Should you consider real estate as part of your investment portfolio?

Author

Josh Pigford

Real estate is one of the primary asset classes to be considered when building an investment portfolio, alongside stocks, bonds (fixed-income), cash/cash equivalents, and derivatives. Real estate (in the form of physical property or financial instruments like REITs) can help you build a well-diversified portfolio, reduce overall portfolio volatility, and reduce market risks specific to certain asset classes (like stocks and bonds).

The risk-reward profile for real estate generally lies somewhere between stocks and bonds. Although the rent payments from holding real estate are not as stable as those of coupon (interest) payments from bonds, real estate has the added benefit of capital appreciation of the property.

Historical performance of real estate as an asset class

Real estate is touted as a hedge against inflation because real estate returns generally keep up with or slightly outperform inflation. For most of US history, real estate prices have moved in tandem with the inflationary pressures in the economy.

Only during the period of Great Moderation (aka the Goldilocks economy), where there was low inflation, stable growth, lower uncertainty, rising asset prices, and more risk-taking, did the real estate market compete with the stock market in terms of returns. This “Goldilocks” period started in 1990 and ended in 2006, leading to the 2008 financial crisis, as housing prices fell when the bubble burst.

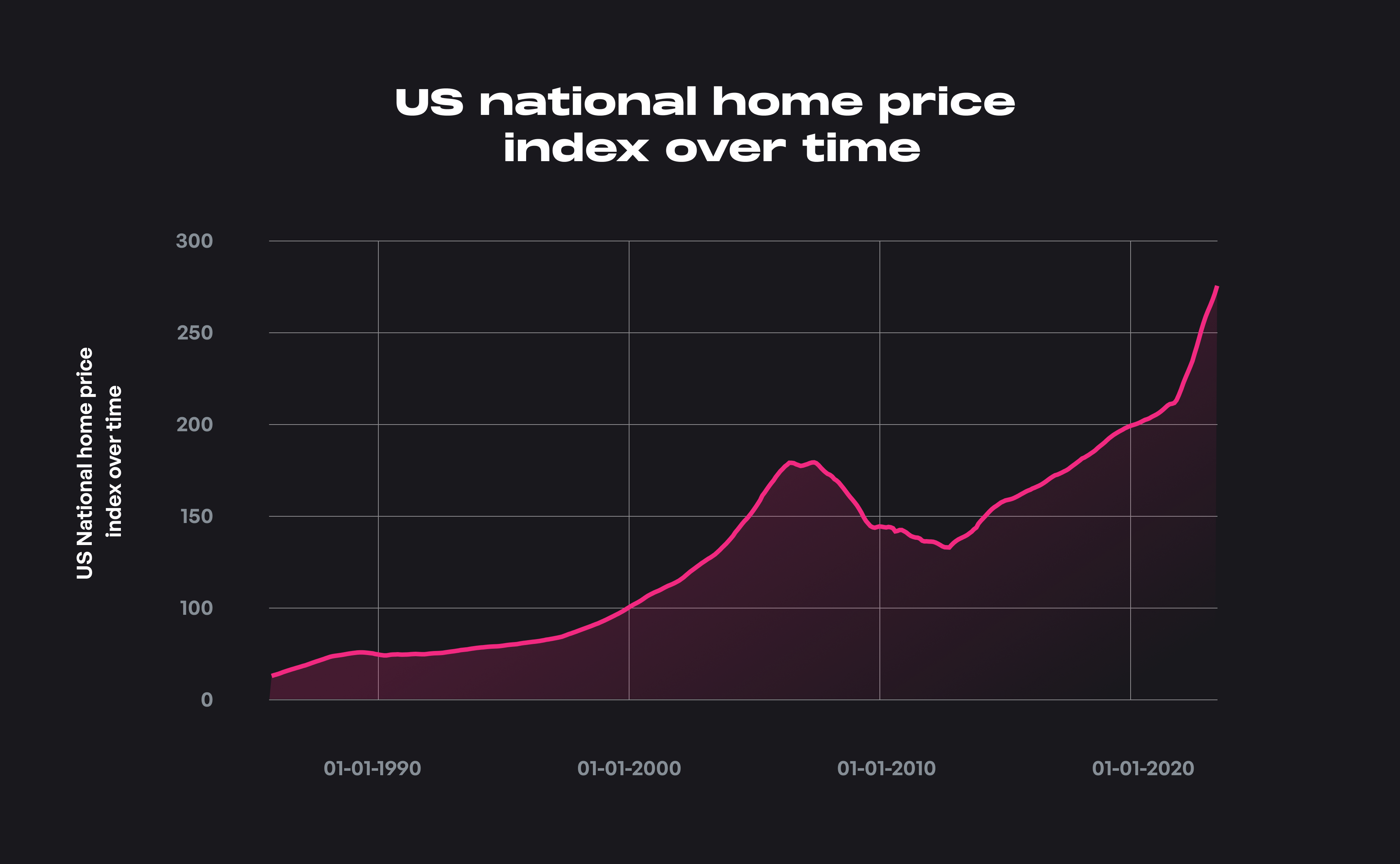

We can observe these trends by looking at the S&P/Case-Shiller U.S. National Home Price Index, which tracks the changes in the value of residential real estate nationally and shows that home prices in the US have more than quadrupled from 1987 to the present (2022).

To look at it through a monetary lens, $100 invested in residential real estate in the US in January 1987 would have turned into $444 by January 2022. (You can view all data and analysis here.)

( Disclaimer: The S&P/Case-Shiller U.S. National Home Price Index is not an investable index. It is used for representational and comparison purposes only.)

