How to make equity investing part of your investment strategy

Author

Josh Pigford

To understand the equity markets, we must first understand what a stock or a share is. A stock is a financial instrument that gives you a stake of ownership in a company as a stockholder (shareholder). Holding the stock of a particular company means that you are entitled to a portion of the company's future cash flows.

The equity market (otherwise known as the stock market) is the marketplace through which shares in public companies are bought and sold through a stock exchange. The three major stock exchanges in the US are the American Stock Exchange ( AMEX ), the New York Stock Exchange ( NYSE ), and the National Association of Securities Dealers ( NASDAQ ).

How do you benefit from holding stocks?

If you purchase a stock, there are three ways to benefit as a shareholder of the company's stock. They are:

Appreciation: Stock prices represent demand and supply in the stock market. When demand for a stock increases, the price of the stock increases and vice versa. In turn, t he demand and supply are controlled by the sentiments of the market (microeconomic and macroeconomic factors, industry tailwinds, unexpected changes in the company's earnings/profits, political factors, etc.). If investors feel like a particular stock (or the market in its entirety) will do well in the future, the price of the stock increases, thereby increasing the value of your stock holdings.

Dividends: Dividends are a way of rewarding the shareholders of a company by distributing part of the company's profits to those shareholders. Dividends are usually paid quarterly, semi-annually, or on an annual basis. However, dividends are not guaranteed and can increase/decrease/be cut off entirely at the sole discretion of the company's management. And not all stocks or companies pay dividends in the first place.

Buybacks: A stock buyback (or share repurchase) occurs when a company uses its cash to reacquire its shares from the stock market. When companies reabsorb shares from the market, it reduces the number of outstanding shares available, thereby increasing the ownership stake of each shareholder.

How have equities performed historically as an asset class?

