Understanding Grantor vs Grantee in Real Estate Transactions

Author

Josh Pigford

In the realm of real estate transactions, the terms grantor and grantee play pivotal roles, each embodying distinct responsibilities and rights. Recognizing the nuances of these roles is essential for anyone involved in buying or selling property.

Definition of Grantor

The grantor is fundamentally the party initiating the transfer of property rights. This individual or entity holds the current title to the property and decides to convey ownership to another party. In essence, the grantor is the seller in a real estate transaction. The act of transferring ownership is formalized through the signing of a deed, making the grantor responsible for initiating this crucial step. The nature of the rights transferred can vary significantly depending on the type of deed used in the transaction, ranging from quitclaim deeds, which may offer no guarantees about the property's title, to general warranty deeds, which provide comprehensive protections to the buyer.

Definition of Grantee

Conversely, the grantee is the recipient of the property rights. This role is typically assumed by the buyer in a real estate transaction. The grantee accepts the title to the property, assuming ownership from the grantor upon the closing of the transaction. The rights and protections afforded to the grantee can differ markedly based on the deed type. For instance, a general warranty deed ensures the grantee receives a title free of any defects, offering the highest level of security, whereas a quitclaim deed may offer little to no protection against title defects.

Understanding these roles and the implications of different types of deeds is crucial for both grantors and grantees. It ensures that both parties enter into transactions with a clear comprehension of their rights and the extent of the protections afforded to them.

Significance in Real Estate Transactions

In the intricate world of real estate, understanding the significance of transferring ownership and the legal implications and protections involved is paramount. This knowledge not only empowers parties in a transaction but also safeguards their interests.

Transferring Ownership

- Method of Transfer: The grant deed is a common instrument for transferring title to real property, explicitly recognized by statute as a conveyance method. Its counterpart, the quitclaim deed, acts more like a release, transferring whatever interest the grantor has without guarantees.

- Execution and Delivery: For a deed to effectively transfer title, it must be properly executed, delivered, and accepted. This process involves the grantor's intention to immediately pass title and the grantee's intent to accept, as evidenced by acts, words, or conduct.

- Voluntary and Involuntary Transfers: Transfer of property can occur voluntarily, such as in a sale, or involuntarily, through legal actions like foreclosure.

Legal Implications and Protections

- Acknowledgment and Recordation: While not mandatory for a deed's validity, both acknowledgment by a notary and recordation provide substantial benefits. Acknowledgment serves as a safeguard against forgery, and recordation protects the grantee's interests by publicizing the transfer sequence.

- Protection Through Deeds: Different types of deeds offer varying levels of protection. General warranty deeds guarantee the grantee against any title defects, even those predating the grantor's ownership, while special warranty deeds limit protection to the grantor's ownership period. Quitclaim deeds, conversely, offer no assurances on the grantor's interest, posing higher risks.

- Title Concerns: Proper recording of property transfers is crucial to maintaining a clear title. Gaps in the title can lead to ownership disputes, highlighting the importance of title insurance as a defense against potential encumbrances.

By grasping these critical aspects of real estate transactions, parties can navigate the complexities of ownership transfer with confidence, ensuring their rights are protected and their investments secure.

Types of Deeds and Their Impact

In the real estate domain, the deed used during a transaction significantly influences the rights and protections of both the grantor and grantee. Understanding the differences among various types of deeds is crucial for anyone involved in real estate transactions. This section delves into the specifics of General Warranty Deeds, Special Warranty Deeds, Grant Deeds, Quitclaim Deeds, and Deeds In Lieu Of Foreclosure, highlighting their unique characteristics and the impact they have on both parties in a transaction.

General Warranty Deed

A General Warranty Deed offers the most comprehensive protection to the buyer. It assures that the property is free from any defects or encumbrances, regardless of when they occurred. This type of deed makes the grantor liable for any debts or problems with the property, even those unknown at the time of sale. It is a preferred choice in transactions where the buyer seeks maximum assurance about the property's title.