Stocks vs. Real estate - Performance and volatility

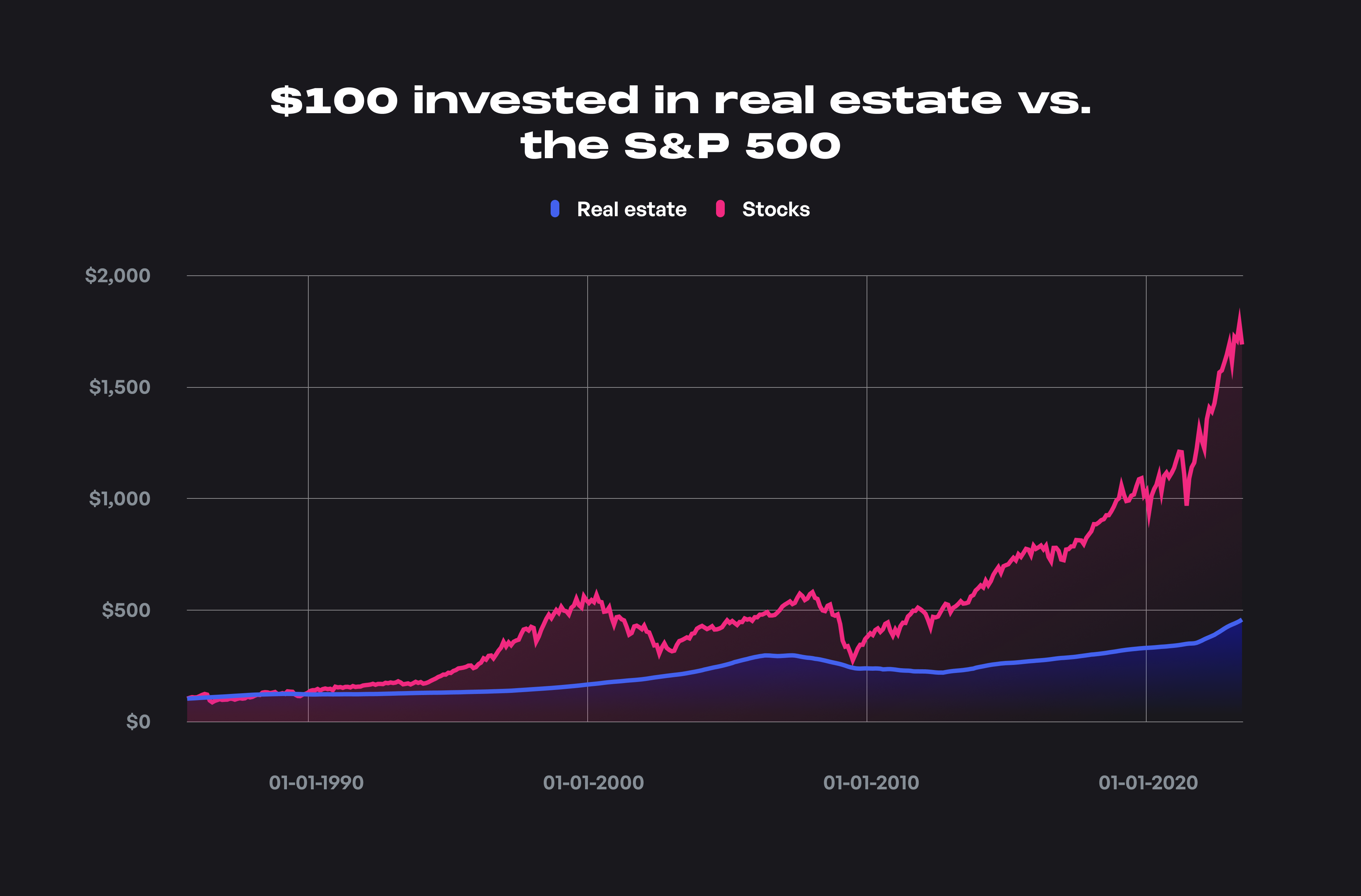

Comparing the performance of real estate with that of the S&P 500 (which represents the 500 largest publicly listed stocks in the US by market cap), we can see that over the last 35 years, stocks have been the more dominant asset class in terms of returns.

In monetary terms, $100 each invested in stocks and real estate in January 1987 would have increased to $1,647 and $444, respectively. This observation shows that over the last 35 years, stocks have resulted in returns that outperformed real estate by 4X.

