Zero-Based Budgeting: The Path to Financial Clarity

Author

Josh Pigford

Zero-based budgeting (ZBB) is a meticulous approach to planning and decision-making that revolutionizes the way organizations, and individuals manage their finances. Unlike traditional budgeting methods that adjust previous budgets to account for new expenses, ZBB starts from a "zero base." This means every expense, no matter how small, must be justified for the new period. Originating in the late 1960s by Peter Pyhrr, a former Texas Instruments account manager, ZBB challenges entities to analyze each expense's necessity and impact rigorously.

Key Features of Zero-Based Budgeting

- Starting from Zero: Each budget cycle begins from scratch, emphasizing critical evaluation over historical spending patterns.

- Justification of Expenses: Every cost must be validated, ensuring that only essential expenses are included in the budget.

- Strategic Allocation: ZBB allows for a strategic, top-down review of spending, aligning expenditures with organizational or personal financial goals.

Application in Personal Finance

In personal finance, ZBB translates to assigning every dollar of take-home pay a specific job, aiming to balance income and expenditures each month. This method promotes intentional spending, where savings and expenses are planned meticulously, preventing unplanned or frivolous expenditures. It encourages individuals to prioritize savings, invest in essential needs, and cut down on unnecessary costs, fostering a disciplined approach to financial management.

Business Implementation

For businesses, ZBB is a powerful tool for eliminating wasteful spending and focusing on high-value initiatives. It enforces accountability and ownership across departments, compelling managers to justify each budget item's necessity. This rigorous process aids in identifying cost-saving opportunities, improving operational efficiency, and aligning spending with strategic business objectives.

Zero-based budgeting's comprehensive nature requires a detailed examination of every expenditure, making it a highly effective strategy for achieving financial clarity and discipline. Whether applied to personal finance or within an organization, ZBB promotes a culture of cost-consciousness and strategic planning, paving the way for sustainable financial health and growth.

How to Create a Zero-Based Budget

List Your Monthly Income

To initiate a zero-based budget, one must first determine their monthly income. This includes regular paychecks and any additional income, such as earnings from side hustles. Utilizing budgeting tools like EveryDollar can simplify this process, allowing for an accurate total of monthly income to be established, which serves as the foundation for the budgeting process.

List Your Expenses

Following the identification of monthly income, the next step involves listing all expected expenses. This exhaustive list should cover every financial obligation, from essential living costs, such as food and shelter, to discretionary spending like entertainment. Critical categories to consider include giving (recommended at 10% of income), savings (variable based on financial goals), the Four Walls (food, utilities, shelter, and transportation), other essentials (insurance, debt repayment, childcare), extras (entertainment, dining out), and month-specific expenses (holidays, celebrations).

Subtract Your Expenses from Your Income to Equal Zero

The essence of zero-based budgeting lies in ensuring that income minus expenses equals zero. Achieving this balance might require adjustments, such as reallocating surplus funds towards financial goals or reducing expenses to address a deficit. This iterative process encourages a disciplined approach to managing finances, ensuring every dollar is purposefully allocated.

Track Your Expenses All Month Long

Maintaining a zero-based budget requires diligent tracking of all transactions throughout the month. Every dollar earned or spent should be accounted for within the budget, ensuring adherence to the established financial plan. Advanced budgeting tools can facilitate this process by automating the tracking of transactions, thereby simplifying budget management.

Make a New Budget Before Each Month Begins

Given the variability of expenses and income, it's imperative to create a new zero-based budget for each month. This proactive approach allows for the incorporation of month-specific expenses and adjustments based on previous spending patterns, ensuring readiness for the financial demands of the upcoming month.

By following these steps, individuals can effectively implement a zero-based budgeting system, fostering financial discipline and clarity.

Advantages of Zero-Based Budgeting

Better Understanding of Financial Means

Zero-based budgeting compels individuals and organizations to meticulously examine each dollar spent within each budgeting period. This rigorous justification of operating expenses not only highlights areas generating revenue but also sheds light on legacy costs often overlooked in traditional budgeting. By requiring a fresh justification for every expense, zero-based budgeting ensures a deeper understanding of financial operations, preventing the gradual and often unnoticed increase in expenses that can lead to significant resource misallocation over time.

