What is an Estate? A Comprehensive Guide for Beginners

Author

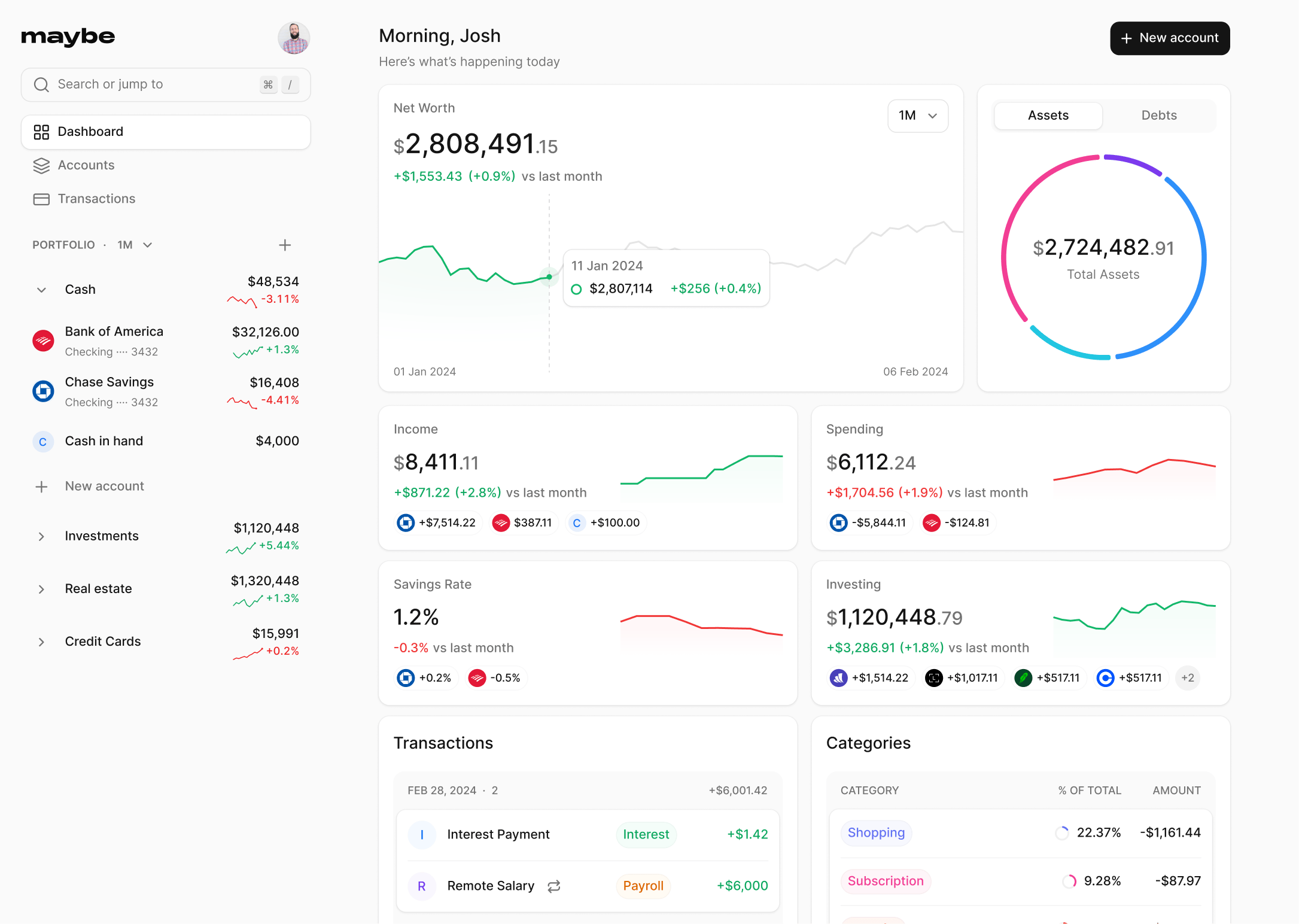

Josh Pigford

An estate represents the total economic value of an individual's investments, assets, and interests. It encompasses everything from tangible items like land, real estate, collectibles, and furnishings to intangible assets such as investments. The legal definition of an estate is an individual's total assets minus any liabilities. This valuation becomes particularly critical in two scenarios: if the individual declares bankruptcy or upon their death. In the case of bankruptcy, the estate is assessed to determine which debts can be reasonably expected to be paid. Upon death, the estate's planning becomes crucial, involving the management and division of personal assets, marking a significant aspect of financial planning.