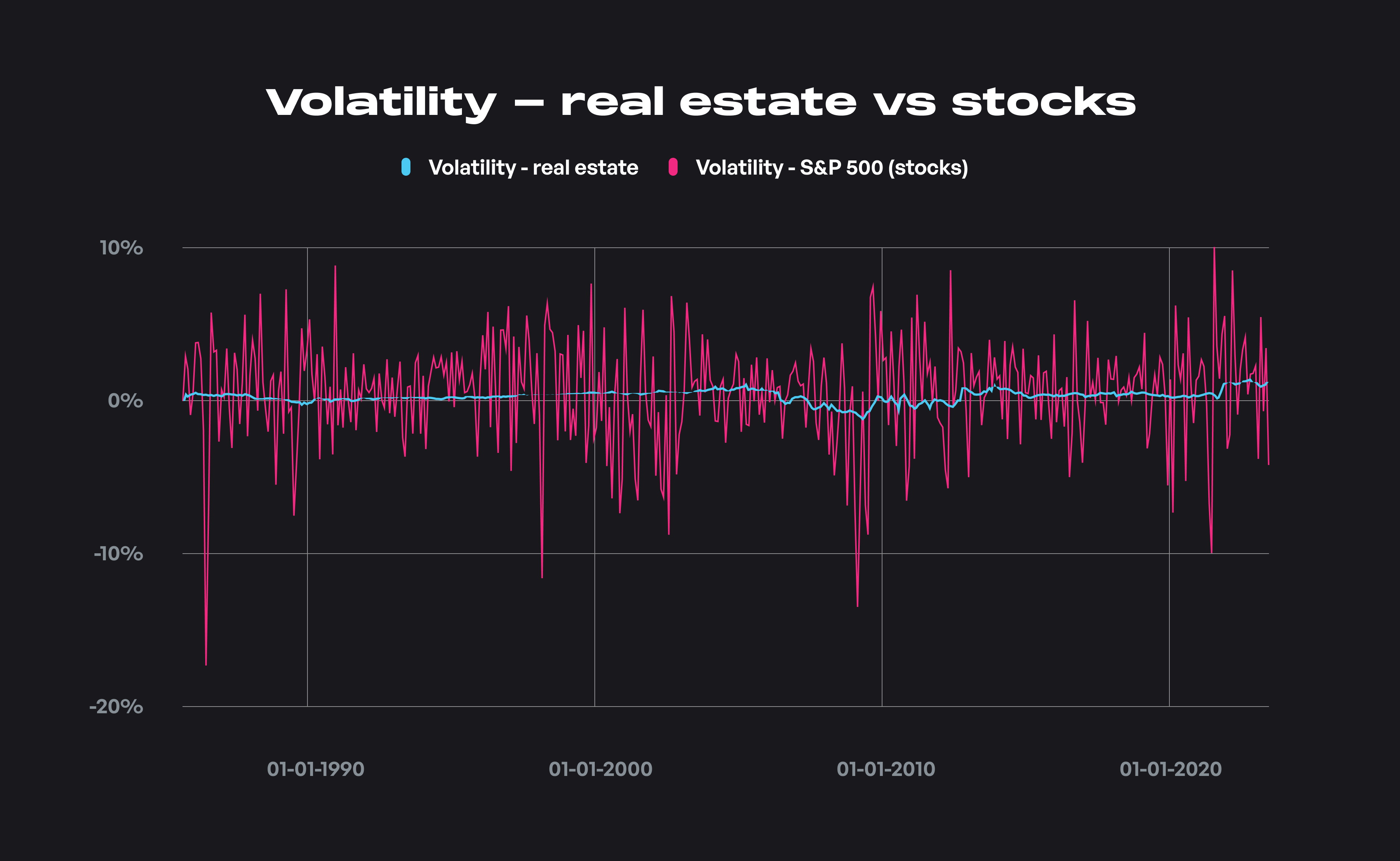

Looking at volatility, however, there is a different story to be told. The annualized volatility of real estate is at 1.82% vs. 14.91% for stocks, which is an 8X increase in the volatility of stocks compared to real estate.

The 2008 financial crisis

The primary causes for the creation and crash of the bubble are still disputed to this day. However, some main factors include cheap credit and lax lending standards. Even people who had no job or income were given mortgages as these mortgages were sold to investors as mortgage-backed securities and were highly profitable to the banks.

In a system where the incentives were misaligned, bad actors such as the senior executives of the mortgage funding firms, investment banking firms, and credit-rating agencies were not punished for taking advantage of the system.

As the bonuses and compensation that the executives received were tied to short-term performance over long-term effects and outcomes, they did not care for the future effects those decisions would cause to their firms.

Let us consider the performance of $100 invested in real estate (data taken from the S&P/Case-Shiller U.S. National Home Price Index) versus stocks (the S&P 500) before, during, and after the financial crisis.

In the initial stages (2006-2007), stocks performed relatively well while real estate slowly decreased in value. However, due to the sub-prime mortgage crisis, the collapse of complex financial instruments like mortgage-backed securities, and the failure of major financial institutions like the Lehman Brothers, the stock market crashed sharply. The bankruptcy of Lehman triggered a 4.5% decline in the value of the Dow Jones Industrial Average in a single day, then the sharpest drop since 9/11.

Post-2009, the stock market started recovering from the crash, and by the year 2013, investors who had invested at market peaks in 2007 would have recovered their capital. However, real estate prices continued to slowly decline in value till 2012 , after which they made a slow recovery.

An investor who bought real estate at the market peaks in 2007, on the other hand, had to wait for nine years before the prices reached the levels they had invested in (without adjusting for inflation).

$100 invested in real estate in February 2007 would have turned into $74 by January 2012 (a 26% drop in value). The same $100 invested in stocks during the same period would have turned into $93.30 (a 7% drop in value).

Looking at the table below, we can observe that from 2007 to 2012, real estate prices dropped by 6% every year , adjusting for seasonality. Stocks only reduced by about 1.56%, but with much higher volatility than real estate.