Enhanced Savings

One of the most compelling advantages of zero-based budgeting is its ability to transform savings goals into explicit budget items. By treating savings as necessary expenses, individuals are essentially "paying themselves first," laying a foundation for financial stability. This methodical approach to budgeting encourages the prioritization of savings, whether for retirement, emergency funds, or specific financial goals, ensuring that saving is not an afterthought but a planned action.

Customization

Zero-based budgeting stands out for its adaptability to personal and organizational financial needs. Each budgeting cycle is an opportunity to reassess and realign financial plans with current income, needs, and goals. This flexibility allows for a tailored approach to budgeting, accommodating changes in financial circumstances and objectives. Furthermore, by planning indulgences and discretionary spending in advance, individuals can control impulse spending, making zero-based budgeting a highly customizable and effective financial planning tool.

Focused Operations

The requirement to justify each expense in a zero-based budget brings organizational operations into sharp focus. Managers are prompted to identify the most cost-effective ways to deliver activities and services, aligning resources with strategic objectives. This focus on operational efficiency can lead to significant cost savings, with companies reporting reductions between 10 and 25%. Such savings are crucial for bolstering margins or investing in future growth, demonstrating how zero-based budgeting can lead to more focused and financially sound operations.

Disadvantages of Zero-Based Budgeting

Time-Consuming Process

One of the primary challenges of zero-based budgeting (ZBB) is its resource-intensive nature. Unlike traditional budgeting, which may only require reviewing and adjusting previous budgets to account for new expenses, ZBB demands a detailed review and justification for every budget element. This comprehensive evaluation process can significantly increase the time and effort needed, potentially outweighing the benefits. Critics argue that the extensive time cost involved in ZBB may not justify its implementation, especially in environments where resources are already stretched thin.

Potential Short-Term Focus

Zero-based budgeting can inadvertently promote a short-term mindset among managers and decision-makers. By necessitating the justification of expenses within the immediate budgeting period, there's a risk of prioritizing areas that will generate revenue in the near term over those that are crucial for long-term competitiveness but may not immediately impact the bottom line. This bias towards short-term planning can result in underfunding essential long-term investments such as research and development or worker training, potentially harming an organization's ability to remain competitive.

Irregular Income Management Challenges

Adopting ZBB can be particularly challenging for individuals or organizations with irregular income streams. The process requires a shift in mindset for managers and can increase stress on teams already managing fluctuating revenues. The necessity to create a new budget for each period, factoring in the unpredictability of income, can introduce additional uncertainty and stress. This environment may foster a competitive atmosphere as departments vie for funding, fearing their projects may be deprioritized or eliminated, thus affecting the overall spirit of cooperation within the organization.

FAQs

How Can a Zero-Based Budget Propel You Towards Your Financial Objectives?

A zero-based budget significantly enhances your financial discipline by necessitating deliberate decision-making in your spending habits. It ensures that every dollar you plan to spend is allocated for a specific purpose, preventing indiscriminate or unplanned expenditures and aligning your spending with your financial goals.

What Exactly Is Zero-Based Budgeting in the Realm of Financial Management?

Zero-based budgeting (ZBB) is a meticulous budgeting method that requires a comprehensive reevaluation of all expenditures in each new budget cycle. This approach stands in contrast to traditional budgeting methods, which often involve making adjustments to previous spending levels. ZBB demands a justification for every dollar spent, starting from scratch, thereby promoting more responsible financial planning and management.

Why Is Zero-Based Budgeting Considered the Most Effective Budgeting Strategy?

Zero-based budgeting is acclaimed for its numerous benefits, which include promoting more efficient operations, reducing costs, enhancing budget flexibility, and facilitating strategic financial planning. This budgeting method encourages a meticulous examination of how funds are allocated, ensuring that resources are directed towards the most profitable or essential activities.

How Does Zero-Based Budgeting Apply to Personal Finance?

In personal finance, zero-based budgeting is a strategy where your income minus your expenses equals zero. This means that every dollar you earn is assigned a specific role, whether it's for saving, spending, or investing. If your monthly income is $5,000, then your total allocations for expenses, savings, and any other financial commitments should also total $5,000. This approach ensures that every dollar you earn has a clear purpose.