Special Warranty Deed

The Special Warranty Deed provides a more limited guarantee compared to the General Warranty Deed. It only covers issues that arose during the grantor's period of ownership. This deed is common in transactions like foreclosures or sales by entities that have not occupied the property and therefore cannot vouch for its history beyond their ownership period. While it offers less protection, it is still a viable option for certain types of real estate transactions.

Grant Deed

A Grant Deed, also known as a special or limited warranty deed in some jurisdictions, strikes a balance between the quitclaim and general warranty deeds. It guarantees that the grantor has not previously sold the property and that there are no undisclosed encumbrances during their ownership. However, it does not protect against claims that predate the grantor's ownership. This deed type is often used in tax and foreclosure sales.

Quitclaim Deed

The Quitclaim Deed offers the least protection for the buyer, as it does not guarantee a clear title. It simply transfers whatever interest the grantor has in the property to the grantee, without any warranties. Quitclaim deeds are typically used in low-risk transactions between parties who know and trust each other, such as family members transferring property among themselves.

Deed In Lieu Of Foreclosure

A Deed In Lieu Of Foreclosure is an arrangement where the borrower voluntarily transfers the property title back to the lender to avoid foreclosure. This option can be less damaging to the borrower's credit than a foreclosure and may offer a quicker resolution for both parties. However, it involves the borrower relinquishing their home, and not all lenders may accept this type of deed.

Understanding the distinctions among these deeds allows individuals involved in real estate transactions to make informed decisions that align with their needs and protect their interests. Each deed type carries its own set of guarantees and risks, making it imperative to choose wisely based on the specific circumstances of the transaction.

Navigating the Closing Process

Navigating the closing process in real estate transactions involves a series of critical steps to ensure the legal transfer of property from the grantor to the grantee. This phase includes conducting thorough title searches, obtaining title insurance, and finalizing the transfer with the proper documentation and legal formalities. Understanding these components is essential for both parties to ensure a smooth transition and safeguard their interests.

Title Searches and Insurance

- Role of Title Examiners: Title examiners play a crucial role in uncovering the property's chain of title documents using various systems such as public land records and the Mortgage Electronic Registration System (MERS). Their findings help establish the seller's legal ownership and reveal any encumbrances that must be resolved prior to closing.

- Critical Information Unveiled: The title search process can reveal various issues such as mortgages, liens, community association assessments, and easements that need to be addressed. These findings are crucial for clearing the title and ensuring the grantee receives a property free of undisclosed encumbrances.

- Title Insurance: To protect against unforeseen title issues that may arise post-closing, title insurance is a vital component. It offers financial protection to both lenders and homebuyers from losses stemming from title defects or liens.

Finalizing the Transfer

- Legal Description and Documentation: The transfer process begins with obtaining the legal description of the property from the current deed. This description is critical for accurately identifying the property being transferred.

- Notarization and Recording: All owners, if more than one, must sign the deed, which then must be notarized. Recording the new deed with the local Recorder's office is a necessary step to finalize the transfer and make it public record.

- Disbursement of Funds: Post-closing, the title company manages the disbursement of funds to the seller, lender, and any other parties involved. This includes handling escrow accounts for the seller and lender to ensure all financial obligations are met.

- Delivery of Post-Closing Packages: Finally, the title company ensures that all parties receive post-closing packages and that all documents listed in the title commitment are recorded in the public record. This step marks the completion of the closing process and the official transfer of ownership.

By meticulously following these steps, parties involved in real estate transactions can navigate the closing process effectively, ensuring a legally sound transfer of property ownership.