Estate vs. Personal Assets

Distinguishing between estate and personal assets is essential for effective estate planning. Estate assets include property owned at the time of death, such as bank accounts, investments, real estate, and personal effects. However, not all property one owns may be distributed through a will. For example, property owned as joint tenants automatically passes to the surviving owner, not becoming part of the estate assets distributable by a will. Similarly, certain accounts with designated beneficiaries, such as retirement savings, bypass the estate to benefit the named individuals directly. Understanding the distinction between what constitutes an estate asset and what does not is a foundational step in estate planning, ensuring a clear direction for the distribution of assets according to the individual's wishes.

The Legal Process of Estate Management

Probate and Its Importance

Probate is the legal process that occurs after an individual's death, focusing on the distribution of assets, whether through a will or according to state laws in the absence of a will. This process involves several critical steps, starting with the validation of the will, if one exists. An executor or, in cases without a will, an administrator is appointed to oversee this process. Their responsibilities include gathering the deceased's assets, settling outstanding debts, and distributing the remaining assets to the rightful beneficiaries. The probate process is subject to court supervision, ensuring the deceased's assets are distributed fairly and according to legal standards.

- Appointment of Executor or Administrator: The probate court appoints an individual to manage the estate's affairs, leading to the collection and distribution of the deceased's assets.

- Asset Collection and Debt Settlement: The executor gathers assets and pays off debts, including taxes owed by the deceased.

- Asset Distribution: Following debt settlement, the executor seeks court approval to distribute the remaining assets to beneficiaries.

Estate Planning Essentials

Estate planning is a comprehensive approach to managing one's assets both during their lifetime and after death. A well-structured estate plan includes creating a will, setting up trusts, and making beneficiary designations on accounts that can bypass the probate process, such as life insurance policies and retirement accounts. This planning is crucial for ensuring that assets are distributed according to the individual's wishes and can help avoid a lengthy and costly probate process.

- Creating a Will: A cornerstone of estate planning, a will outlines asset distribution and can appoint guardians for minor children.

- Setting Up Trusts: Trusts can manage and distribute assets efficiently, potentially avoiding probate.

- Beneficiary Designations: Naming beneficiaries on certain accounts ensures these assets transfer directly to them, bypassing probate.

By understanding the legal process of estate management and implementing essential estate planning strategies, individuals can ensure their assets are managed and distributed according to their wishes, providing peace of mind and financial security for their beneficiaries.

Estate Planning Tools

Estate planning tools are essential for ensuring that an individual's wishes regarding their estate are honored, both during their lifetime and after their death. These tools include a variety of legal documents and arrangements, such as wills, trusts, powers of attorney, and healthcare directives. Each tool serves a specific purpose and is crucial in comprehensive estate planning.

Wills and Trusts

- Wills: A will is a legal document that outlines how a person's assets and property should be distributed after their death. It can also include instructions for appointing an executor to manage the estate and guardians for minor children. The creation of a will is a fundamental step in estate planning, allowing individuals to specify their wishes clearly and prevent potential disputes among heirs.

- Trusts: Trusts are legal entities that hold assets on behalf of beneficiaries. There are various types of trusts, including living trusts (both revocable and irrevocable) and testamentary trusts. Living trusts become effective during the grantor's lifetime, offering flexibility and privacy, as they often bypass the probate process. Testamentary trusts are established through a will and take effect after the grantor's death. Trusts can be tailored to achieve specific goals, such as asset protection, tax planning, or providing for a loved one with special needs.

Power of Attorney and Healthcare Directives

- Power of Attorney: This legal document grants a trusted individual, known as an agent, the authority to make financial decisions on behalf of the principal (the person creating a power of attorney) in case of incapacity. A durable power of attorney remains effective even if the principal loses mental capacity, ensuring that financial matters can be handled without court intervention.

- Healthcare Directives: Advance directives encompass documents like a health care proxy and a living will, allowing individuals to outline their preferences for medical treatment in the event they become incapacitated. A healthcare proxy appoints a trusted person to make healthcare decisions on behalf of the individual, while a living will specifies the types of medical interventions the individual does or does not want. These directives ensure that healthcare decisions are made according to the individual's wishes and can relieve loved ones from making difficult decisions during emotional times.