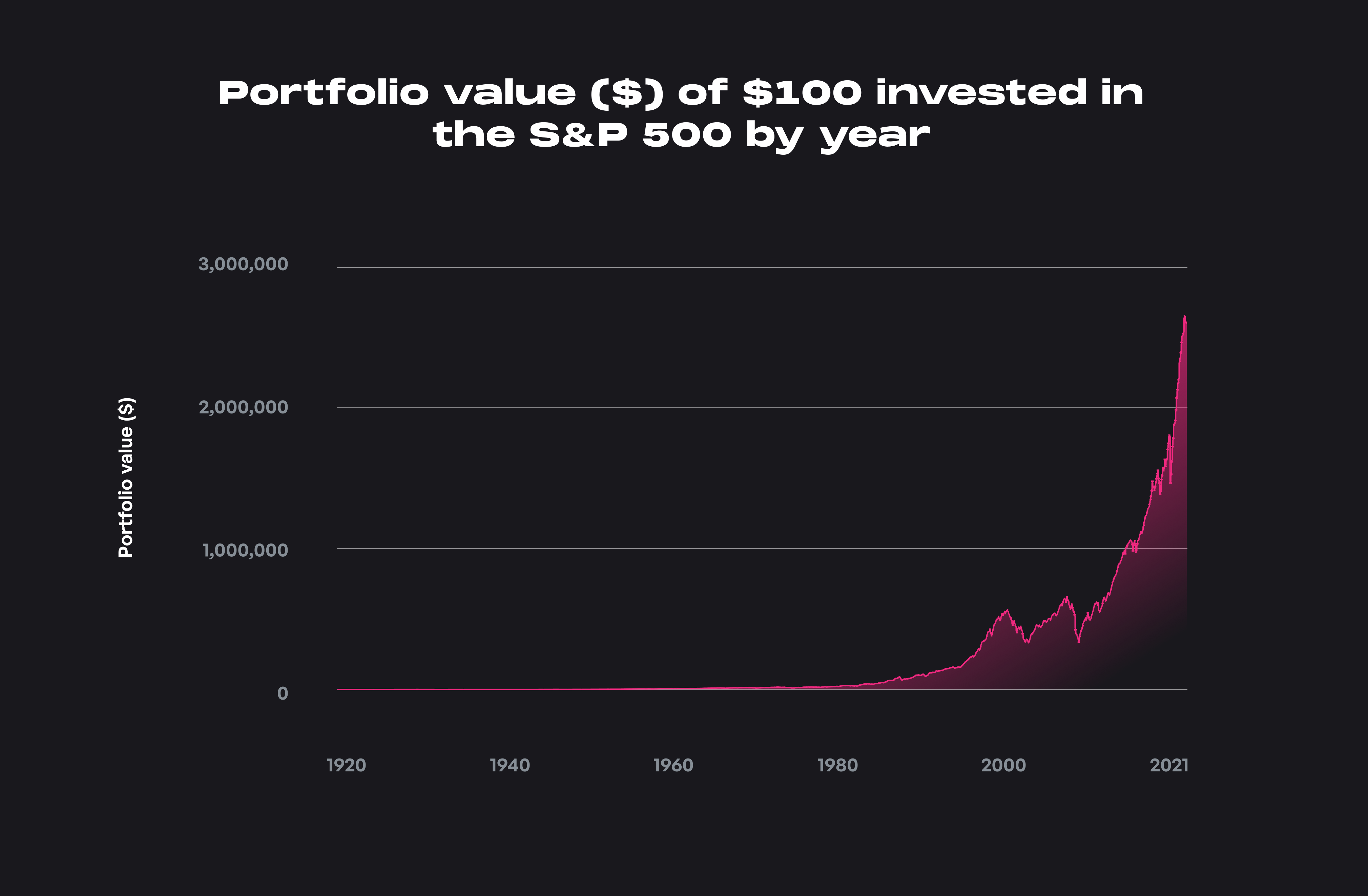

If we began our investing journey in 1929, the Compounded Annual Growth Rate (CAGR) of the S&P 500, which consists of the 500 largest companies in the United States, has been about 7.65%, assuming all the dividends are reinvested and adjusting for inflation.

In terms of dollars, $100 invested in the S&P in 1929 would have ballooned into $185,900 by February 2022. This $185,900 is inflation-adjusted, which means that today's value of that $185,900 is close to $2,417,000 in today's dollars (without inflation adjustments).

(Data and analysis on the above are available here.)

Exhibit 1: Variability in returns of the S&P 500 by month

Month to month, there are no patterns of stock market returns. This analysis shows that in the short term, stocks are highly volatile. So trying to predict return patterns monthly is a waste of time—and most likely a waste of money as well.

