Budgeting 101: The Ultimate Guide to Financial Freedom

Author

Josh Pigford

Understanding your financial flow is a foundational step towards achieving financial freedom. It involves a comprehensive analysis of your income, expenses, and spending patterns. This section delves into three critical components: determining your net income, identifying fixed and variable expenses, and understanding the role of discretionary spending.

Determining Your Net Income

Net income is the amount of money you have left after all deductions, such as taxes, have been made from your gross income. This includes wages from employment, as well as other sources like social security, disability, pensions, child support, regular interest, or dividend earnings, and alimony. Knowing your net income is essential as it sets the baseline for your budgeting process.

Identifying Fixed and Variable Expenses

Expenses can be categorized into two types: fixed and variable.

- Fixed Expenses: These are costs that remain relatively constant each month. They often represent the "needs" within your budget, consuming a significant portion of it. Examples include rent or mortgage payments, car payments, insurance premiums, and property taxes. Despite their consistency, it's crucial to review these expenses regularly as they can change over time, such as when switching service providers or facing rent increases.

- Variable Expenses: These costs fluctuate based on lifestyle choices and spending habits, representing the "wants" in your life. Variable expenses include groceries, dining out, entertainment, gasoline, and home repairs. They can be less predictable and more volatile, making them challenging to track and budget for. However, they also offer the greatest opportunity for adjustments to save money or reallocate funds towards financial goals.

The Role of Discretionary Spending

Discretionary spending is a subset of variable expenses, encompassing non-essential costs that enhance your lifestyle, such as meals at restaurants, entertainment, vacations, and luxury items. This type of spending is funded by discretionary income, which is what remains after covering all necessities. The flexibility of discretionary spending means it's often the first area adjusted when looking to cut costs or save for a significant expense.

Understanding the difference between discretionary expenses and non-discretionary expenses is crucial. Non-discretionary expenses, or needs, are essential for day-to-day living and cannot be easily eliminated. In contrast, discretionary expenses, or wants, are more flexible and can be adjusted based on financial goals or economic circumstances.

In summary, a thorough understanding of your financial flow involves knowing your net income, categorizing expenses into fixed and variable, and recognizing the role of discretionary spending. This knowledge empowers individuals to make informed decisions about their finances, paving the way for a more secure financial future.

Setting Up Your Budget

Choosing a Budgeting Method

Selecting the right budgeting method is crucial for effective financial management. Several strategies can be tailored to individual needs and financial goals. For instance, the Zero-Based Budgeting method allocates every dollar to specific categories ensuring income minus expenses equals zero, which is ideal for detailed tracking. Alternatively, the 50/30/20 method simplifies budgeting by dividing income into necessities, wants, and savings. For those with irregular incomes, the Percentage-Based approach adjusts expenditures based on changing income levels, which is highly adaptable.

Allocating Funds Across Categories

Once a budgeting method is chosen, the next step involves distributing funds across various categories. This process should align with one's financial goals and priorities. Essential categories like housing, utilities, and groceries generally receive a larger portion of the budget. Discretionary spending, such as entertainment and dining out, might be allocated less. It's important to use a systematic approach, possibly assigning specific percentages of the total budget to each category to maintain a balanced financial plan.

Adjusting for Irregular Income

For individuals with variable income, budgeting requires a flexible approach. Begin by determining baseline monthly expenses to cover essential needs. Next, calculate the average monthly income over a period, subtracting necessary taxes for accurate net income. Using this average, allocate funds to both fixed and variable expenses, ensuring essentials are prioritized. Any excess income should be directed towards savings or debt repayment. Tools like budgeting apps or multiple bank accounts can aid in tracking income and expenditures effectively, ensuring financial stability despite income fluctuations.

By employing these strategies, individuals can create a robust budgeting system that not only manages monthly expenses efficiently but also enhances their ability to achieve long-term financial goals.

Tracking and Adjusting Your Spending

Monitoring Expenses Regularly

Regular monitoring of expenses is crucial for maintaining a budget and ensuring financial stability. Individuals should start by adding up all sources of income, including salaries, interest, and any other earnings. It's important to use net income figures, accounting for taxes if they aren't automatically deducted. Expenses should then be categorized into fixed and variable costs. Fixed expenses, such as rent and insurance, remain constant, while variable expenses like food and entertainment can fluctuate. By using tools available through one's bank account, such as downloading statements or scanning receipts, individuals can track their spending efficiently.

