How to use Bogleheads three fund portfolio to build your wealth

Author

Josh Pigford

If you’ve hit the ceiling maximizing your retirement accounts and are looking for the next step in your wealth-building playbook, then look no further than the ease and simplicity of the Bogleheads three-fund portfolio.

Because even if the world of investing feels like a black box that you don’t understand (yet) — you can still get your foot in the door and start making money while you sleep.

And you can do it in a way that cuts the learning curve considerably!

By using the tools and resources available from some of the best investors in the business — you can learn how to get your money working for you (instead of just having it sit in the bank collecting negligible interest).

You simply have to get started.

Which is what we’re going to help you with today.

The four principal traits of a successful investor

When starting to build toward long-term wealth, your first job is to refine the way you think. So it can impact how you act.

And as Jack Bogle shares in the foreword of The Boglehead’s Guide to Investing, there are four principal traits of a successful investor (which have nothing to do with your prowess at picking stocks).

Trait #1 — Courage: Most people are scared to invest because of uncertainty. But building wealth (like all self-improvement) involves embracing discomfort. And doing what’s necessary despite the fear.

Trait #2 — Discipline: Accumulating wealth is not how much you make; it’s how much you keep. And it takes discipline to be patient and wait (especially when your investments can fluctuate.)

Trait # 3 — Careful planning: Wealth building is all about choice. It’s your job to decide what to do with every dollar that comes into your life. “You can spend it today or save and invest it to make more dollars tomorrow. The key to successful money management is striking a healthy balance between the two.”

Trait #4 — Staying the course: Investing is about buying assets, holding them for long periods, and reaping the harvest years later. It requires patience and optimism. If you’re ill-prepared to manage your emotions along with your portfolio, you’ll be fighting an uphill battle.

Another surprisingly helpful trait that will give you a leg up with investing — is ignorance.

Knowing nothing is an advantage

Why? Because you don’t need to unlearn any bad advice or behaviors.

Sure, you still have better habits to build and perhaps a more optimistic outlook to adopt. But starting from scratch is a secret weapon when it comes to investing.

And while it’s entirely up to you who you learn from and how you begin your investment journey — I find it’s always best to start with teachers who have already done what you want to do.

Mostly so you can avoid the mistakes they made and focus solely on mirroring their successes.

And, as our headline suggests, we’re taking today’s lessons straight from one of the largest forums on investing and personal finance — the Bogleheads.

What is a Boglehead, and why should I care?

The Bogleheads are a group of investors who follow the philosophy and strategy of investing advocated by John Bogle, founder of the Vanguard Group.

The Boglehead’s website attracts an incredible 50,000 visits and as many as 1,500 individual posts each day. All of which give ordinary investors (like you and me!) an opportunity to begin or improve their investing — by applying thoroughly tested and proven principles.

Here’s what they have to say about their approach to investing:

We follow a small number of simple investment principles that have been shown over time to produce risk-adjusted returns far greater than those achieved by the average investor.

The Bogleheads approach to investing (in a nutshell)

Take 100 young Americans starting out at age 25. By age 65, one will be rich and four will be financially independent. The remaining 95 will reach the traditional retirement age unable to self-sustain the lifestyle to which they have become accustomed.

John. C Bogle

If those stats seem startling, have no fear!

Because you can aim to be in the top five percent of financial health — by adopting a lazy approach to investing (which we’re covering today) and following some of the key principles favored by the Boglehead’s:

✔ Choose a sound financial lifestyle

✔ Start early and invest regularly

✔ Know what you’re buying

✔ Preserve your buying power

✔ Keep costs and taxes low

✔ Diversify your stock portfolio (and diversify your stock risk with a bond portfolio)

Of course, it pays to remember that before you get into the basics and begin investing, you should also have the following three things sorted with your personal finances:

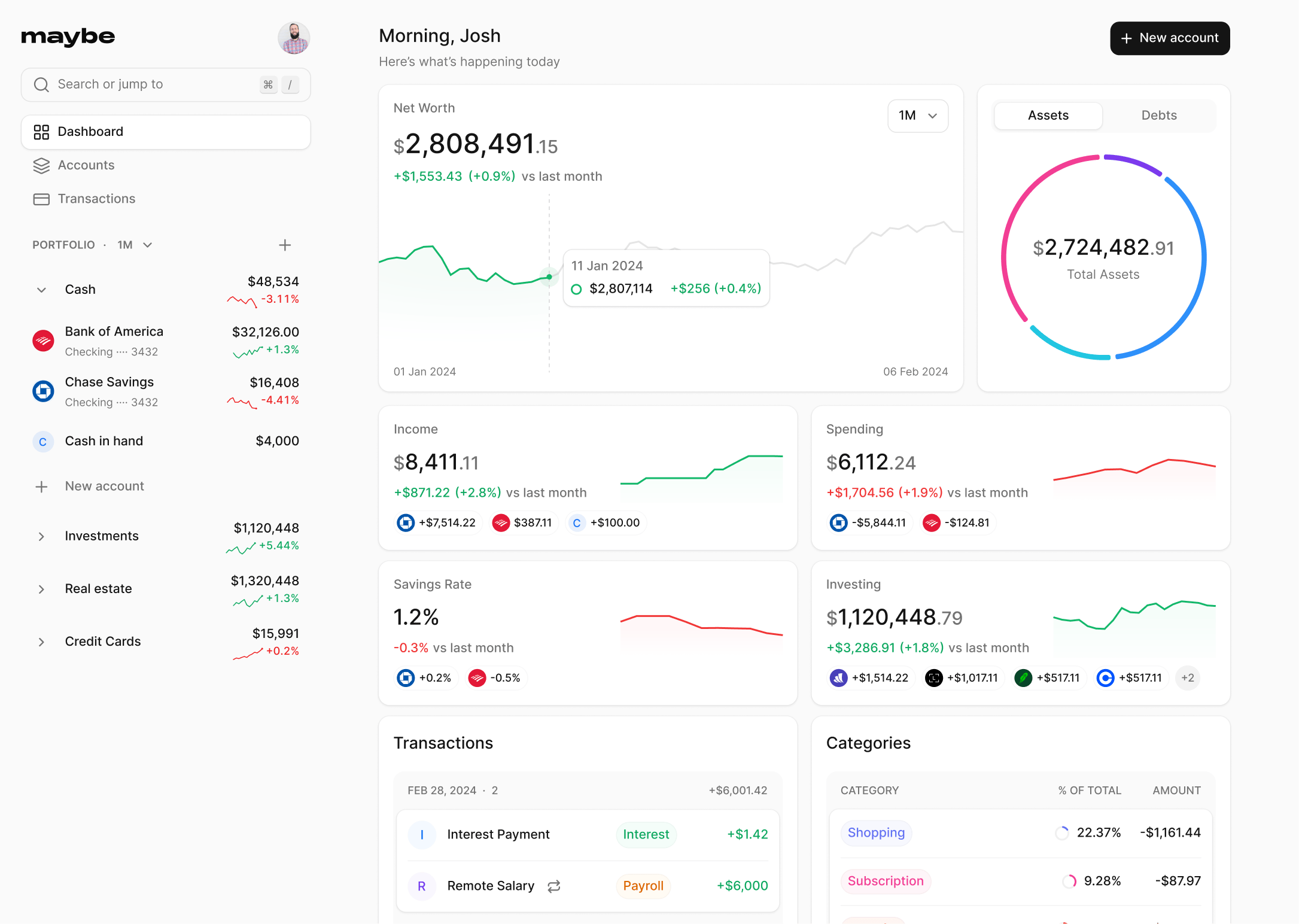

- Graduate from the paycheck mentality to the net worth mentality. Charting a course to financial freedom begins with having a complete view of your financial status. Make it a habit to calculate your net worth once a year to know where you stand.

- Pay off your credit card and high-interest debts. “Debt is deadly, and earning to spend gets you nowhere.” Carrying bad debt severely limits your chances of obtaining financial freedom. To accumulate wealth, first, you need to confront what you owe.

- Establish an emergency fund. If you can save anywhere from 3 to 12 months’ worth of living expenses — you’ll have the funds and peace of mind to withstand unforeseen (and often unforgiving) financial setbacks.

An introduction to the Boglehead’s three-fund portfolio (AKA the lazy portfolio)

Index investing is an investment strategy that Walter Mitty would love. It takes very little investment knowledge, no skill, practically no time or effort—and outperforms about 80 percent of all investors.