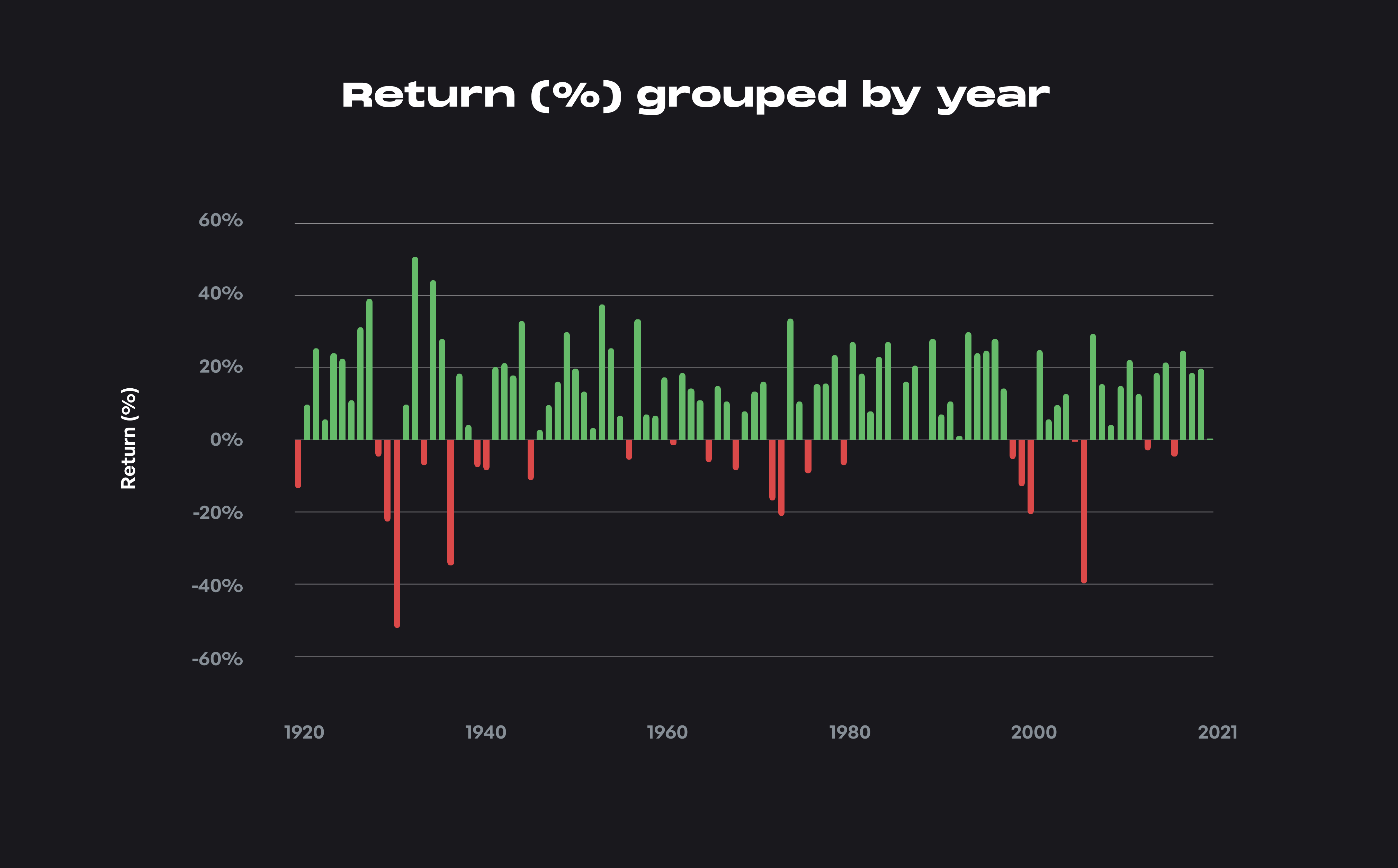

Exhibit 2: Variability in returns of the S&P 500 by year

There is still no specific pattern formation in the stock market from year to year. But as observed in the graph below, there are way fewer years of negative returns (24 years) than positive ones (78 years) since 1920. Historically, the probability of your portfolio to have reduced in value in any given year for the S&P from 1920 is only 23.5%.

Exhibit 3: Variability in returns of the S&P 500 on a 5-year basis

We can establish a clear pattern of positive returns when you hold the S&P 500 for greater than five years. As you can infer from the chart below, over any five years (point to point), the returns of the S&P 500 have always been positive, with several five-year periods showing returns of 50% or greater. This analysis shows that even though equities are volatile in the short run, their performance is much more predictable over the long term.

Holding equities in your portfolio

There are several ways to include the equities asset class in your portfolio. Each instrument has its associated risks and rewards, as outlined below. It is up to you as an investor to pick and choose the specific risks you are comfortable taking concerning the equity component of your portfolio.

Individual stocks:

The first method by which you can make equities a part of your portfolio is by holding individual stocks of various companies that you think will provide positive, outsized returns in the future. Here, you as the investor are left to decide on the valuation at which you enter/exit the stock, which stocks/industries you focus on, how you handle company and country-specific risks, and so on.

Actively managed mutual funds:

The second method of equity exposure involves picking fund managers who try and consistently beat the market. Your effort here as an investor would be to try and pick the next Warren Buffett or Peter Lynch. It's possible to make money this way, and it can feel helpful to have an advisor actively managing your money for you. But be warned, active fund managers generally charge much higher fees than passive funds, and approximately 80% of them underperform their benchmark indices (such as the S&P 500).

Passive funds and ETFs:

Don't look for the needle in the haystack. Just buy the haystack!

