Financial Terms / Q - R / Quantitative tightening

Quantitative tightening

Quantitative tightening is a strategy used by central banks (such as the Federal Reserve) to rein in the money supply by selling accumulated securities (U.S. Treasuries) to the open market and increasing interest rates.

Quantitative tightening is also called balance sheet normalization, as the central bank sells the securities it has bought from the open market to reduce its inflated balance sheets. It also removes liquidity from the banks and the market to discourage lending and investments to consumers and businesses, increasing savings and technically slowing down inflation.

Discover more financial terms

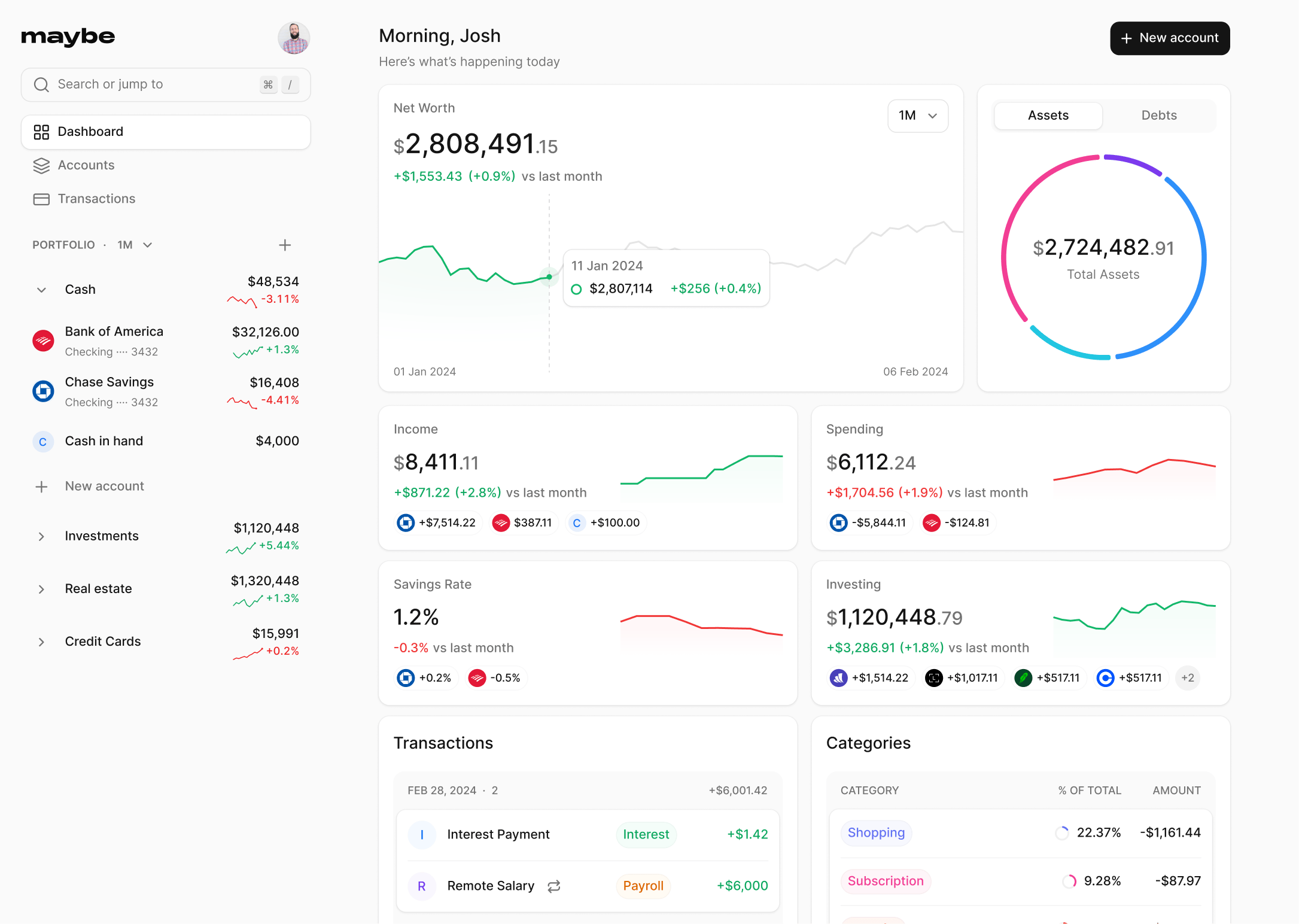

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.