Boglehead’s Guide to Investing

Index investing is the closest you can come to a “set it and forget” source of passive income.

There’s very little upkeep. And your only job is to be patient and watch the power of compounding growth.

Of course, there’s the possibility of taking a loss somewhere down the line. But given this is a long-term strategy for building wealth, if you can ride out the dips, you’re almost certain to come out on top.

Here is the gist of the Boglehead’s indexing investment strategy:

Instead of hiring an expert or spending a lot of time deciding which stocks or actively managed funds are likely to be top performers, invest in index funds and forget about it!

But before we dig into how to implement a three-fund portfolio — let’s get clear on a few of the basics.

Need to know: The basics of building a passive investment strategy

When you start to research investment funds and what’s available to you, you’ll likely encounter a few terms that might trip you up or stall your decision.

Two things that are important to get clear on are:

- The difference between an ETF and a mutual fund, and

- The advantages of passive investing vs. active management

ETF vs. Mutual Fund

When you start researching funds and brokerages, you’ll notice there are typically two types of funds you’ll have the option to choose from — mutual funds or ETFs.

They are both a bundle of securities (stocks, bonds, money market instruments, and other types of investments) referred to as funds.

If you think about when you go grocery shopping:

The individual items you place in your shopping cart (bread, milk, butter, etc.) would be your stocks and bonds. And when you put those individual items into your grocery bags, the bags with items in them are your funds.

The most significant difference between mutual funds and ETFs is how and when they are traded and the tax implications.

Predictably, there are pros and cons to each. But to cut through the noise, keep it simple and reduce the research required to make an informed choice, here’s what the Boglehead’s have to say:

We’ve come to the conclusion that low-cost mutual funds should be the primary investment of choice for most investors.

In this case, they’re talking about index mutual funds, which have some significant advantages for all levels of investors.

Here are the top ten:

- Diversification

- Professional management

- Low minimums

- No loads or commissions

- Liquidity

- Automatic reinvestment

- Convenience

- Customer service

- Communications and record-keeping, and

- Variety

Actively vs. Passively Managed Funds

There are two major fund management styles: active and passive management (indexing).

- Passive simply means a fund's goal is to track an index (e.g., S&P 500) closely.

- Active means a manager actively makes decisions on what the fund invests in and how much. An active fund's goal is to beat a benchmark (e.g., S&P 500). And is typically more expensive.

Of course, whether you choose active or passive managed funds for your portfolio is up to you. But, as noted by the Boglehead’s:

With a very simple, no-brainer investment strategy called passive investing you have, at the very least, a 70 percent chance of outperforming any given financial pro over an extended period of time.

Note: For many years, mutual funds were somewhat synonymous with active investing (it was too difficult logistically to build a fund that tracked an index.) Fortunately, technology caught up with time, and it became possible to create mutual funds that tracked an index.

In other words, brokerages now use both active and passive management styles for mutual funds. So when researching — look for mutual funds with “index” in the name to follow today’s strategy.

Here are some costs and other advantages of an indexing investment strategy:

- There are no sales commissions

- Operating expenses are low

- Many index funds are tax-efficient

- You don’t have to hire a money manager

- Index funds are highly diversified and less risky

- It doesn’t much matter who manages the fund

- Style drift and tracking errors aren’t a problem

It is tough to pick stocks or focused mutual funds that will beat their respective market benchmark (and it will likely cost you more).

It is significantly easier to realize that the markets are efficient enough, pick a few index funds and focus on the more important decision of your asset allocation.

Asset Allocation: The most critical portfolio decision you’ll make

The most fundamental decision of investing is the allocation of your assets: How much should you own in stocks? How much should you own in bonds? How much should you own in cash reserve?

Jack C. Bogle

Diversification is the key to reducing investment risk.

You can easily diversify your portfolio with indexing (as it’s built into the funds). And you can diversify your stock risk by adding a bond portfolio.

Determining how much of your portfolio to invest in bonds and how much to hold in equities (stocks) is an asset allocation decision.

Asset allocation is the process of dividing our investments among different kinds of asset classes (baskets) to minimize our risk, and also to maximize our return for what the academics call an efficient portfolio.

