Step-by-Step Instructions on How to Void a Check

Author

Josh Pigford

Step 1: Get a black or blue pen

To void a check, one should use a permanent pen in black or blue ink. This ensures that the VOID mark is permanent and cannot be easily altered or erased, indicating that the check should not be processed.

Step 2: Write 'VOID' on the check

There are several ways to mark a check as void:

- Write "VOID" in large letters across the front of the check to cover most of the space.

- Alternatively, write "VOID" on specific parts such as the dateline, payee line, amount box, amount line, and signature line. This method ensures that no one can fill out any essential fields to misuse the check.

Step 3: Make a copy of the voided check

After voiding the check, it is advisable to make a copy for record-keeping. Note the check number on the copy and ensure that the word "VOID" is visible on the duplicate if using duplicate checks. This step is crucial for tracking and referencing in personal financial records.

Step 4: Properly dispose of the original check

Once the check is voided and copied, it is important to keep the original in a secure place or dispose of it properly to prevent any fraudulent use. If not required to submit the physical check, storing it securely with other financial documents or shredding it can prevent potential misuse by fraudsters.

Reasons to Void a Check

Setting up Direct Deposit

Voiding a check is often required when setting up direct deposit with an employer. This process ensures that the paycheck is deposited directly into a bank account, speeding up the access to funds compared to physical checks. A voided check provides the employer with necessary details, such as the bank account number and routing number, ensuring the accuracy of the transaction.

Setting up Automatic Payments

Similarly, voiding a check is crucial for setting up automatic payments. Whether for business owners paying vendors or individuals scheduling regular payments for bills such as mortgages or car loans, a voided check provides the recipient with the correct banking information to process payments securely and efficiently.

Correcting a Mistake

Sometimes, a check may need to be voided if a mistake is made while filling it out. This could be an incorrect date, payee name, or amount. Voiding the check prevents unauthorized or erroneous transactions and allows the issuer to write a new check with the correct information.

Canceling a check

There are instances where a check needs to be canceled after it has been written. This might occur if the check was written for the wrong amount or issued to the wrong person. Voiding the check ensures that it cannot be cashed or deposited by anyone, thus protecting the issuer from potential financial loss. If the check has already been handed to the payee, the issuer may need to request a stop payment from their bank, which could involve additional fees.

Safety Tips for Voiding a Check

Use a Permanent Pen

When voiding a check, it's imperative to use a pen that ensures the word "VOID" cannot be easily altered or erased. Gel pens with black ink are highly resistant to check-washing techniques, making them an optimal choice. Roller-ball, thick felt tip, and fountain pens also offer a level of resistance against alterations. It's advisable to avoid blue ink, ballpoint pens, and "permanent markers" as these can be more susceptible to tampering.

Shred the Original Check

After voiding a check, proper disposal is crucial to prevent any potential fraudulent use. Shredding the original check is the most secure method of disposal. For those without access to a shredder, tearing the check into small pieces and disposing of the bits in separate bins can prevent complete reconstruction. When shredding, ensure that the MICR code, which contains sensitive banking information, is completely destroyed. Utilizing a secure shredding vendor can provide additional peace of mind.

Track Voided Checks in a Check Register

Maintaining a record of voided checks is essential for managing personal finances effectively. Upon voiding a check, one should immediately make a note in their check register, indicating that the check has been voided. This practice not only helps in keeping a detailed record for future reference but also assists in balancing the checkbook accurately. Recording the transaction when voiding and regularly reconciling the expense account can provide a clearer picture of spending habits and financial status.

Alternative Methods if You Don't Have Physical Checks

In situations where physical checks are unavailable, individuals have several alternative methods at their disposal to fulfill their banking needs. These alternatives not only offer convenience but also ensure transactions can be completed without delay.

Ask your bank for a counter check

Counter checks serve as a temporary solution for those who lack personal checks. Available at most banks, they can be obtained by visiting a branch, presenting identification, and sometimes paying a small fee. It's important to note, however, that counter checks may lack certain personalizations, such as your name and address, which could lead to them not being accepted by all merchants or organizations. Despite this, they provide an immediate solution for making payments directly from one's account.

Provide a deposit slip

Due to advancements in banking technology, the traditional deposit slip is becoming less common for depositing checks. Many banks have phased out the requirement for deposit slips at ATMs, as modern machines are capable of reading checks or counting cash and crediting the associated account automatically. This method simplifies the process of depositing checks without the need for manual entry of details, making it a convenient option for those without access to physical checks.