Using Tools for Budget Management

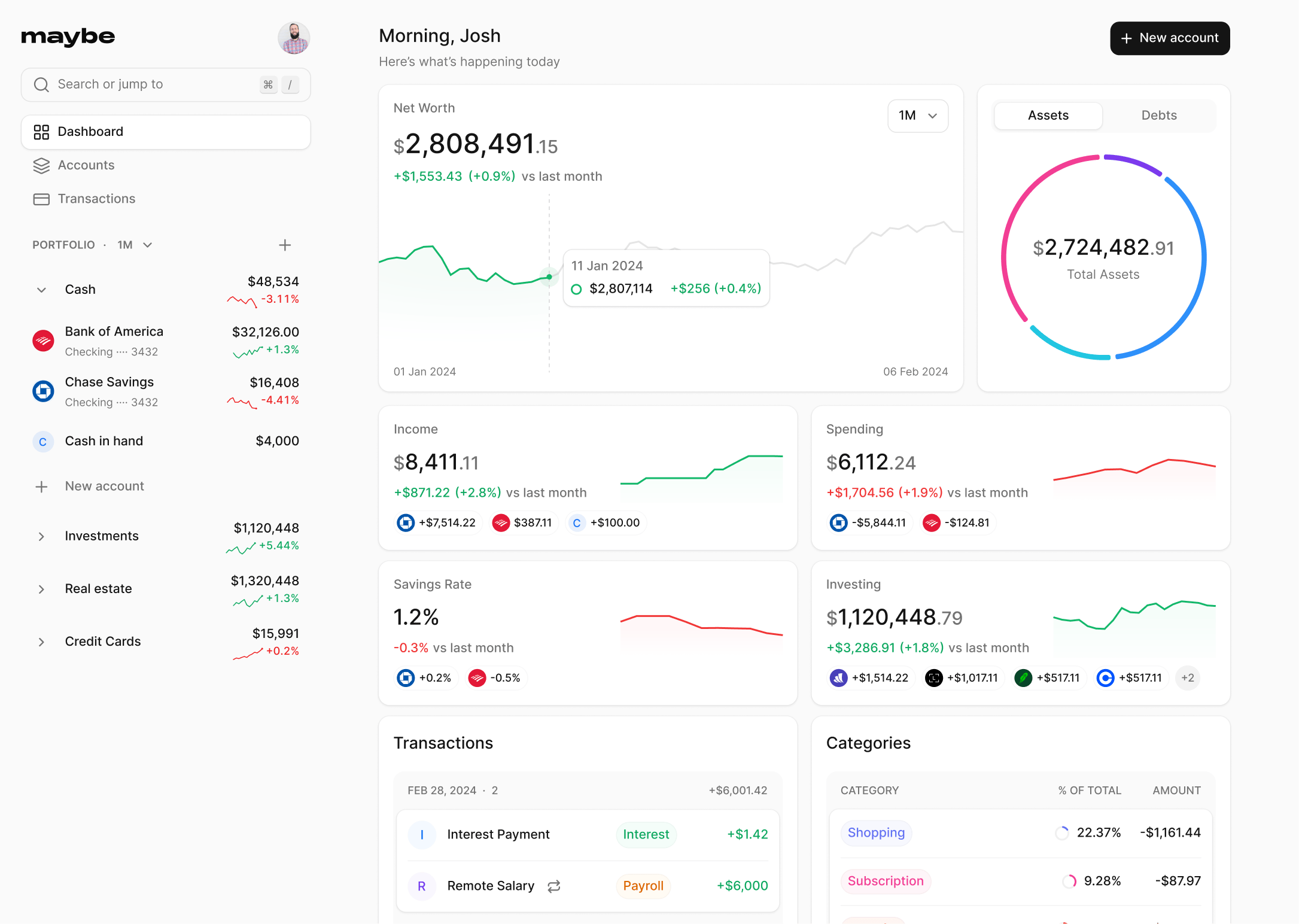

There are numerous tools available to assist with budget management, from simple spreadsheets to sophisticated budgeting apps like Mint, PocketGuard, and Wally. These tools help individuals track their spending patterns and manage their finances more effectively. For those who prefer manual tracking, creating a personal budget spreadsheet can be beneficial. This method involves listing all expenses and categorizing them into needs, wants, and savings or debts, which aligns with the 50/30/20 budgeting method. Additionally, expense management software can automate many of the tasks associated with budget tracking, such as categorizing transactions and generating spending reports.