Bogleheads Guide to Investing

Using the Boglehead’s framework, the three funds you’ll want to include in your portfolio are:

- Total Stock Market Index Fund,

- Total International Stock Index Fund, and

- Total Bond Market Fund

According to Maybe’s in-house advisor — Vanguard, Fidelity, iShares, Schwab, and SPDRs, all have great funds to consider. And there shouldn't be much of a difference between them.

FYI: Further down in this post, we’ve got some examples of portfolios you can swipe that will make your asset allocation decision even more effortless.

But before we get to that, to develop a superior strategy (and crank up your confidence), it pays to do some self-discovery first.

Five things to consider before deciding on your asset allocation

Before picking your funds and making your asset allocation plan, it’s necessary to think about some key questions that take into account your specific situation:

- What are your goals? You must know what you are saving for (comfortable retirement? First home? Child’s college education?) and how much money is necessary to achieve that outcome.

- What is your time frame? Stocks can be a poor investment for short-term goals but excellent over the long term. Be sure to get clear on the result you want and when you hope to achieve it.

- What is your risk tolerance? You need to understand that stocks and bonds go up and down. You need to be comfortable with that fact. And know where your limits lie.

- What is your personal financial situation? Your specific circumstances directly influence the number of securities you select and their allocation. Take into account your current net worth (assets less debt) and factor in your age and risk tolerance.

- Are there any restrictions to your investing? For instance, at this point, you may only be able to choose from the funds offered in your retirement plan.

Once you have answered these questions, the next decision is how much of your portfolio to allocate to bonds.

Reducing Risk with Bonds: The counterweight to stocks in your asset allocation plan

Although it may seem counterintuitive, your portfolio will actually have better overall performance if you add bonds to the mix. Because bonds generally perform better when stocks fall, bonds lower your risk a lot while limiting your returns only a little.

Ramit Sethi

Unfortunately, while there are many tools for advisors to use with their clients — there are few tools for consumers to use when creating your asset allocation plan.

So let’s take a look at a few simple guidelines to follow when it comes to balancing your portfolio with bonds to reduce risk:

- Increase your percentage of bond holdings if you are a more conservative investor.

- Decrease your percentage of bond holdings if you want to be more aggressive with your portfolio.

- It’s hard to go wrong with any good quality, low-cost short or intermediate-term bond fund.

And as a helpful side note, Mr. Bogle suggests that owning your age in bonds is a good starting point.

So, a 20-year-old would hold 20 percent of their portfolio in bonds. By the time this investor reaches 50, the bond portion of the portfolio would have gradually increased, in 1 percent increments, to now represent 50 percent of his portfolio.

If you’re new to investing, it might make sense to start with some simple portfolio suggestions that you can easily replicate for yourself. And then adjust as necessary.

In that case, here are some asset allocation options to entertain.

Eight simple passive investment portfolios to swipe (depending on your stage in life)

We’ve lifted these asset allocation suggestions directly from Boglehead’s Guide to Investing.

This is mainly to help you reduce indecision and give you a practical starting point for setting up your three-fund portfolio.

The following four portfolio examples use asset classes (not specific funds) which can be helpful if you’re not exclusively using Vanguard accounts.

#1 — A young Investor

- Domestic large-cap stocks — 55%

- Domestic mid/small-cap stocks — 25%

- Intermediate-term bonds — 20%

#2 — A middle-aged investor

- Domestic large-cap stocks — 30%

- Domestic mid/small-cap stocks — 15%

- International funds — 10%

- REIT’s 5%

- Intermediate-term bonds — 20%

- Inflation-protected securities — 20%

#3 — An investor in early retirement

- Diversified domestic stocks — 30%

- Diversified international stocks — 10%

- Intermediate-term bonds — 30%

- Inflation-protected securities — 30%

#4 — An investor in late retirement

- Diversified domestic stocks — 20%

- Short- or intermediate-term bonds — 40%

- Inflation-protected securities — 40%

The following four portfolios are for investors using Vanguard funds exclusively.

