Tactical Asset Allocation: A Dynamic Approach to Portfolio Management

Author

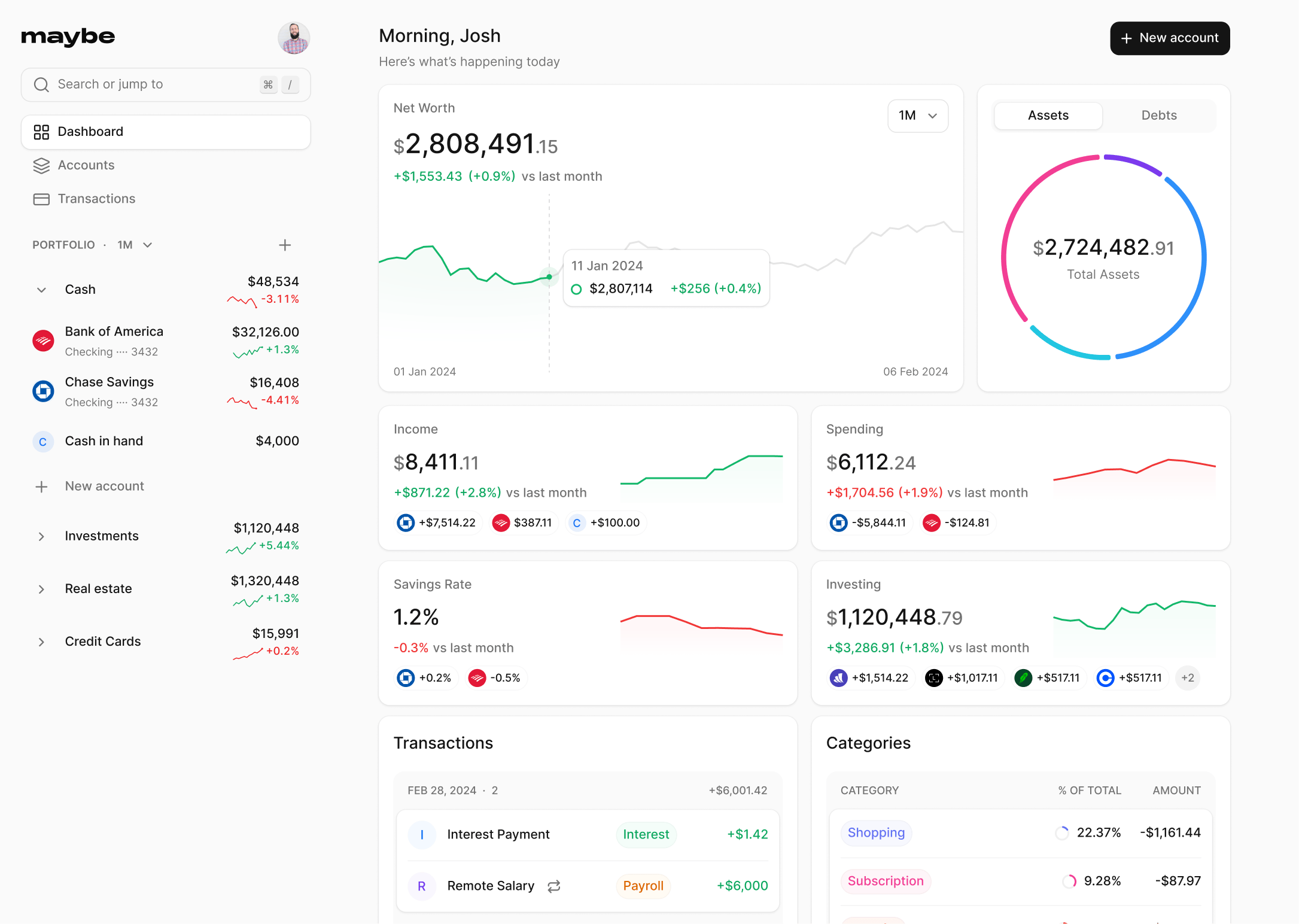

Josh Pigford

In an ever-changing market landscape, tactical asset allocation emerges as a dynamic and flexible approach to portfolio management, differentiating itself from the more static strategic asset allocation. By adjusting the weightings of assets in a portfolio, tactical asset allocation tailors investments to capitalize on market conditions, economic forecasts, and short-term opportunities, aiming to maximize returns while managing risk. This approach is most suitable for investors looking for ways to potentially outperform the market by adapting their investment strategies in response to changing market dynamics. An understanding of tactical asset allocation versus strategic asset allocation, along with examples and strategies, is crucial for investors aiming to make informed decisions in the swiftly evolving financial markets.

This article will delve into the intricacies of tactical asset allocation, highlighting its benefits, such as the potential for enhanced portfolio performance and risk management. We will also explore how to implement a tactical asset allocation strategy effectively, considering various factors and market indicators to guide asset reallocation decisions. Furthermore, attention will be given to the challenges and considerations associated with tactical asset allocation, including its comparison with dynamic asset allocation and addressing common disadvantages. Through this comprehensive overview, investors will gain valuable insights into tactical asset allocation, equipping them with the knowledge to make strategic investment choices that align with their financial goals and risk tolerance.

Benefits of Tactical Asset Allocation

Flexibility and Opportunistic Investing

Tactical Asset Allocation (TAA) offers a dynamic management approach, allowing portfolio managers to adjust asset allocations based on short-term market conditions. This flexibility enables them to capitalize on market inefficiencies and exploit short-term trends, such as sector rotation strategies that shift investments among different sectors based on expected performance. By maintaining the ability to adapt quickly to market changes, TAA provides a significant advantage in navigating economic cycles and enhancing portfolio performance.

