Financial Terms / C - D / Consumer Price Index (CPI)

Consumer Price Index (CPI)

The Consumer Price Index (CPI) measures the average changes in the prices of a basket of goods and services by urban customers of a particular country. It is most commonly used as a proxy for a measure of inflation in the economy, which serves as an indicator of the growth and health of an economy.

Discover more financial terms

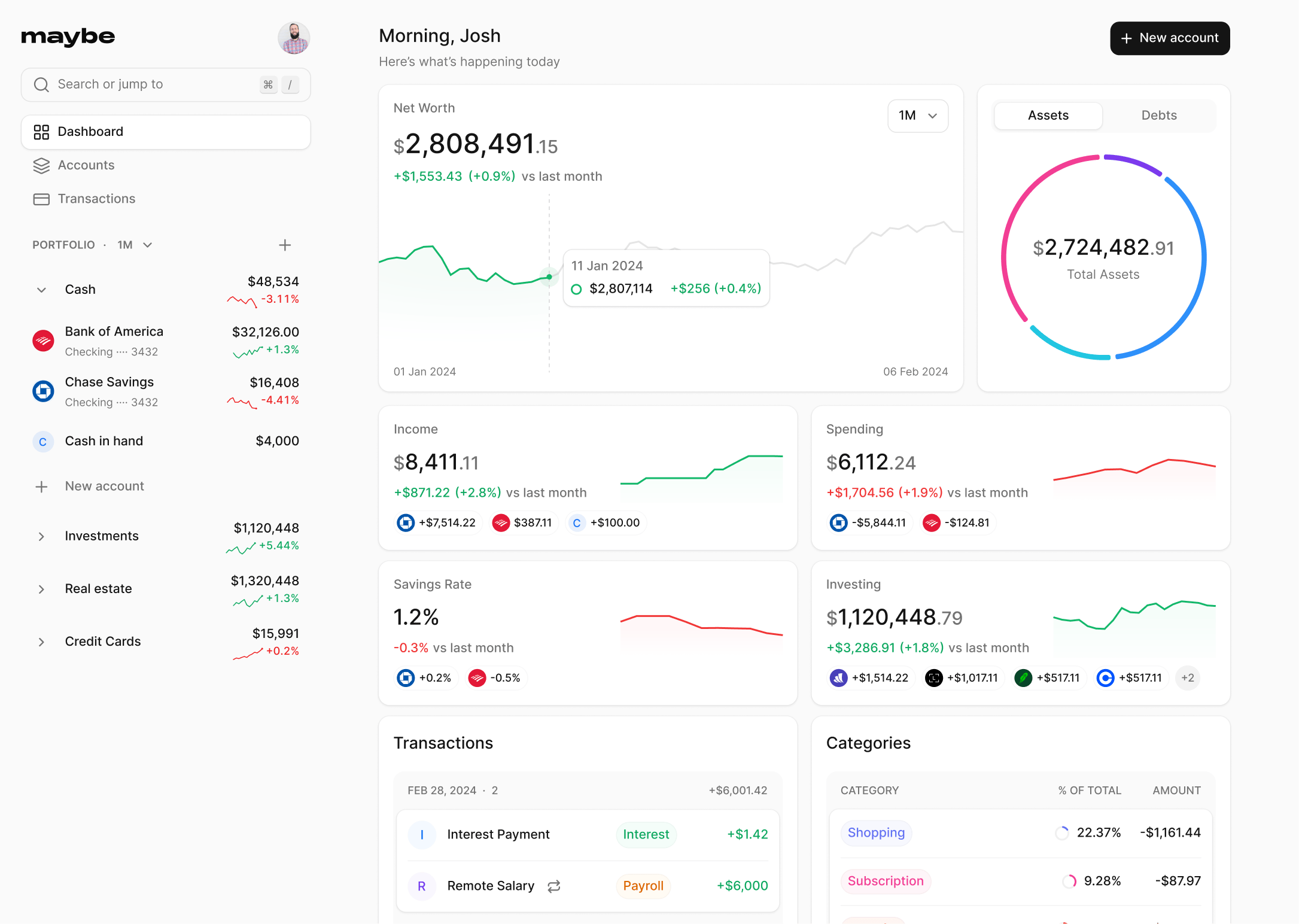

Join the Maybe  waitlist

waitlist

Join the waitlist to get notified when a hosted version of the app is available.