By utilizing these estate planning tools, individuals can secure their financial future and healthcare preferences, providing peace of mind for themselves and their families.

Navigating Estate and Inheritance Taxes

Navigating estate and inheritance taxes involves understanding the complexities of both federal and state tax laws. With the potential for significant tax implications on the transfer of assets upon death, it is crucial to be informed of the current laws and strategies to minimize tax liability.

Federal and State Tax Implications

The Tax Cuts and Jobs Act (TCJA) of 2017 significantly raised the lifetime exemption for estates, setting the thresholds at $13.61 million for single individuals and $27.22 million for couples in 2024. However, this increased exemption is set to phase out by the end of 2025, potentially halving the current levels. Additionally, many states impose their own estate and/or inheritance taxes, often at lower thresholds than the federal exemption, affecting a broader range of estates. For instance, Oregon's estate tax applies to estates exceeding $1 million. With property values and asset appreciation potentially pushing estates beyond these exemptions, it is vital to be aware of both federal and state tax requirements.

Strategies to Minimize Tax Liability

- Annual Gift Tax Exclusion: In 2024, individuals can gift up to $18,000 per recipient without incurring gift tax liabilities, with married couples able to gift up to $36,000. Utilizing this strategy can effectively reduce the estate's value, thereby lowering potential tax liability.

- Strategic Use of Trusts: Trusts can serve multiple purposes, including tax minimization. By transferring assets into a trust, individuals can potentially bypass the probate process and reduce estate taxes. Types of trusts beneficial for tax planning include irrevocable life insurance trusts (ILITs) and intentionally defective grantor trusts (IDGTs), each offering unique advantages in estate tax planning.

- Charitable Donations: Contributions to qualified charities can reduce the taxable estate's value. Donating to a donor-advised fund (DAF) or directly to charities can provide immediate income tax deductions and lower the estate's value for tax purposes. Additionally, gifting appreciated securities allows for the deduction of their fair market value without incurring capital gains tax.

- Education Accounts: Funding education accounts, such as 529 plans, for children or grandchildren can reduce the estate's value. Contributions to these accounts are not considered part of the estate for tax purposes, offering an effective way to pass on wealth while minimizing tax exposure.

By employing these strategies, individuals can navigate the complexities of estate and inheritance taxes more effectively, ensuring that their assets are transferred according to their wishes while minimizing tax liabilities.

The Role of Estate Planning Professionals

Choosing the Right Attorney

Selecting an appropriate estate planning attorney ensures your assets are handled according to your wishes. Estate planning attorneys specialize in creating legal documents such as wills and trusts, and are adept at navigating the complexities of inheritance and tax laws. When searching for an attorney, it's beneficial to look for individuals with specific qualifications in estate planning. Certifications, such as board certification in wills, trusts, and estates, indicate a high level of expertise. Additionally, platforms like Martindale Hubbell and The American College of Trust and Estate Counsel provide reliable listings of seasoned attorneys. Personal referrals and comprehensive interviews can also play a vital role in choosing the right attorney, ensuring they align with your personal and financial goals.

Financial Advisors and Estate Planning

Financial advisors bring a broad spectrum of expertise to the estate planning process, complementing the legal insights provided by attorneys. They play a pivotal role in formulating financial strategies that encompass income sources, investment portfolios, and insurance coverage. Here are key ways financial advisors contribute to estate planning:

- Maximizing Financial Efficiency: Advisors can suggest financial instruments like trusts to manage and protect assets, ensuring they are distributed according to the client's wishes while potentially avoiding probate.

- Insurance and Long-Term Care: Advisors assist in selecting appropriate life and long-term care insurance, ensuring adequate coverage that supports the client's family financially upon unforeseen events.

- Charitable Contributions: They provide guidance on structuring charitable gifts to maximize tax benefits, often recommending tools like donor-advised funds for efficient philanthropic giving.

- Beneficiary Designations: Financial advisors ensure that all beneficiary designations on accounts such as retirement plans and insurance policies are updated and aligned with the client's estate planning goals.

By integrating the expertise of both attorneys and financial advisors, individuals can create a robust and effective estate plan that not only meets legal requirements but also achieves personal financial objectives.

How behavioral finance can make you a better investor

Josh Pigford

Cash Tracker: A Comprehensive Guide to Managing Your Finances with Maybe

Josh Pigford

Investing during recessions and bear markets

Josh Pigford

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.