John C. Bogle

The quote above perfectly represents the essence of the methodology of passive investing: instead of trying to find the one perfect stock, buy a spectrum of stocks that represent the entire market. Passive funds and exchange-traded funds (ETFs) aim to replicate the performance of a specific benchmark index such as the S&P 500 (the 500 largest US companies by market capitalization) or the Russell 2000 (2000 small-cap companies). Passive funds generally beat actively managed funds 80% of the time and have much lower fees (expense ratios)), often as much as ten times lower than the fees of actively managed funds. Passive ETFs are also generally more tax-efficient than holding individual stocks. As you'll see shortly, we recommend putting most of your money in these passive equity investments.

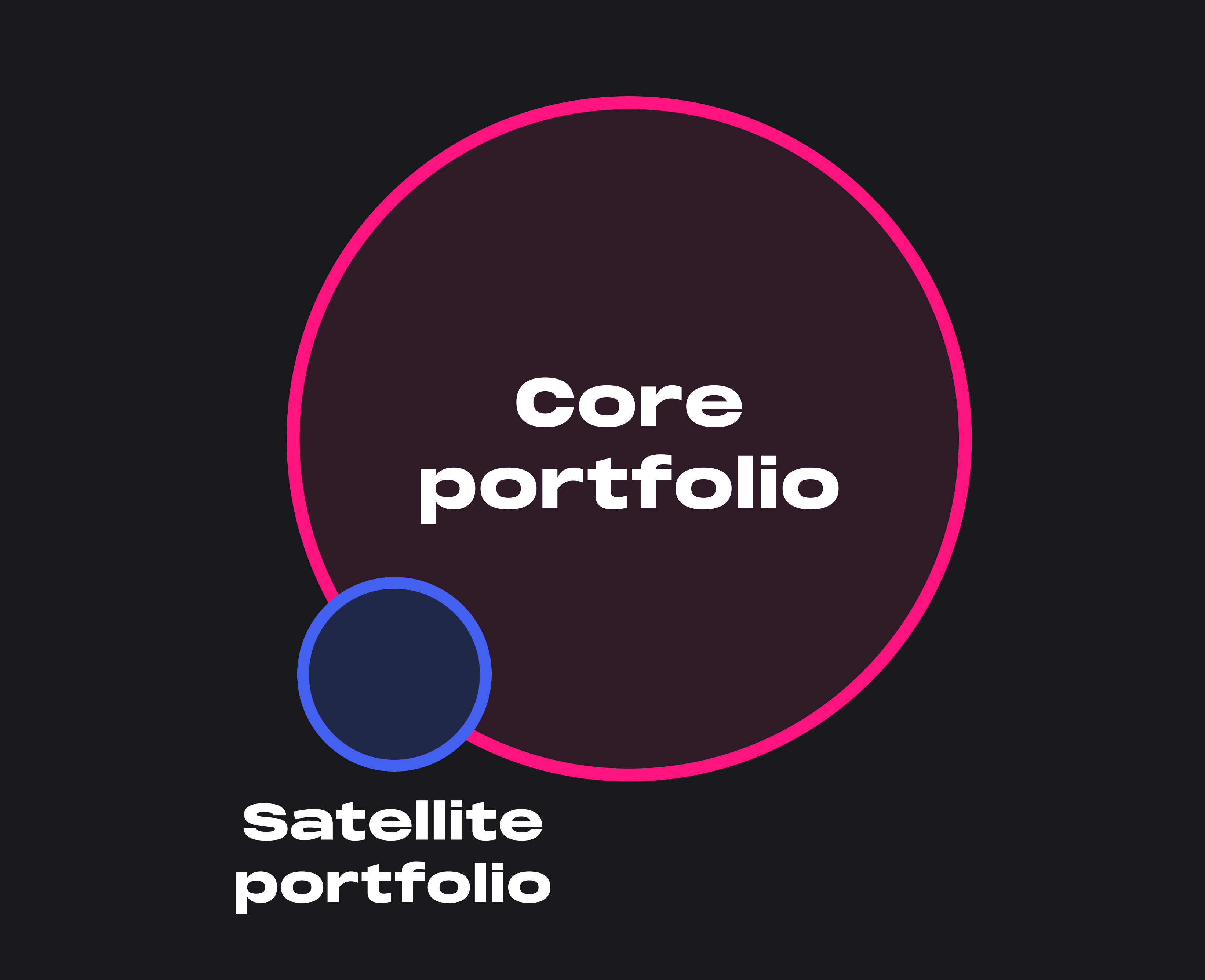

An optimal equity allocation strategy

Most individual investors’ optimal asset allocation strategy would be to have a core portfolio and a satellite portfolio. You can allocate the core portfolio to passive funds and ETFs and build up the satellite portfolio with a few individual stocks, sectoral bets (via passive/active ETFs or mutual funds), and actively managed funds. This split allows most of your money to grow passively and with low risk while giving you a little wiggle room to play or experiment with higher-risk strategies that require active management.