Enter bank information online

The digital era has introduced several online alternatives for handling transactions that would traditionally require a check. Online banking services, mobile apps, and bank websites provide access to account and routing numbers, allowing individuals to set up direct deposits or automatic payments without needing a physical check. For instance, if setting up direct deposit with an employer, one might only need to provide a bank statement or access their account information online to share the necessary details. Additionally, many organizations now accept direct deposit authorization forms filled out with account details as an alternative to requiring a voided check.

By utilizing these alternative methods, individuals can navigate their banking needs efficiently, even without physical checks.

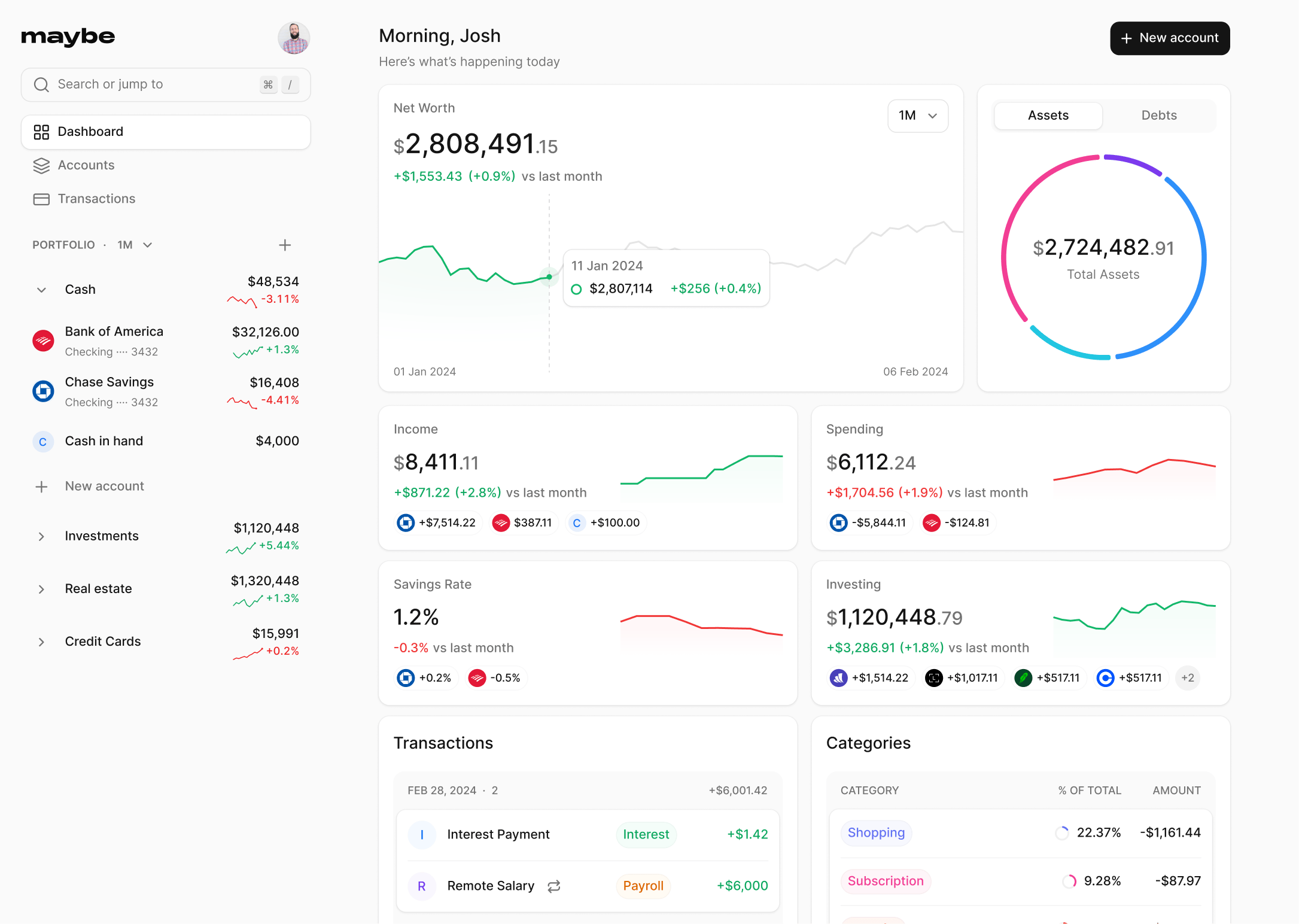

Maybe's Best Way to Make Your Money Work for You: Expert Tips and Strategies

Josh Pigford

Behavioral Biases: How you can improve your saving & investing decisions

Josh Pigford

Understanding money and its history

Josh Pigford

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.