Asset Allocation by Age: A Comprehensive Guide for Every Life Stage

Josh Pigford

Maybe Credit Card 500 Limit: Understanding the Benefits and Limitations

Josh Pigford

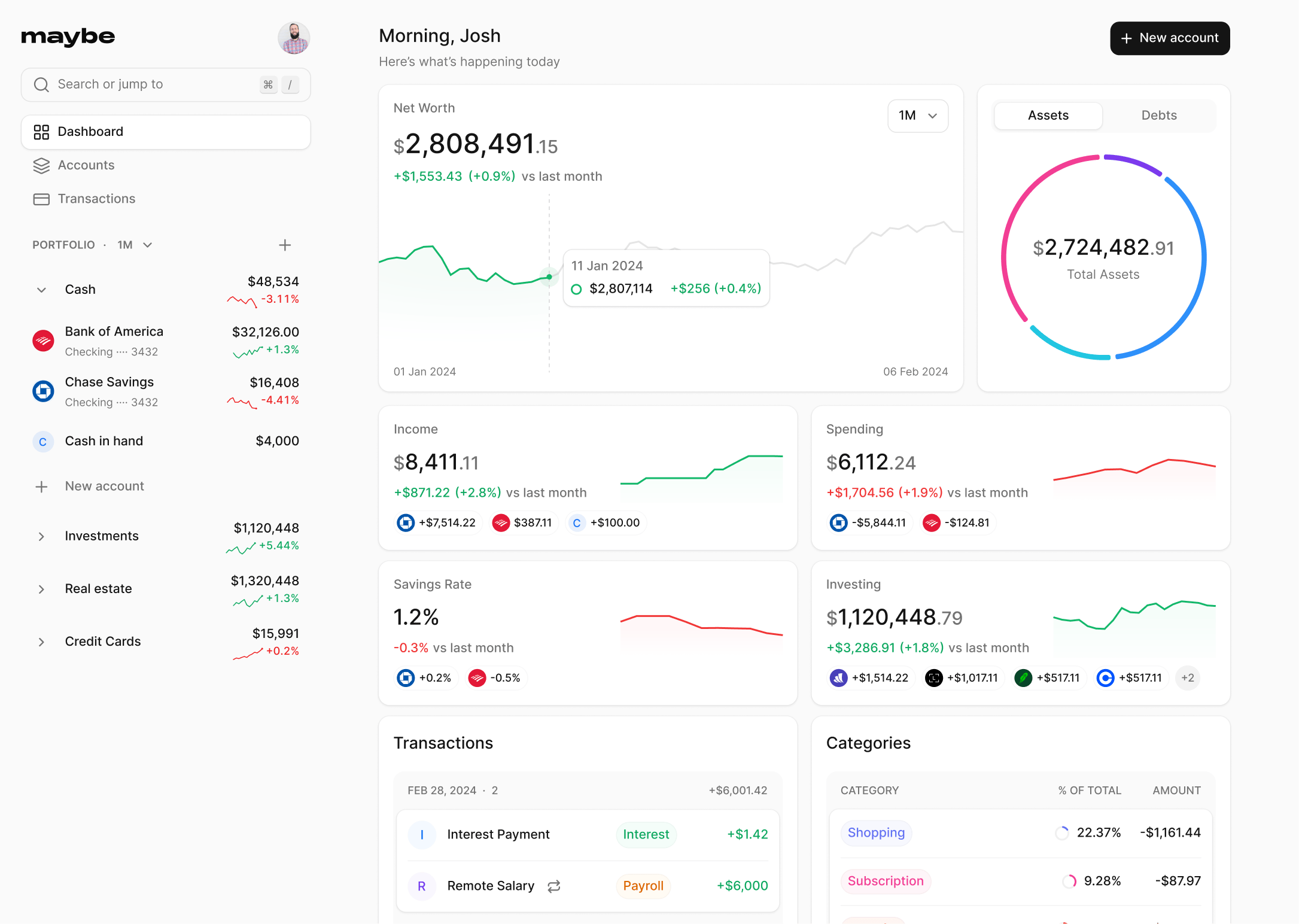

Cash Tracker: A Comprehensive Guide to Managing Your Finances with Maybe

Josh Pigford

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.