💡 IMPORTANT: This portfolio only deals with the equity allocation in your portfolio. Any well-diversified portfolio should have an asset allocation spread across several asset classes like stocks, bonds, real estate, gold, crypto, etc.

Allocation specifics:

The allocation to each portfolio varies from individual to individual based on various factors such as age, industry knowledge, conviction, emotional profile, risk tolerance, and many more aspects related to investor behavior and expertise. However, a generally accepted range would be:

Core portfolio : 90-100%

Satellite portfolio : 0-10%

Emotional advantages:

We, as investors, are emotional beings who tend to behave irrationally and make sub-optimal choices when it comes to making difficult decisions in complex situations. This behavior is due to the effect of cognitive biases on our reasoning. Choosing individual stocks (both as an investor and an active fund manager) involves making complex decisions that can lead to sub-par investing performance. These decisions involve dealing with entry/exit parameters, industry-specific factors, management-centric factors, micro/macroeconomic factors, country-specific risks, etc. It's tough to make these kinds of decisions when emotion enters the picture—and anytime you might make or lose money, emotion will enter the picture.

Investing should be more like watching paint dry or watching grass grow.

Paul Samuelson

Good investing is generally very boring. That's what the core portfolio is for—to make as much money with as little excitement or emotion as possible. But we as humans are impulsive creatures who seek excitement, which is where the satellite portfolio comes in handy. You can use your satellite portfolio as your playground for investing in the next exciting company/industry or take on some riskier bets. The satellite portfolio prevents you from making any catastrophic decisions that affect your overall portfolio.

Fees and flexibility:

Don't forget that the stock market can cost you money just as quickly as it can make you money. The fees you pay as expense ratios, brokerage fees, and other transaction costs can lead to a significant difference in your portfolio returns over long periods. Picking individual stocks or investing in active funds generally results in higher portfolio turnover costs due to frequent buying and selling.

Also, selling stocks requires you to pay capital gains taxes on your profits which can accrue into massive amounts with time. Active funds also have high expense ratios, including the fund managers' salaries, analysts, profit to the firm, and so on, which are coming out of your pocket.

In terms of flexibility, ETFs offer more flexibility than mutual funds as they have higher liquidity, can have lower expense ratios (depending on the sector and strategy), and can be bought and sold throughout the day. On the other hand, mutual fund units are allocated based on the NAV (net asset value) at the end of the day.

Key Takeaways:

A few essential pointers can help you as an investor build out your equity portfolio and, more importantly, stay the course during volatile periods of ups and downs in the market.

- Understand that when you buy stocks, you're not just buying pieces of paper but ownership in some of the largest companies in the world. Try your best not to fall into the trap of buying and selling your ownership in high-quality companies.

- Treat your stock purchases of large, renowned, high-quality companies the same way you would when purchasing a house. Most people don't call up their real estate agent every day and ask for the price of their property. However, most investors want to check the price of their stocks daily. When it comes to investing, the best advice (by Jack Bogle) is, "Don't do something, just stand there!.” Use a more extended timeframe (> 5 years) when dealing with equity investments.

- Finally, pay close attention to the fees (management fees, brokerage fees, transaction costs) you're paying for the various investment vehicles you hold in your equities portfolio. Fees can balloon into significant amounts of money over your lifetime, and money lost to fees is money that doesn't continue to compound for your benefit. If you pay lower fees, you can keep a larger part of your retirement pie for yourself.

Maybe's Top Picks: Best Personal Money Management Software for Mac

Josh Pigford

Bad Investments: How to Avoid Losing Money

Josh Pigford

Should you consider real estate as part of your investment portfolio?

Josh Pigford

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.