Enhanced Returns and Risk Management

TAA strategies are designed to maximize returns through active management of asset allocations. By selecting the best-performing funds and discarding the worst, TAA aims to improve returns while simultaneously managing risk. The approach has demonstrated the ability to capture a larger percentage of gains while limiting losses, which is crucial in volatile markets. For instance, during the 2000-2023 market cycles, TAA strategies showed not only impressive returns but also significantly lower drawdowns compared to more static strategies, thus allowing for quicker recovery periods and less overall portfolio volatility.

Diversification Across Asset Classes

One of the fundamental principles behind TAA is its focus on diversification. By employing a broad range of asset classes, including equities, fixed income, and commodities, TAA reduces the risk associated with investing heavily in a single asset class. This diversification helps in smoothing out the returns and reducing the impact of volatility on the portfolio. Tactical asset allocation not only adjusts allocations within asset classes but also across them, providing a robust mechanism for managing potential risks and improving the resilience of the investment portfolio.

Implementing Tactical Asset Allocation

Analyzing Market Trends and Economic Conditions

To implement tactical asset allocation effectively, it is crucial to analyze current market trends and economic conditions. This analysis involves understanding various market regimes and their potential impacts on different asset classes. By identifying these trends and conditions, investors can anticipate market movements and adjust their asset allocations accordingly. For instance, if economic indicators suggest an upcoming recession, increasing allocations to bonds and decreasing exposure to stocks might be a prudent tactical move.

Deciding on Asset Allocation Shifts

Once market trends have been analyzed, the next step is deciding on specific asset allocation shifts. Tactical asset allocation allows for short-term deviations from strategic asset allocation to capitalize on perceived market opportunities. For example, if the technology sector is expected to outperform in the near future, an investor might temporarily increase their allocation to technology stocks. These shifts are generally moderate, often ranging between 5% to 10% of the total asset allocation to avoid excessive risk and maintain alignment with long-term investment goals.

Monitoring and Adjusting the Portfolio

Continuous monitoring of the portfolio is essential in tactical asset allocation. This involves regularly reviewing the performance of the tactical shifts against the strategic asset allocation and making adjustments as needed. Active portfolio rebalancing helps in optimizing the risk-return profile based on the evolving market conditions. If a tactical decision does not yield the expected results, or if market conditions change, the portfolio should be adjusted back to its strategic asset allocation, ensuring it remains aligned with the investor's long-term objectives and risk tolerance.

Challenges and Considerations

Market Timing Risks

Tactical asset allocation (TAA) relies heavily on the ability to time the market effectively, a feat that is notoriously difficult to achieve consistently. Research indicates that the majority of portfolio managers struggle to make successful market-timing decisions, which can significantly hinder the performance of TAA strategies. The allure of market timing may be strong, but the challenges it presents, such as the risk of missing out on the best days of a bull market or remaining invested during the worst of a bear market, can lead to suboptimal outcomes and poor long-term returns.

Increased Transaction Costs

Implementing TAA involves frequent adjustments to the portfolio's asset mix, which can incur substantial transaction costs. These costs, including commissions, bid/ask spreads, and potential capital gains taxes, can erode the returns of a TAA strategy. For instance, a hypothetical investor facing annual transaction costs of 1.5% could see their returns reduced from 8.0% per annum to 6.5% per annum, resulting in a significant decrease in capital accumulation over time. It is crucial for investors to consider these costs and strive to minimize them to enhance the efficiency of their TAA strategy.

Need for Active Management and Expertise

TAA is an active investment strategy that demands a high level of expertise and a hands-on approach. Successful implementation requires ongoing research, monitoring, and the ability to make informed adjustments based on market conditions. This necessitates a commitment of time and effort, as well as access to sophisticated analytical tools and resources. Institutional investors and high-net-worth individuals may have the capabilities to execute TAA effectively, but individual investors may find it challenging and time-consuming. Therefore, those considering TAA should evaluate whether they have the necessary resources and willingness to dedicate the required time to manage their portfolio actively.

FAQs

Understanding Dynamic and Tactical Asset Allocation

1. How does tactical asset allocation differ from dynamic asset allocation?

Tactical asset allocation focuses on making short-term changes to a portfolio's composition based on the current risk and return potential of different asset classes, considering the prevailing market conditions. In contrast, dynamic asset allocation involves a continuous adjustment of the portfolio's asset mix in response to ongoing market and individual asset changes.

2. Can you explain the dynamic asset allocation strategy?

Dynamic asset allocation is a strategy used in portfolio management where the mix of asset classes is frequently adjusted to reflect current market conditions. This approach typically involves decreasing investments in underperforming asset classes while increasing investments in those that are performing well.

3. What does the tactical asset allocation approach entail?

Tactical asset allocation (TAA) is an active portfolio management strategy that adjusts the composition of a portfolio to capitalize on market trends or economic conditions. This means actively managing the allocation of different asset classes, such as stocks, bonds, and cash, within a portfolio based on anticipated market movements.

4. What does dynamic allocation approach mean?

The dynamic allocation approach refers to the practice of modifying the asset mix within a portfolio according to market trends. This strategy aims to adapt to changing market conditions by adjusting the proportions of various asset classes within the portfolio.

Cryptocurrency as a part of your investment portfolio

Josh Pigford

Maybe Credit Card 500 Limit: Understanding the Benefits and Limitations

Josh Pigford

11 bold ways to boost your financial health

Josh Pigford

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.