Asset allocation and how to use it to reach your financial goals

Author

Josh Pigford

In simple terms, asset allocation is defined as dividing your portfolio among the different investment categories available such as stocks, bonds, real estate, gold, crypto, cash, etc. By understanding the concepts behind asset allocation, you will understand the right mix of assets you need to invest in to achieve success in both your short-term and long-term goals.

What is an asset class?

To understand asset allocation, we have to wrap our heads around what an asset class is. In simple terms, an asset class is a group of investments with certain common characteristics that behave similarly to each other.

Consider the different tech products you use in your day-to-day life, like your mobile phone, laptop, television , and so on. Even though you can watch your favorite Netflix show on all of these devices, each device has its individuality and serves a different purpose.

This variability is the same in terms of asset classes. Even though you can use several asset classes for wealth building and preservation, each asset class serves its purpose and is irreplaceable in its own right.

What are the different types of asset classes?

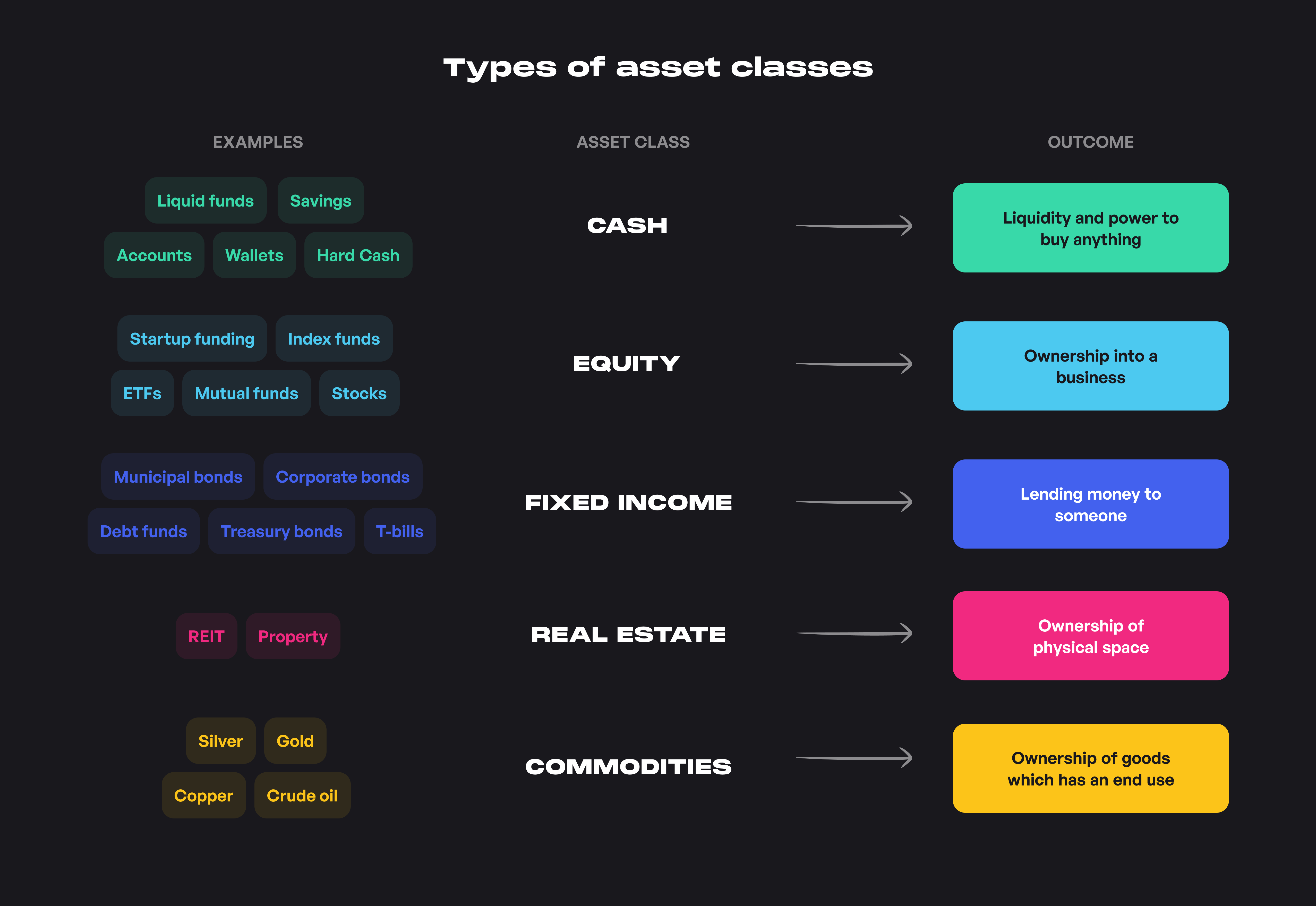

Throughout recent history, there have been five major types of assets classes. They are:

- Equities (Stocks)

- Fixed Income (Bonds)

- Real Estate (REITs and residential/commercial property)

- Money Market Instruments (Cash and cash equivalents)

- Commodities (Gold, silver, oil)

Next, let's take a quick look into each asset class and how it can help you achieve your financial goals.

- Equities (Stocks): Owning stock or a share in a company means you are a part-owner of the company you invested in. Owning a company’s stock means that you are entitled to your share of the company's earnings. The first way you can benefit from owning stock is through a rise in the stock price. Stocks can pay out high returns when prices go up but can just as quickly incur losses, especially in the short term. This unstable fluctuation is called volatility. You can also make money in equities when a company issues dividends/stock buybacks. Dividends are distributions of company profit from stock price increases to its shareholders, usually on a quarterly or annual basis.

- Fixed Income: This category includes assets like Treasury bonds, government, municipal bonds, corporate bonds , etc. These assets have a lower expected return than equity, but they are less volatile and do not fluctuate as much, so they are considered less risky than investing in stocks. Fixed-income assets generally pay a set interest rate for a specified period and then return the investor's capital after the period is completed.

- Money Market Instruments: This category includes instruments like Treasury Bills (T-Bills), Commercial Paper (CPs), Certificate of Deposits (CD's), and so on. These assets are generally more short-term focused than fixed income instruments and are best suited for short-term investing. They have the lowest return among the three asset classes described so far. The primary advantage of money market instruments is liquidity: money held in this asset class is easily accessible, and you can withdraw it at any time.

- Commodities: Commodities include physical goods like gold, copper, crude oil, natural gas, wheat, corn, and even electricity. During periods of high inflation, gold prices go up, so you can use it to reduce the overall risk of your portfolio. You can also use commodities to diversify your portfolio as the returns of gold do not move in accordance with the returns of stocks and bonds.

- Real estate: Traditionally, real estate meant land or commercial/residential property, but you can also invest in real estate by buying REITs. A REIT is a fund that owns, operates, or finances income-generating real estate. You can invest in publicly-traded REITs on the stock market or invest in REIT mutual funds/ETFs. You can view real estate as an asset class that provides diversification, is resistant to inflation to a certain degree, has low liquidity (challenging to buy and sell quickly), and generates moderate returns.

Which asset class has given the best historical returns?