Ways to add real estate to your portfolio

Real estate as an asset class/investment for most of history had been available only to wealthy individuals and institutional investors like pension funds, insurance companies, and other huge financial institutions. It also required vast amounts of capital and active management and maintenance of the property, which made it relatively inaccessible to retail investors as an investment alternative.

However, in the last few decades, real estate investment funds (especially Real Estate Investment Trusts (REITs) and Real estate mutual funds) have made this asset class accessible to the retail investor. Access to real estate as an addition to your investment portfolio as a retail or institutional investor can offer benefits such as dispersing risks between asset classes, diversification, and efficient capital allocation. Some of the ways in which you can invest in real estate are detailed below.

Direct real estate investing:

This investing involves purchasing specific properties based on your research to generate rental income from that property. Flipping a house after buying and renovating it also comes under this category.

Advantages:

- You have a lot of control over developing and renovating the house, making changes, etc.

- You can choose the buyer and set the purchase price/rent of the property, and it is possible to generate a consistent income through increases in rent over time due to inflation.

Disadvantages:

- For most retail investors, especially younger ones, purchasing homes as an investment does not provide adequate asset allocation because of the upfront capital requirements necessary to buy a house. A house is also a highly illiquid investment—it’s tough to convert it to cash quickly in most housing markets.

- You must spend time or hire someone to manage and maintain the property and choose the best tenants (renters) to get a steady income stream.

- Purchasing one or two properties can expose you to locality-specific risks. If market prices/rent for homes in that area drop, your investment loses value.

Real estate investment trusts (REITs) :

As a retail investor, REITs are shares that you can buy publicly on the stock market (there are private market REITs too) that invest in real estate, mortgages, or other real estate collateralized investments. You can learn more about REITs here.

Advantages:

- You don't require a lot of upfront capital or expertise in real estate to invest in REITs.

- You don't have to maintain or manage a property and deal with different types of property-related issues.

- REITs provide adequate location and property type diversification as they own or operate different properties across several locations and geographies. Investing in REITs reduces the location and property-specific risks that come along with direct real estate investments.

Disadvantages:

- From an investment diversification perspective, REITs are more correlated with the stock market than direct real estate investments, which means that fluctuations and crashes in the stock market could affect the value of REITs.

- Even though you don't have to research the real estate market, you’ll have to do your research on which REITs are worthy investments.

- As REITs are traded on the public and private markets, they are constantly revalued by investors in the market and are hence more volatile than direct real estate investments.

Real estate mutual funds:

Real estate mutual funds invest in REITs and real estate companies. Like equity mutual funds, these mutual funds generally have analysts and portfolio managers that perform extensive research on the REITs and real estate companies they hold in their mutual fund portfolios.

Advantages:

- These funds provide higher diversification benefits than direct investments and REITs and are backed by the fund's research. You can view the holdings of the fund and the reasoning behind each holding.

- With just a tiny investment amount, you can allocate broadly over various REITs and real estate companies, providing significant diversification at a low cost.

- With broad market real estate mutual funds, you are only exposed to the market risk, as all the location and property-specific risks are diversified away.

Disadvantages:

- Real estate mutual funds have a whole team that decides on the instruments they will invest in and hence have higher management fees (higher expense ratio) than REITs.

- Real estate mutual funds are also generally less liquid than REITs.

Key Takeaways

- Holding real estate as part of your portfolio can help you increase diversification, serve as a hedge against inflation and reduce the volatility of your portfolio with a risk/reward profile that is somewhere between that of stocks and bonds.

- Real estate has provided lower returns than the stock market (according to the S&P/Case-Shiller U.S. National Home Price Index) but was much less volatile than stocks.

- Direct investments into real estate come with liquidity problems (it's easier to convert other asset classes like stocks and bonds into cash) and maintenance issues.

- You can add real estate to your portfolio as direct investments into properties, buying REITs, or investing in real estate mutual funds, each of which has its unique pros and cons.

11 bold ways to boost your financial health

Josh Pigford

Maybe's Top Budgeting Software for Large Companies: Streamline Your Finances with Ease

Josh Pigford

10 things to do after you sell your business

Josh Pigford

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.