Evaluating Spending Habits

Evaluating spending habits involves a detailed analysis of where money is being spent and identifying areas where adjustments can be made. By examining categories of spending, individuals can pinpoint unnecessary expenditures and make informed decisions about where to cut costs. High-cost expenses, such as housing and vehicles, often consume a significant portion of the budget and may require more substantial changes to manage effectively. Regular reviews of expenses, whether weekly, monthly, or quarterly, are essential for maintaining control over one's finances and achieving long-term financial goals. Through these evaluations, individuals can adjust their budgets to better align with their financial objectives, ensuring a healthier financial future.

Saving Strategies Within Your Budget

Prioritizing Savings

Creating a disciplined savings strategy begins with understanding and prioritizing your financial goals. One effective method is the 50/30/20 rule, which allocates income into three categories: necessities, wants, and savings. By dedicating at least 20% of income to savings, individuals can build a robust financial foundation. Setting specific, measurable, and time-related goals---like saving for a down payment on a home or an emergency fund---helps maintain focus and motivation. Automating savings deposits ensures that funds are consistently set aside before they can be spent on other expenses, reinforcing the habit of "paying yourself first."

Cutting Down Unnecessary Expenses

Reducing expenses is crucial for freeing up more money to save. Individuals should start by evaluating their spending habits to identify areas where cuts can be made without sacrificing quality. Simple changes, such as canceling unused subscriptions, opting for generic brands, and utilizing discounts and coupons, can significantly lower monthly expenses. Additionally, planning meals and cooking at home rather than dining out can drastically reduce food costs. For larger savings, consider negotiating bills like utilities or insurance and cutting back on high-cost items like luxury goods or expensive hobbies.

Utilizing Savings Accounts Effectively

Choosing the right type of savings account is essential for maximizing the growth of your funds. Traditional savings accounts offer stability and liquidity, making them suitable for short-term savings goals. For longer-term goals, high-interest savings accounts or certificates of deposit (CDs) provide higher returns, helping funds grow more rapidly. It's also beneficial to use multiple savings accounts for different goals, which simplifies tracking progress and ensures that funds are allocated appropriately. Regularly reviewing and comparing the terms, interest rates, and fees of your savings accounts can further optimize your savings strategy.

By integrating these strategies into your financial plan, you can enhance your ability to save effectively within your budget, moving closer to achieving financial stability and freedom.

Dealing with Debt and Loans

Managing Minimum Payments

When tackling debt, it is crucial for individuals to understand the importance of managing minimum payments effectively. Minimum payments are the lowest amount of money that one must pay on their debt accounts each month to remain in good standing with creditors. While making minimum payments can prevent penalties and negative impacts on one's credit score, they usually cover only interest, barely reducing the principal balance. Consequently, debts linger longer, accruing more interest.

Strategies for Debt Repayment

- Avalanche Method:

- - Prioritize debts with the highest interest rates.

- Allocate extra funds to these debts while maintaining minimum payments on others.

- This method reduces the amount spent on interest over time, making it a cost-effective strategy.

- Snowball Method:

- - Focus on paying off debts with the smallest balances first.

- After clearing a small debt, the funds used for that debt are then directed to the next smallest balance.

- This strategy provides psychological wins, boosting motivation.

- Debt Consolidation:

- - Combine multiple debts into a single loan with a potentially lower interest rate.

- Simplifies monthly payments and can reduce the total interest paid.

- Negotiating with Creditors:

- - Contact creditors to negotiate terms possibly reducing interest rates or securing more favorable repayment terms.

- Ensure agreements are in writing to avoid future discrepancies.

- Using Balance Transfer Credit Cards:

- - Transfer high-interest debt to a credit card with a lower interest rate, often as part of an introductory offer.

- Important to pay off the transferred balance during the promotional period to avoid high rates post-promotion.

Avoiding New Debts

To ensure financial stability and avoid the accrual of new debts, individuals should adopt prudent financial habits:

- Budgeting: Maintain a rigorous budget to manage expenses and avoid overspending.

- Emergency Fund: Establish and grow an emergency fund to cover unexpected expenses without resorting to credit.