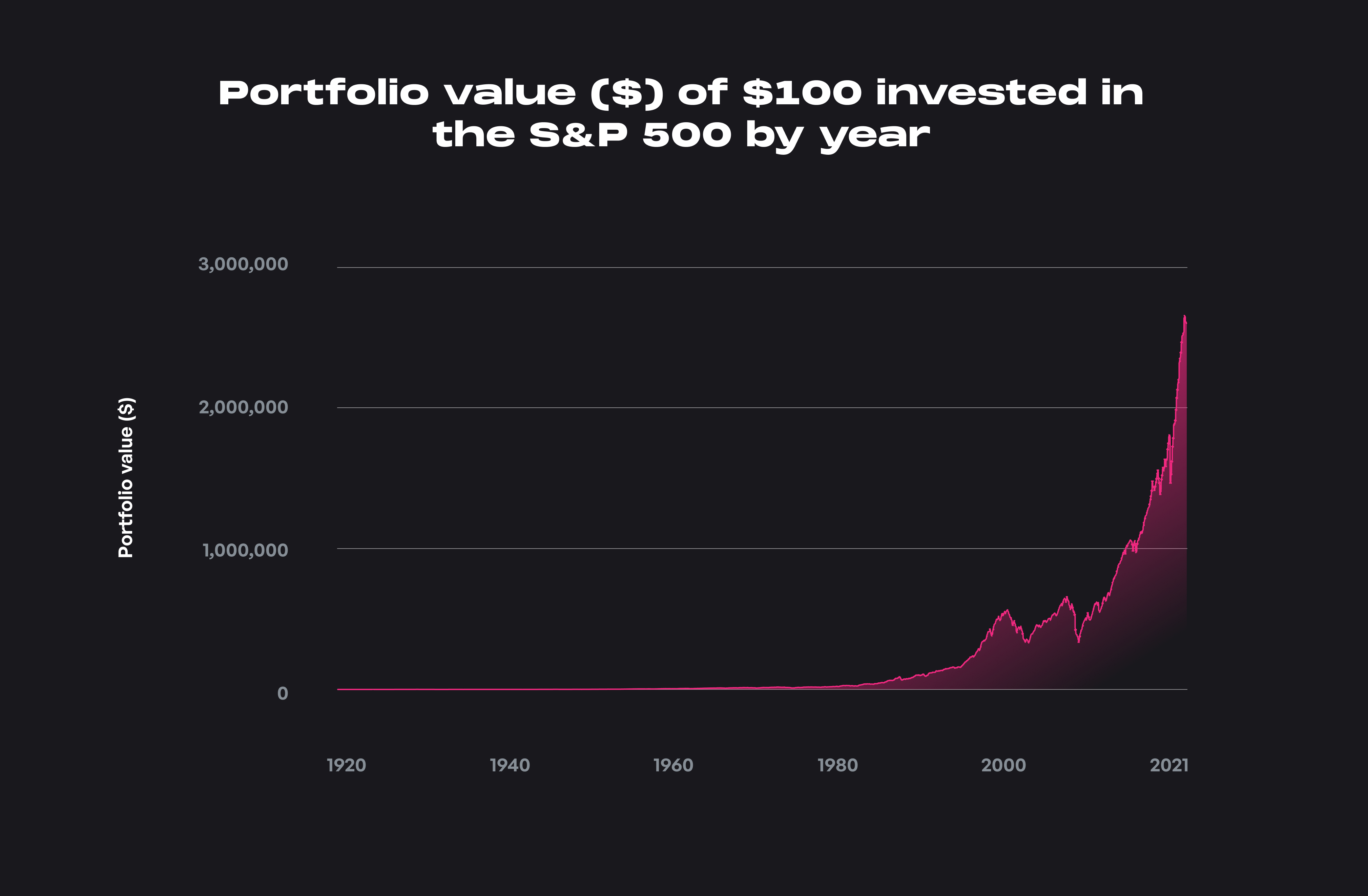

Even though new asset classes like cryptocurrencies have given some spectacular returns in the last few years, the big five asset classes have all been around much longer than that. Looking at performance over long timeframes (100+ years), the stock market has produced the highest returns over time.

If we start our journey of investing in the early 1920s, the CAGR (compounded annual growth rate) of the S&P 500 has been about 7.68%, assuming all dividends are reinvested and adjusting for inflation.

To put it in monetary terms, $100 invested in the S&P 500 on January 1, 1920 , would have been worth about $185,900 (in 1920 dollars, adjusted for inflation) by February 21, 2022. In 2022 dollars, that’s $2.614 million without adjusting for inflation. In comparison, the same $100 invested in T-Bills , a money market instrument, during the same period would have returned little more than $8000 in today's dollars. You can check out all the above calculations and enter your inputs here.

Stocks can be high ly volatile in the short term, and the key is giving it time to run by overcoming the urge to sell during short-term volatile periods. The S&P 500, for example, is far less reliable over any 12-month period, meaning you face a greater risk of losing money.

However, when you stretch the holding period to five years, you're far more likely to make money. So, the longer your holding period is, the more likely you will make money in the stock market.

Why are asset classes useful?

Asset classes can help you diversify your investment portfolio to maximize your returns based on factors like your tolerance for risk, financial goals, investment objectives, investment time horizon, and preferences towards certain types of assets.

Investing in different asset classes enables you to ensure a certain diversity in your investments as each asset class has different characteristics and behaves differently in any given market environment.

How to allocate assets to meet your financial goals:

Now that you know about the different asset classes and how you can leverage them to achieve your financial goals, we can start thinking about allocating your investments across various asset classes.

The answer to the question of how to allocate assets is the dreaded phrase: "It depends.". However, we can look at some of the factors you must consider when deciding how much of your portfolio you can dedicate to each asset class.