#5 — A young investor using Vanguard funds

- Total Stock Market Index Fund — 80%

- Total Bond Market Index Fund — 20%

#6 — A middle-aged investor using Vanguard funds

- Total Stock Market Index Fund — 45%

- Total International Index Fund— 10%

- REIT — 5%

- Total Bond Market Index Fund — 20%

- Inflation-Protected Securities — 20%

#7 — An investor in early retirement using Vanguard funds

- Total Stock Market Index Fund — 30%

- Total International Index Fund — 10%

- Total Bond Market Index Fund — 30%

- Inflation-Protected Securities — 30%

#8 — An investor in late retirement using Vanguard funds

- Total Stock Market Index Fund — 20%

- Short-Term of Total Bond Market — 40%

- Inflation-Protected securities — 40%

You’ll notice that some of these options above use more than three funds in their allocation. The Boglehead’s make the note that:

There is no magic in the number three; the phrase is shorthand for a style of portfolio construction that emphasizes simplicity and is related to lazy portfolios.

So whether you swipe an asset allocation plan from above or develop your own — keeping it simple is the key.

Four Steps to Financial Freedom: Implementing your passive investment strategy

Now that we’ve covered the technical stuff, we can move on to the exact steps you can follow to get started with passive investing. And start building your three-fund portfolio.

Step 1: Assess your specific set of circumstances

Get clear on your financial goals, time frame, risk tolerance, current personal financial situation, and factor in any restrictions that will affect your investment options.

Be honest with your answers and reasonable with your expectations.

Step 2: Pick your firm and funds

Settle on a reputable firm (we suggest looking at Vanguard, Fidelity, iShares, Schwab, and SPDRs first) and research their products. If you do only one thing, it should be to read the funds prospectus.

“The mutual fund prospectus is the single best way to find out about the objectives, costs, past performance figures, and other important information about any mutual fund you’re considering investing in.”

Step 3: Decide on your asset allocation

The most straightforward path for implementing the Boglehead’s three-fund portfolio is to explore the portfolio options we listed earlier and pick one that suits your situation.

Alternatively, you can come up with your own asset allocation plan. But make sure to factor in everything you discovered in step one.

Step 4: Fund your accounts

Once you have a list of funds you want to own in your portfolio, start buying them individually.

- Determine how much you need to buy in — the minimum principal

- Set up a savings goal to accumulate enough to pay for the minimum of the first fund

- Buy the fund and continue investing a small amount into it each month ($100 is excellent to begin)

- Set a new savings goal to buy into the next fund and repeat the process.

You don’t need to have enough to buy into all your funds at once. Take it one by one and grow your portfolio over the next 1-2 years.

For example, let’s say you’re working with the following parameters:

- You have $500 to invest each month

- You want to buy into three low-cost index funds

- Each of the funds you want to buy into has a minimum principal of $3000

- As a starting point, you want to invest $100 each month post-buy-in

Here’s what that might look like:

As you can see, it will take two years to accomplish your goal of investing in all three funds with a $500 monthly investment.

And by saving for your principal and buying in one by one, you’ll be able to start earning interest off your investment by the 6-month mark.

As you earn more (or spend less), you can increase your monthly investment amounts. And depending on your situation, the time it takes to buy in will fluctuate. But this should give you a solid framework for getting started. And give you a reasonable time frame (two years) for setting up your portfolio.

The price of peace of mind

Phew! We’ve covered a lot in this post.

But even though getting started with investing can at times feel overwhelming, it’s the decision to make the first move that is often the biggest hurdle to overcome.

So let me ask you this…

What is the cost of not getting started now?

This mind-blowing math from Ramit Sethi might be enough to light a fire under you:

- If you invest $10 per week: After one year, you’ll have $541; after five years, you’ll have $3,173; after ten years, you’ll have $7,836.

- If you invest $20 per week: After one year, you’ll have $1,082; after five years, you’ll have $6,347; after ten years, you’ll have $15,672.

- If you invest $50 per week: After one year, you’ll have $2,705; after five years, you’ll have $15,867; after ten years, you’ll have $39,181.

(Note: the figures above assume an 8% return)

If you think about what those extra dollars will do for your financial goals, knowing that you’ll be earning this money (almost) automatically — you might start to feel giddy with glee (I know I do).

And coupled with what you’ve learned today — you now have a strategy you can put into practice that will allow you to accomplish it with ease. You simply need to take the first step.

The Ultimate Guide to Asset Allocation: Strategies for Optimal Portfolio Diversification

Josh Pigford

How to take charge of your personal finances

Josh Pigford

Should you consider real estate as part of your investment portfolio?

Josh Pigford

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.