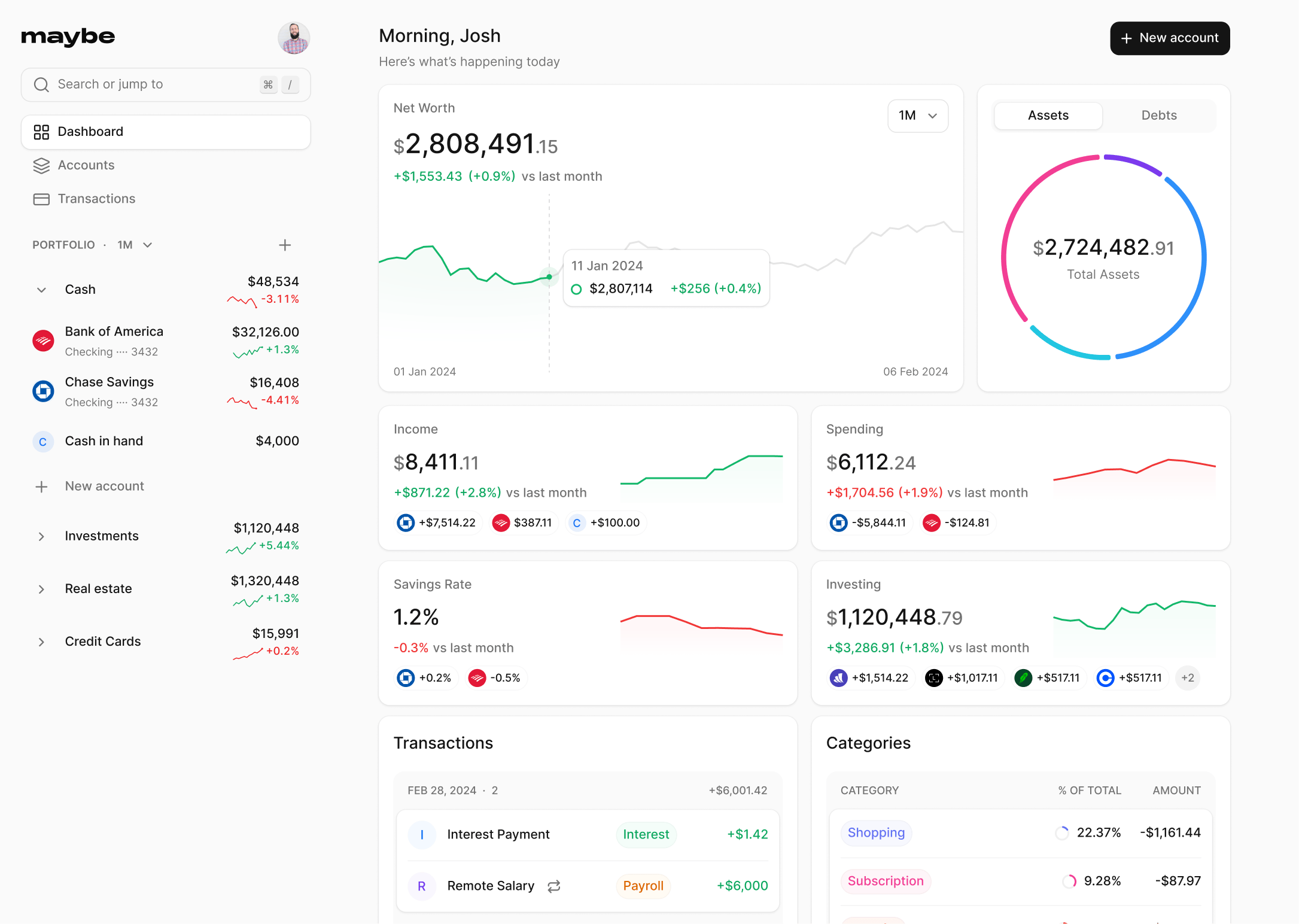

Cash Tracker: A Comprehensive Guide to Managing Your Finances with Maybe

Josh Pigford

Bad Investments: How to Avoid Losing Money

Josh Pigford

How the Market Works: Demystifying Stock Market Operations

Josh Pigford

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.