Some of the factors you have to take into consideration while allocating your assets are:

Age and time horizon: Age plays a significant part in deciding your asset allocation in your retirement portfolio. If you are in your 20s and 30s, you have plenty of time to wait for investments to grow or recover from setbacks. This means you can afford to allocate a large percentage of your portfolio to riskier assets like equity and cryptocurrencies. The main goal in this stage is wealth-building, so you should try and take on enough risk to achieve higher returns.

Income: The amount of money you invest is directly proportional to your income. Any boost in your income in the form of bonuses, appraisals, promotions, switching jobs, or building different income streams can help you achieve your financial goals faster by investing more of your income in dollar terms.

Number of Dependents: If you have several dependents, you need to invest more of your income into short-term investments. There might be several recurring expenses with a short time horizon, like educational and medical expenses. In such cases, you should make sure you have enough liquidity either by holding cash or by investing in short-term money market instruments.

Expenses: To improve your financial health and achieve your goals, you must keep your expenses in check and live within your means. Removing extravagant and unnecessary costs can go a long way in ensuring that you reach your financial goals on time. This practice can help you save a large portion of your monthly income, which you can then invest in suitable asset classes.

Income Stability: The Covid-19 pandemic has opened our eyes to the realization that income stability is of utmost importance, especially in troubling times. Job security, type of employment, regularity of cash flows, and other factors play a vital role in asset allocation.

Risk Appetite: Your risk appetite (that is, how much risk you’re comfortable with or desire to take on) should be an amalgamation of all the above factors as it depends on your age, income, savings rate, income stability, and time horizon. Suppose you are a young professional with moderately high income, low expenses, and no dependents. In that case, you can afford to allocate a high percentage of your portfolio to riskier assets like stocks and crypto. Some people are more risk-averse than others and should dedicate a smaller portion toward equities and crypto. Your risk appetite is thus a combination of the factors mentioned above as well as your willingness to take risks and face volatility.

Improvements in asset allocation:

Now that we've learned about the different assets and how to use them in our financial portfolio based on certain factors, we can discuss how you can optimize your allocation from financial and personal perspectives.

Global Diversification: Diversifying across different markets all across the globe can be an effective way to improve returns and reduce volatility. You can use the famous phrase: "Every day there is a bull market somewhere in the world." to your benefit. Getting exposure to global equities reduces the impact of localized downturns in certain markets and diversifies your investment across different geographies.

The table below shows that no single market has consistently outperformed any other over the past ten years. Also, diversifying globally has the added advantage of reducing volatility which keeps you invested in the market even during economic downturns. You can start by investing in a global ETF like the Vanguard Total International Stock Index Fund ETF ($VXUS).

- Investing in Small Cap Value stocks: In 1992, Nobel Laureate Eugene Fama and researcher Kenneth French came up with the Fama Three-Factor model, which showed that small-cap value stocks outperformed the market consistently. You can read more about the Fama and French Three-Factor Model here. Thus, allocating a small part of your portfolio either towards a group of Small Cap Value Stocks or a Small Cap Value ETF could increase the expected return. You could give a higher allocation to small-cap value stocks/ETFs if you are younger.

- Investing in Cryptocurrencies: Whether you believe in cryptocurrencies or not, based on your risk/reward parameters, you can allocate a small part of your portfolio towards riskier asset classes like cryptocurrencies such as Bitcoin and Ethereum. Just be aware that due diligence is necessary before investing in any cryptocurrency. Understanding the underlying blockchain technology, use case and what each crypto project is striving to achieve is essential before investing.

Nowadays, there is a much more comprehensive array of asset classes from which you can pick and choose, like artwork and NFTs, collectibles, financial derivatives, and so on. If you have the appetite for it, you can choose to allocate a small portion of your portfolio to these asset classes as well.

Final Thoughts and wrap-up:

We've come a long way in this post, from understanding the concept of what an asset class is, to learning about the different asset classes and how to allocate them efficiently based on certain factors to reach your financial goals. Finally, we learned how to optimize and improve your asset allocation.

Even though we've covered so much, it’s important to remember that the asset allocation you choose will depend on your personal preferences and environment. The asset allocation you want to pursue is dependent on your goals and risk tolerance, so it would be advisable to build out the assets in your portfolio based on your particular situation. A simple rule of thumb: allocate your assets so that it helps you sleep well at night.

Cryptocurrency as a part of your investment portfolio

Josh Pigford

The complete guide to managing and optimizing your expenses

Josh Pigford

Loud Budgeting: A Step-by-Step Guide to Financial Success

Josh Pigford

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.