Small Businesses

Josh Pigford

Step-by-Step Instructions on How to Void a Check

Josh Pigford

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.