- Insurance: Adequate insurance coverage helps mitigate potential financial disasters that could lead to debt.

- Spending Discipline: Use credit cards judiciously, ensuring that balances can be paid off monthly to avoid interest charges.

- Financial Education: Continuously educate oneself on financial management techniques and the implications of various types of credit.

By adhering to these strategies and maintaining a disciplined approach to finances, individuals can manage existing debts effectively and prevent the formation of new ones, paving the way towards financial freedom.

Review and Adjust Your Budget Regularly

Scheduling regular reviews of one's budget is akin to performing routine maintenance on a vehicle---it ensures everything runs smoothly and efficiently. Individuals are encouraged to examine their budget on a monthly basis, allowing for the identification of any discrepancies early on and adjusting plans accordingly. This proactive approach prevents making significant financial decisions without a clear understanding of one's current financial standing. For instance, without regular budget reviews, one might underestimate expenses such as dining out, leading to unexpected financial strain. By diverting funds from other areas, individuals can avoid dipping into savings or derailing debt repayment goals. Regular budget reviews not only offer peace of mind but also ensure that all financial affairs are in order.

Scheduling Regular Budget Reviews

- Monthly Check-ins: Aim to review the budget at least once a month. This habit helps in keeping track of expenses, income changes, or any new financial goals.

- Paycheck Reviews: For those with variable income or tight cash flow, reviewing the budget every paycheck can be beneficial to ensure no mistakes are made and that ends are meeting.

- Automation: To reduce the frequency of manual budget reviews, consider automating as much of the financial process as possible. This includes automatic savings transfers, direct deposits, investing through payroll deductions, and automatic bill payments.

Adapting to Financial Changes

Life events such as a change in employment status, a pay raise, or unexpected expenses necessitate adjustments to the budget. It's crucial to update the budget to reflect any changes in income, whether it's a decrease or increase. Adding new expenses as they arise, such as a new gym membership or a financed vehicle, ensures that the budget remains accurate. Furthermore, one cannot foresee every expense, and financial surprises can disrupt a budget. Maintaining a healthy emergency fund can mitigate the impact of these unforeseen expenses, allowing for financial stability in the face of challenges.

Setting New Financial Goals

Reevaluating and setting new financial goals is essential as one's financial situation evolves. Whether saving for a down payment, starting a business, or expanding the family, a budget that aligns with these goals is crucial for success. Adjusting the budget to accommodate short-term or long-term financial goals enables individuals to set and achieve evolving savings targets. Reflecting on financial goals and adjusting them as necessary ensures that the budget supports one's financial journey, allowing for flexibility and adaptability in the face of life's uncertainties.

In summary, reviewing and adjusting one's budget regularly is a vital practice for maintaining financial health. It allows individuals to stay aligned with their financial goals, adapt to changes, and navigate unforeseen expenses with confidence.

FAQs

What is the 50/30/20 budgeting rule?

The 50/30/20 budgeting rule is a straightforward guideline for managing your finances. It suggests allocating 50% of your income to essential needs, 30% to discretionary expenses such as entertainment, and 20% to savings and debt repayment.

What are the seven steps to achieving financial freedom?

Achieving financial freedom can be broken down into seven actionable steps:

- Save $1,000 as an initial emergency fund.

- Eliminate all debt (except mortgage) using the debt snowball method.

- Accumulate 3-6 months' worth of expenses in a comprehensive emergency fund.

- Invest 15% of your household income into retirement plans.

- Start saving for your children's college education.

- Aim to pay off your home mortgage early.

- Focus on building wealth and giving back to the community.

What is the most important rule of budgeting?

The most critical rule of budgeting, often referred to as the 50/30/20 rule, suggests that after-tax income should be spent as follows: up to 50% on necessities and obligations, 20% on savings and debt repayment, and the remaining 30% on other desires.

Is the 50/30/20 budgeting rule practical for everyone?

The 50/30/20 rule is a helpful starting point for many, but it may not be feasible for everyone. Factors such as income level and living costs can affect whether allocating only 50% of income to necessities is sufficient.

Bad Investments: How to Avoid Losing Money

Josh Pigford

Bank Account Tracker: How Maybe Can Help You Keep Tabs on Your Finances

Josh Pigford

Maybe's Top Picks: Best Business Budgeting Software for 2024

Josh Pigford

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.